Brexit is upon us without much certainty as to what the U.K.’s exit from the EU will take. A Light/No Brexit, a No-Deal scenario and a disorderly No-Deal Brexit all remain possibilities, with the latter especially feared by many in the packaged food industry. Let’s take at the top 5 implications of the best and worst-case scenarios on the food industry.

1. A No-Deal Brexit Could Cost the UK Food Industry $1.5 Billion USD

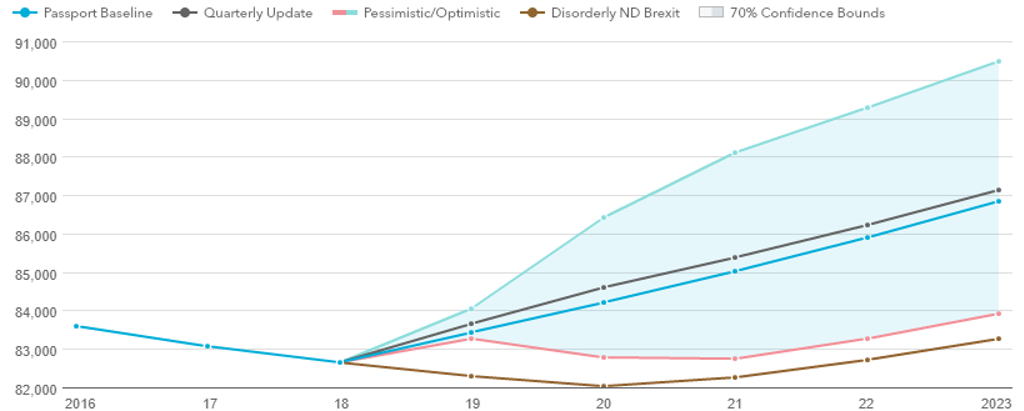

Sales value of Packaged Food in the U.K. is forecast to be affected to a greater extent than volume through to 2023. Under the Light/No Brexit scenario value will be higher than the Baseline by 1.2% (or USD1.0 billion).

Under a No-Deal Brexit, however, value is forecast to be 1.7% lower (USD1.5 billion less), and a Disorderly No-Deal Brexit would mean sales below the Baseline forecast by 4.4% (down USD3.9 billion).

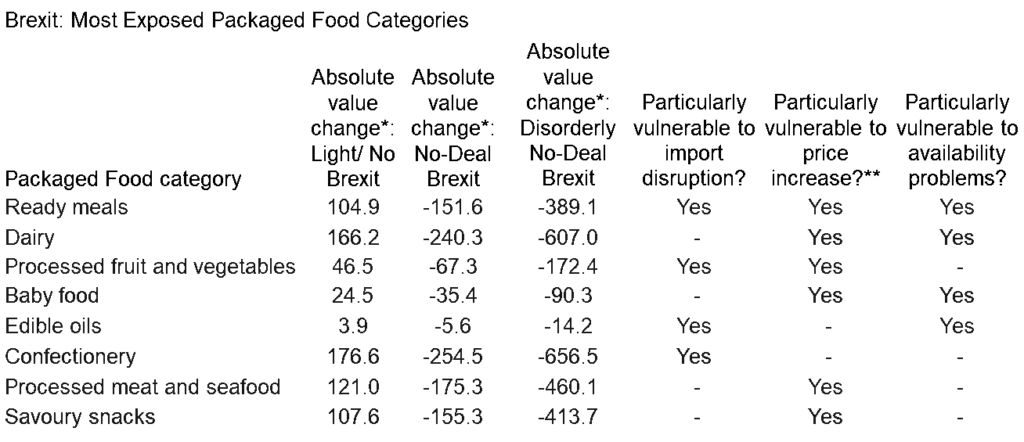

In absolute terms it is dairy, confectionery and savoury snacks that are forecast to take the hardest hit to sales value under a No-Deal/Disorderly No-Deal Brexit - but also processed meat and seafood. The key subcategories here are chilled and frozen poultry, and chilled and frozen seafood, indicating the significant impact across even cheaper meat and seafood options.

2. The Fresh Food Supply Chain Could Receive the Biggest Shock

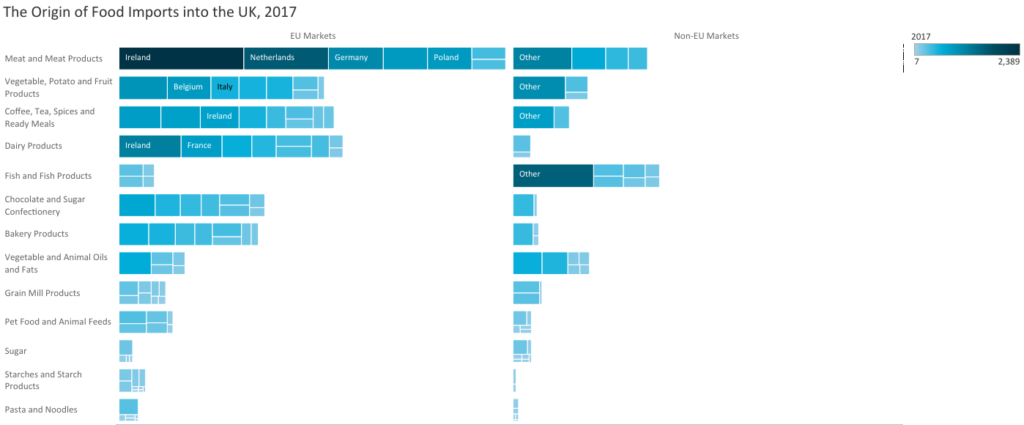

The UK imports approximately 2/5 of the food its consumers use. These imports break down to approximately 3/4 coming from the EU, 1/4 from elsewhere in the world.

Categories heavily imported from the EU include meat and meat products, vegetables and fruit, coffee, tea, ready meals and dairy. These appear particularly likely to feel the negative impacts of any No-Deal Brexit given the shorter shelf lives of these products.

3. Pasta and Noodles Sold in the UK Have the Largest Dependencies on the EU

EU imports of pasta and noodles are fundamental to UK consumption at present with over 85% stemming from abroad and over 75% of that coming from the EU. Comparatively, while much of the UK’s consumed meat and meat products (a much larger market) comes from the EU, overall imports are less as a percentage of all eaten in the UK.

Under this analysis, and including the size of each market, vegetable and animal oils and fats, chocolate and sugar confectionery, coffee, tea, spices and ready meals and vegetables, potato and fruit products, starches and starch products and pasta and noodles look to be areas of particular concern if Brexit disrupts imports.

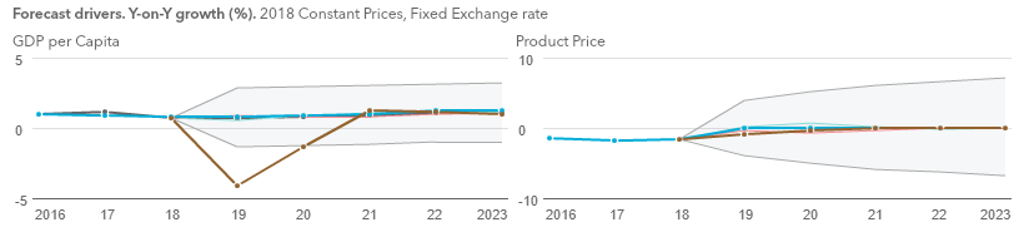

4. Soft Drivers Are More Significant Than Price Increases for Most Food Categories

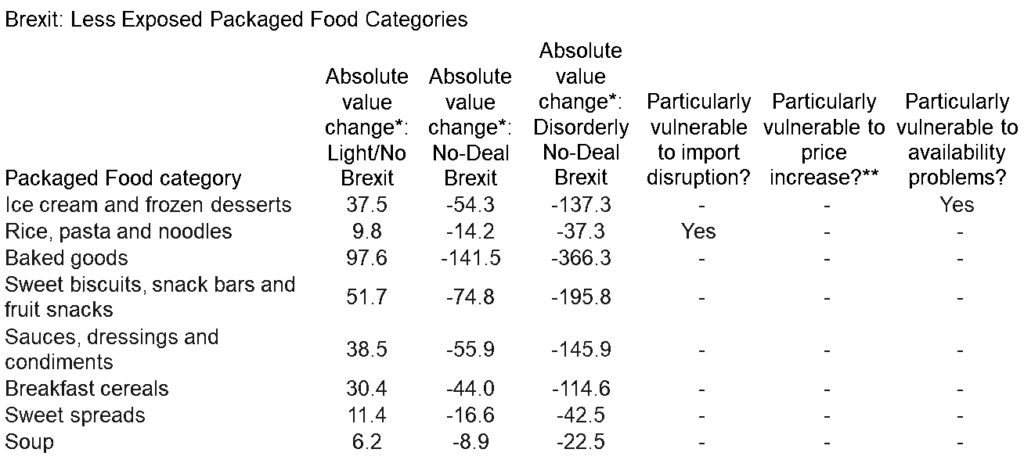

If price rises occur, Euromonitor’s Industry Forecast Model reveals a number of particularly vulnerable categories across the packaged food industry.

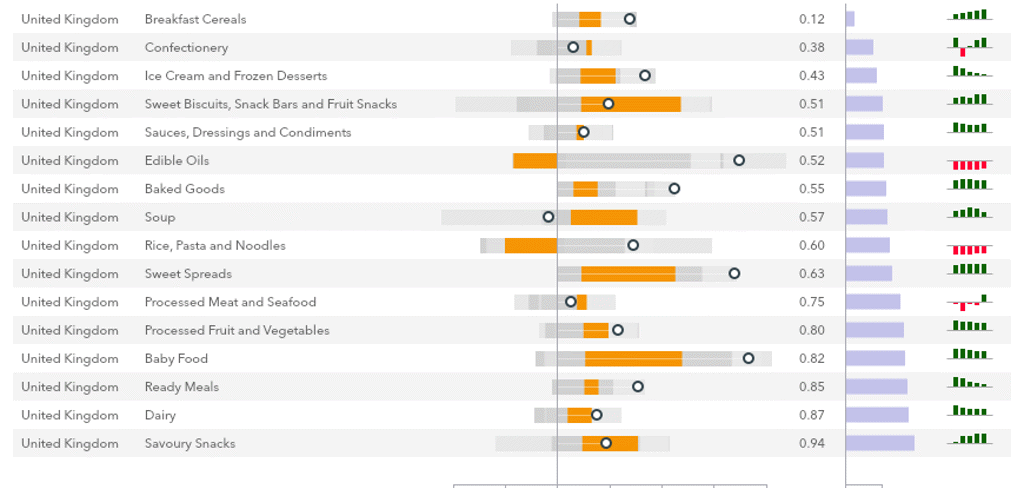

This particular factor is best examined via price elasticity - essentially the responsiveness of value sales to a change in product price. Of the packaged food categories, savoury snacks has the highest price elasticity, breakfast cereals the lowest. In line with the economic Brexit forecast scenarios, dairy, savoury snacks and ready meals are particularly exposed.

5. Ready Meals Likely to Be Most ‘Disrupted’ Category under No-Deal

The ready meals category is particularly vulnerable to the impact of Brexit. Exposed to import disruption, price increases and availability issues, in the event of a Disorderly No-Deal Brexit, Euromonitor forecasts sales value lower by 6.5% compared to a Light/No Brexit scenario.

Although less exposed to price increases/sensitive to availability issues, confectionery would still see the single largest hit to sales value by 2023, followed by dairy - the two largest packaged food categories by sales value.

Notes: * vs Baseline forecast, 2023, USD million; ** Elasticity of 0.75+

Notes: * vs Baseline forecast, 2023, USD million; ** Elasticity of 0.75+

For more on the best- and worst-case scenarios for packaged food, the range of impact by category and other issues to consider for those looking to map the near to mid-term progress of packaged food in the UK, click here.