The Global Food Security & Sustainability Summit, organised by The Pinnacle Group International, is one of the most important events held to address the critical issues of food security. From a local to a global level, and from an interdisciplinary and systemic food systems perspective, the event devoted attention to the future of nutrition. Topics included food waste, technology innovation, supply chain logistics, and alternative proteins and nutrition.

On 30 June 2022, Euromonitor International participated in a panel discussion titled “Understanding Novel Foods, The Benefits and Risks and What It Means to Move from Animal Food Protein to Plant-Based Protein”. Other panellists included Sophie’s BioNutrients, Let’s Plant Meat (Nithi Foods Co Ltd) and A*STAR (Agency for Science, Technology and Research) Singapore.

The discussion largely questioned why plant-based food is still a relatively small market in Asia; sales of meat and seafood substitutes through the retail market were valued at only USD0.2 billion in 2021, when the figure for the rest of the world was USD5.4 billion.

Positioning: Urgent need to move away from comparisons

The concept of plant-based meat is long-established across Asia, with “mock meat” dishes already in abundance, as the Buddhist diet has made vegetarian options common. Mr Smith Taweelerdniti of Let’s Plant Meat shared that while plant-based food is positioned to offer more sating, exciting options for consumers beyond traditional choices, the familiarity of “mock meat” and traditional vegetarian dishes remains strong across Asia, thus making meat analogues easily substitutable.

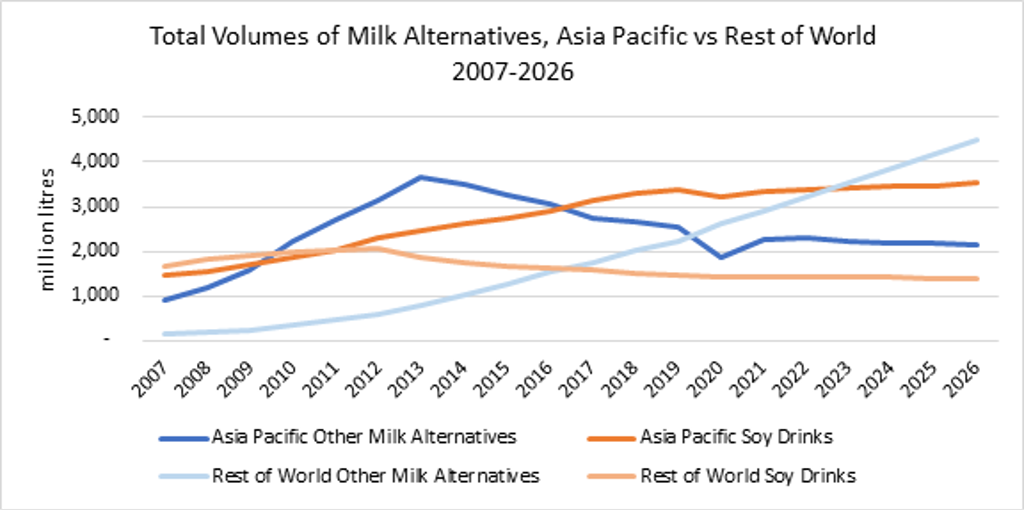

The ascent and maturity of soy drinks consumption in Asia provides insight, with soy drinks widely accepted as a nutritional beverage instead of as a milk alternative. This strong familiarity has anchored demand over many years, opposing the trend seen by the rest of the world. Notably, soy drinks in Asia have held their own amidst the rising popularity of other milk alternatives, such as oat milk and nut milk, as trendy substitutes to dairy. Thus, amidst the rising profile of dairy nutrition over the past decade in the region, soy drinks did not suffer a decline in volume demand.

Source: Euromonitor International Dairy Products and Alternatives

Dr Ralph Graichen from A*STAR Singapore asked, “Does plant-based need to compete with meat?”, highlighting that the comparison could diminish the quality of plant-based food that players are trying to provide. On its own, as simply another source of protein, plant-based food may stand a chance to gain greater traction.

Nutrition: More evidence needed to prove healthfulness of plant-based protein

Meat has long been held in high regard in Asia as an essential food group on its own, due to the belief that it is a key contributor to health and satiety.

In fact, 51% of Asia’s surveyed flexitarians (Euromonitor International’s Voice of the Consumer: Health & Nutrition Survey, fielded February to March 2022, which surveyed Asian consumers from China, India, Indonesia, Japan, South Korea and Thailand) opt for such a diet to “feel healthier” – this points to a dominant perception that substituting meat has to be justified by a health reward. In addition, the healthfulness of plant-based meat has thus far appealed to consumers based on perception rather than nutrition.

This is in part due to the health benefits of plant-based foods thus far lacking marketed evidence, triggering instead a closer look at sodium content and ‘overengineering’. Marketing has largely ridden on sustainability and environmental and animal welfare, which are easier to communicate.

Innovation: Long-term adoption depends on compatibility with local cuisine

Much of the progress of plant-based has been centred on creating excitement among consumers thanks to foodservice – from a luxurious positioning in fine dining restaurants and chef ambassadorship, to seasonal options launched by fast food restaurants – with insufficient consumer acceptance that plant-based food could be a compatible addition to everyday meals at home.

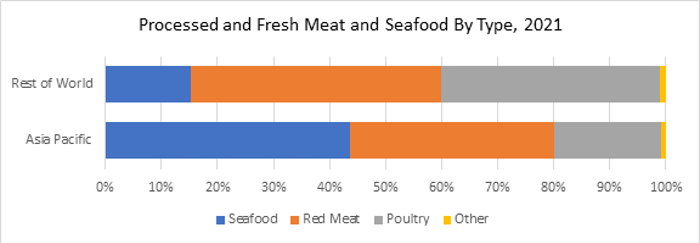

This is further exacerbated by limited demand for formats such as nuggets and patties in Asia. Indeed, plant-based innovation has recently been more prominent in ready meals and appetiser formats (such as dumplings), which are more in line with Asian preferences. Furthermore, the use of animal-based protein in Asia includes lard and fats, adding complexity to plant-based innovation. For players with a clear positioning as offering meat substitutes, their core target consumers are also a smaller proportion of the total Asian population compared with the rest of the world due to the region’s high dependence on seafood.

Source: Euromonitor International Staple Foods, Fresh Food

The panel’s moderator, Mr Eugene Wang of Sophie’s BioNutrients, wrapped up the session with a brief discussion regarding achieving price parity for plant-based food. The panellists agreed that the current economic challenges are expected to derail the movement to reduce the gap between plant-based and animal-based meat, despite progress in scaling production. With price parity still a long-term goal for producers, efforts to encourage mainstream adoption of plant-based food among consumers still have much room for improvement.

For further insight, read our article, The Evolution of Plant-Based Eating and Beyond.