Trade tensions and major disruptions in global supply chains have pushed investors to look for alternative business locations. The regional bloc of the Association of Southeast Asian Nations (ASEAN) is increasingly viewed as a prospective option for new investments thanks to trade liberalisation, rapid digital advancement and cost advantages. Yet, the challenges holding back the region should not be overlooked by investors looking for business diversification.

Increasing trade openness to unlock new growth opportunities

ASEAN countries have relatively high trade openness globally. In 2021, the majority of countries ranked in the upper half of the Trade Freedom Ranking, which measures tariff and non-tariff barriers that affect imports and exports of goods and services.

Singapore and Brunei are leading the way in terms of trade freedom, although recent regional and bilateral trade agreements are also anticipated to spur trade growth in other countries; for example, the UK-Vietnam Free Trade Agreement, Cambodia-Korea Free Trade Agreement and the existent or upcoming free trade agreements between some ASEAN countries and the EU.

The coming into effect of the Regional Comprehensive Economic Partnership (RCEP) is set to further accelerate economic growth and trade expansion in the region. RCEP will provide Asian countries with considerably lower trade barriers, eliminating 90% of the tariffs on imports between the signatories over time.

Digitalisation to make ASEAN more competitive globally

For global businesses, innovation and digitalisation have already become key themes, driven by the necessity to increase efficiency and improve resilience to crises such as the COVID-19 pandemic.

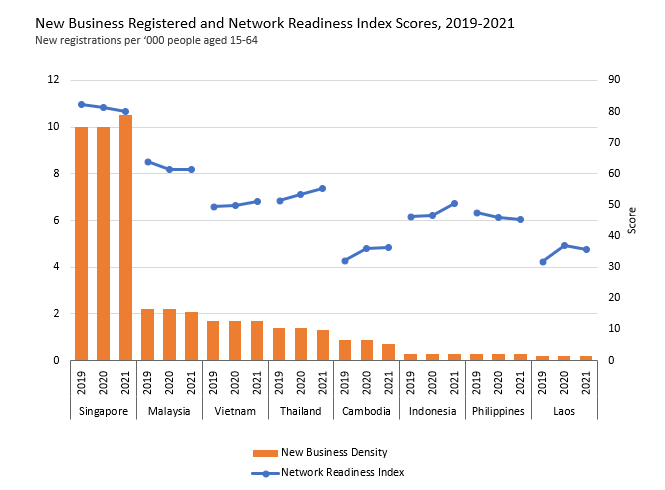

Digitalisation across ASEAN countries increased rapidly in recent years, due to the expansion of connectivity rates and the growth of business engagement in internet-related services. In 2021, two thirds of households in ASEAN had access to the internet, with the figure expected to reach nearly 90% by 2040.

Regional governments understand the potential that digital development carries and, thus, provide national digital development strategies to accelerate transformation through increased awareness, connectivity, enterprise strategies and incentives for business digitalisation. For example, Vietnam’s Digital Transformation Programme to 2025 aims to increase the contribution of the digital economy to the country’s GDP to 20% by 2025.

In addition, the ASEAN Digital Masterplan, launched in early 2021, is expected to further accelerate the growth of regional digital economies by improving telecommunications infrastructure, cybersecurity, reducing regulatory barriers and promoting digital services in various spheres of the economy.

Note: The Network Readiness Index (NRI) identifies the factors enabling national economies to fully benefit from information and communication technology (ICT) advances. The scores are expressed on a 1-to-100 (worst-to-best) scale.

Cost advantages make emerging ASEAN economies attractive investment markets

Overall, tax rates in ASEAN markets typically remain lower than the global average. Singapore continues to excel in financial and trade freedom, securing its position among the most attractive business environments globally.

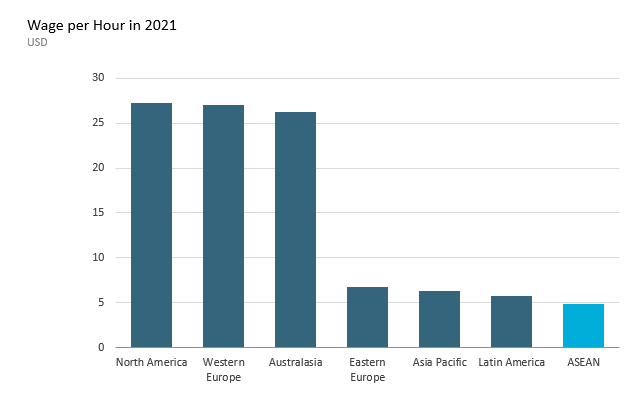

Meanwhile, other ASEAN countries present lower labour costs as their competitive advantage. For example, in 2021, the average hourly wage in Indonesia and Vietnam reached a mere USD1.1 and USD1.5, respectively – comparably lower than USD8.3 in China. In fact, the average wage per hour in ASEAN remains the lowest compared with other regions, as well as with the average wage in Asia Pacific.

Due to lower costs and more stable regulatory environments, the relocation of manufacturing from China to Southeast Asian countries has already accelerated. The US tech giant Apple decided to shift part of its iPad production to Vietnam in 2022. While strict COVID-19 rules in China pushed Apple to move production, lower labour costs also influenced the decision. Nike, Samsung Electronics and adidas have followed a similar course in moving production to ASEAN countries.

Challenges should not be overlooked

Although ASEAN economies provide vast opportunities for global investors, emerging Southeast Asian countries are also facing various challenges, precluding smoother economic development.

- Population ageing will have major future implications for economies, markets and societies. A shrinking labour force will negatively impact productivity growth and raise the pressure on public finances.

- Persisting corruption, low judicial efficiency and substantial bureaucratic procedures are impeding the faster improvement of the business environment in Southeast Asian economies; complicating business processes such as getting permits, registering property, resolving insolvency, dealing with creditors, or protecting stakeholders.

- ASEAN countries continue to struggle with low educational attainment and weak productivity. In fact, on average, only 14% of the population aged 15+ in ASEAN belonged to the higher education band in 2021.

- Infrastructure disparities persist in the region, spanning from a lack of road networks to inefficient digital infrastructure. Rural areas in particular suffer from inadequate physical and digital connectivity.

Building a presence in ASEAN countries is key for businesses seeking major growth opportunities. Decreasing trade barriers, rising internet connectivity rates and lower labour costs present competitive advantages for companies. However, they should also be aware of the bottlenecks and challenges of operating in emerging ASEAN economies.

For further insight and discussion about the economic outlook for ASEAN economies and cities, download and watch our webinar, and read our report, Tapping the Potential of ASEAN.