Recent years have been a whirlwind for the fintech-enabled finance space. Online payments exploded at the height of the COVID-19 pandemic, meme stocks wreaked havoc on some financial markets, and QR codes made a somewhat triumphant return to North America.

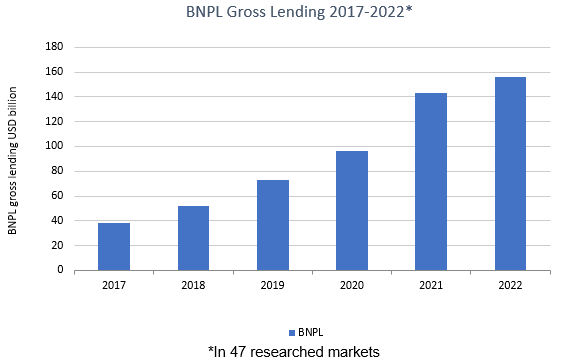

Amongst these storylines, the popularisation and digitisation of Buy Now Pay Later (BNPL) transactions have also taken place in earnest. Transactions have grown dramatically in recent years, with gross lending forecast to surpass USD150 billion in 2022, benefiting from technological advances. Challenges include saturation and regulatory efforts; nevertheless, BNPL is expected to continue to play a growing role in payments.

BNPL transactions forecast to exceed USD150 billion

In 2022, BNPL transactions in the 47 markets that Euromonitor researches are forecast to reach USD156 billion, which is comparable to all personal payment transactions in Denmark or Norway. This figure excludes BNPL explicitly tied to a credit card function (such as that offered by card networks like Mastercard and Visa), but rather is linked primarily to in-store and fintech offerings of instalment payments. As a result, the full spectrum of BNPL transactions is likely to be greater.

Note: 2022 represents forecast data

Fintech companies and pandemic help drive dramatic growth in BNPL

Between 2017 and 2022, BNPL transactions increased by 304% within the 47 researched markets. Growth was already significantly underway prior to the pandemic as fintech companies further embedded themselves into the picture, but the increasing number of consumers utilising fintech and digital solutions as a result of the pandemic drove the trend further. In addition, the uncertainty caused by inflation and changing pandemic-driven trends has emerged as a possible growth driver of BNPL payments, as consumers cope with the need for flexibility.

Uptake of BNPL varies across geographies – still heaviest in markets with first-mover advantage

The uptake of BNPL differs globally, but is particularly strong in markets that founded major fintech companies. Both Sweden (Klarna) and Australia (Afterpay) rank in the top three markets and have had years to see growth for fintech BNPL.

Brazil, on the other hand, is the largest single market for BNPL. Brazil’s strength is derived from the sheer number of ways that BNPL can be conducted in the market, including via store credit and cheques, in addition to uptake of Pix, a major domestic payments platform. BNPL has become particularly popular in Brazil as a way of avoiding the exorbitant interest rates charged on credit cards in the country, which can exceed 400%.

BNPL: Room to grow, but challenges on the horizon

While BNPL is not in fact a new trend per se, it has been revolutionised by app technology, which has made it more easily accessible, enabling significant growth in both uptake and awareness. While further growth is likely, there are significant challenges on the horizon, in the form of impending regulatory efforts by governments, the dramatic increase in interest rates in many markets as a result of inflation, and rising saturation in many of the more developed BNPL markets.

Nevertheless, growth potential exists in new areas, such as B2B payments, and travel – where it makes luxury travel more accessible and can also free up cash flow. BNPL may face some speed bumps, but is likely to play an important role in payments for many years to come.

Stream our webinar to hear Euromonitor experts answer fundamental questions about the multibillion-dollar buy now, pay later (BNPL) landscape, or read our report for a deep dive into this lending format.