According to Euromonitor International, the world beauty and personal care market size will grow to USD547 billion in 2027. Asia Pacific is the key driver of this growth, accounting for 67% of the growth value. Global companies, facing strong competition from local brands in mass categories, invest heavily in Asia Pacific to expand its defensible space in premium categories.

With the region being seen as the future strategic focus, global beauty companies are investing in the following three areas in Asia Pacific: premiumisation of brand portfolio, solid R&D foundation in Asia, and virtual and interactive shopping experience.

Premiumisation of brand portfolio

Global companies have maintained their dominance in the Asian premium market for the last decade. To continue this dominance, global companies constantly replenish premium brand offerings in different categories through acquisitions and internal brand upgrades.

SK-II of Procter & Gamble (P&G) has a 4% brand share of Asia Pacific’s premium market, which builds strong confidence for P&G to target premium consumers in Asia. P&G’s 2021 acquisition of premium players Tula, Ouai and Farmacy Beauty marks the company’s further steps into the premium skin care and hair care segment. In January 2023, the acquisition of Mielle Organics reflects the company’s determination to expand in the segmented hair care market for localised consumer demands. For the Asian hair care segment, there is a high possibility that P&G will make further moves for specific demands from the local market.

With the acquisition of the Chantecaille brand in December 2021, Beiersdorf focuses on expanding its premium skin care portfolio around La Prairie and further strengthening its presence, particularly in Asia Pacific. Beiersdorf also focuses on premiumisation of the Nivea brand by launching its Nivea Luminous630 range in China. The company is convinced that this will open significant growth potential. According to Beiersdorf’s Annual Report 2022, net sales of Nivea Luminous630 increased by 80% compared to the previous year.

Coty, with relatively low visibility in skin care, plans to revamp its skin care brands, Lancaster and Philosophy, with science-backed brand heritages by launching new facial care products in travel retail, especially in the Hainan duty free zone in China.

Seeing global players actively expanding into the Asian premium skin care market, beauty players in Asia are making moves in the vertical skin care market segment. Shiseido has introduced premium sustainable beauty brand, Baum, and Sidekick for Gen Z men’s skin care concerns.

Solid R&D foundation in Asia

Global companies are establishing R&D innovation centres in Asia, which allow them to be closer to dynamic market trends in the region and facilitate the rapid launch of locally-tailored products.

In December 2022, Estée Lauder launched China Innovation Labs in Shanghai to further accelerate skin care products for Chinese consumers. L'Oréal’s innovation centres in China and South Korea work in collaboration with each other, leveraging the strengths of each market to achieve rapid product launching and optimisation within the Asian market. P&G’s innovation centre in Singapore serves as an innovation hub for P&G’s personal health and grooming products.

Virtual and interactive shopping experience

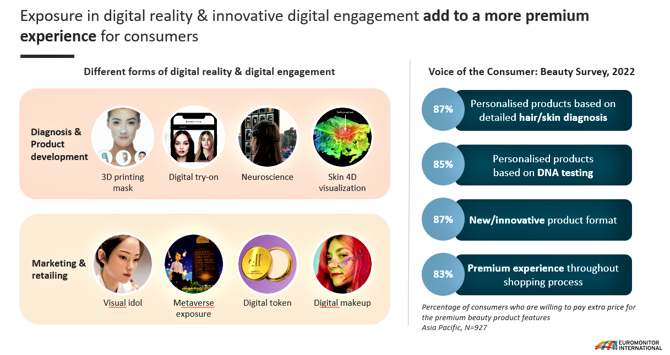

With the world entering a new phase of digital reality, the rise of the metaverse has created a new territory to explore for the beauty industry. With the high e-commerce penetration in beauty retail in Asia, using technologies to provide consumers with customised product recommendations and enrich virtual experience are the strategies that global brands have been exploring.

In mid-2022, P&G relaunched a virtual shopping experience on Shopee, a growing e-commerce player in Southeast Asia. The “Show Me My Home” platform is a relaunch of a 2020 version that allowed users to visit rooms containing P&G brands, like Olay, Oral-B and Gillette. Not only can consumers view commercials from other markets, but they can also win discount promo codes through games – which is the most desired livestreaming feature, according to Euromonitor International’s Voice of the Consumer: Digital Survey 2022. The relaunch is the company’s way to overcome boundaries of consumers not being able to sensorially experience beauty and personal care products online, through a showroom style.

A variety of factors make the Asia Pacific market more competitive

The Asia Pacific market is full of opportunities and challenges. Its large market size, rising potential and evolving local industry chain are all factors that will accelerate the competition. For global companies, how to localise the offerings to accelerate product optimisation and respond quickly to consumer demand is a major task to compete with agile local brands. There will be more collaborations between global players and local partners to pursue agility, including new product development, manufacturing and marketing. A trend towards acquisitions of Asian brands by global players is also expected to be seen in the next five years.

For further insights on global companies in beauty and personal care, read our report, Competitor Strategies in Beauty and Personal Care.