Owing to the fall of Victoria’s Secret and the growth of emerging brands, especially celebrity-led ones, like Savage X Fenty, the US women’s underwear market has been increasingly fragmented since 2016. The US women’s underwear market is the largest among developed economies and the second largest in the world, following China. Most of the leading trends in this market will thus significantly influence the setting of the global market, so Euromonitor International has identified three key trends shaping the US women’s underwear market through the lens of fast-growing celebrity-led brands.

Consumers prefer brands that promote inclusivity and female empowerment

Inclusivity and female empowerment are making inroads in mainstream fashion in the US, driven by increased ethnic diversity, rising obesity among the population, and social issues among women. The share of US obese citizens shot up from 31% in 2006 to 40% in 2021, making it the most obese developed economy in the world. Additionally, according to Euromonitor International’s Voice of the Consumer: Lifestyle Survey 2022, compared to the pre-pandemic (2019) levels, there have been more US female consumers actively involved in social issues and who only buy from brands they trust post-pandemic (2022).

Savage X Fenty and Skims are the most representative beneficiaries of the inclusivity and women’s empowerment trend, thanks to the personal influence of their founders, Rihanna and Kim Kardashian, and statements on being inclusive and making consumers feel confident by providing products for all genders, sizes and backgrounds. For example, Skims’ Fits Everybody bras are sold in sizes XXS to 4XL, and in approximately 20 colours or shades. Recently, Skims addressed a gap in the accessibility market by teaming up with American Paralympic track and field athlete Scout Bassett to launch its Adaptive Collection.

Aligning product offerings to fast-changing consumer demand is key to succeed

Even before the pandemic, there had been a shift from padded and push-up bras towards comfortable choices, such as wireless and unlined bras. However, the pandemic has accelerated the shift, as female consumers increasingly prioritise feeling comfortable in their own bodies. As noted in Euromonitor International’s Voice of the Consumer: Lifestyle Survey 2022, me-centred features, such as “comfortable” and “design/style suited to me” were much more frequently selected than extrinsic motivations, such as “on-trend” and “international brand”, as the apparel and footwear product features influencing US female consumers’ purchases.

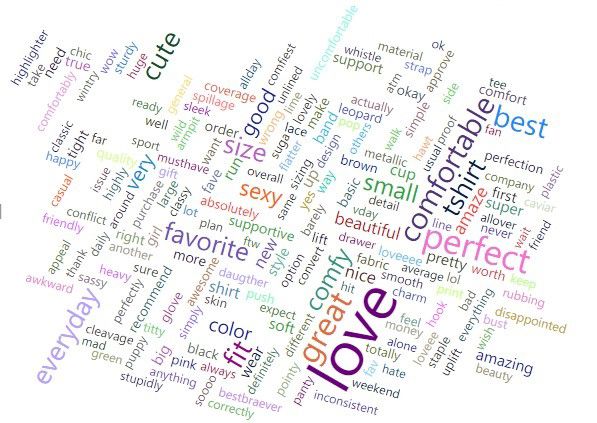

Word Cloud of Consumers’ Reviews on Savage X Fenty’s Best-Selling Bra

Retaining consumers is as relevant as gaining new ones

Both attracting new consumers and building a loyal customer base are fashion players’ primary strategies to deliver continued growth. Turning customers into repeat shoppers is becoming increasingly important to underwear players, as having a loyal customer base can be critical when facing crises, such as the pandemic. Beyond regular engagement through social media campaigns, the most widely seen and practical approach to creating loyal customer bases is building effective loyalty programmes and subscription services.

Savage X Fenty’s Xtra VIP membership programme has made significant contributions to its revenue growth and brand loyalty. It has the features of subscription services, with the programme charging consumers USD49.95 per month. That charge is then returned to the account as in-store credits. Xtra VIPs have access to limited editions and receive exclusive discounts, which makes the programme more like a loyalty programme. This programme has also contributed to the brand’s strategy-building and decision-making. For example, the locations of its stores are decided based on where the brand has a high density of VIPs.

Healthy growth forecast for the US women’s underwear market

The underwear brands that have delivered healthy growth recently revealed strong abilities in seizing the trends discussed above and making efforts in line with other popular topics in the wider apparel industry, such as digitalisation throughout, reinvention of supply chains, and sustainability. In November 2022, Victoria’s Secret acquired Adore Me, a digitally native direct-to-consumer lingerie start-up known for its wide range of sizes, aiming to become more diverse and inclusive, and to tap into Gen Z consumers.

In general, Euromonitor International expects the US women’s underwear industry to deliver healthy growth over the forecast period (2022-2027), and the trends discussed above will continue to shape this industry. In addition to reacting to the trends, brands should also build unique selling points, since the market is increasingly crowded with women’s underwear specialists and competitors from other sectors. For example, athletics brands, such as Lululemon, are also adding underwear lines to blend consumer demand for wellness with the growing trend in athleisure wear.

For further underwear insights, read our report, Savage X Fenty and Skims, or The Rise of Celebrity-Led Underwear Brands in the US.