The Coronavirus (COVID-19) pandemic has had a lasting impact on foodservice. In many countries, government restrictions on dine-in access and operational capacity were devastating for sales but were designed to be short-term remedies to keep the virus from spreading. Longer-term shifts, however, such as a move towards more working from home, will impact not only the way consumers move around in the future but also the foot traffic foodservice operators depend on for sales in travel locations.

A large and growing market for travel foodservice was built on a foundation of predictable patterns in the consumer movement. As working from home normalises and businesses cut back on travel, these consumer patterns are likely to be less predictable and closer to home. When consumers do travel, they will expect more from the foodservice opportunities they encounter and will likely spend more for them.

Office commutes and business trips - the pre-pandemic anchor of travel foodservice

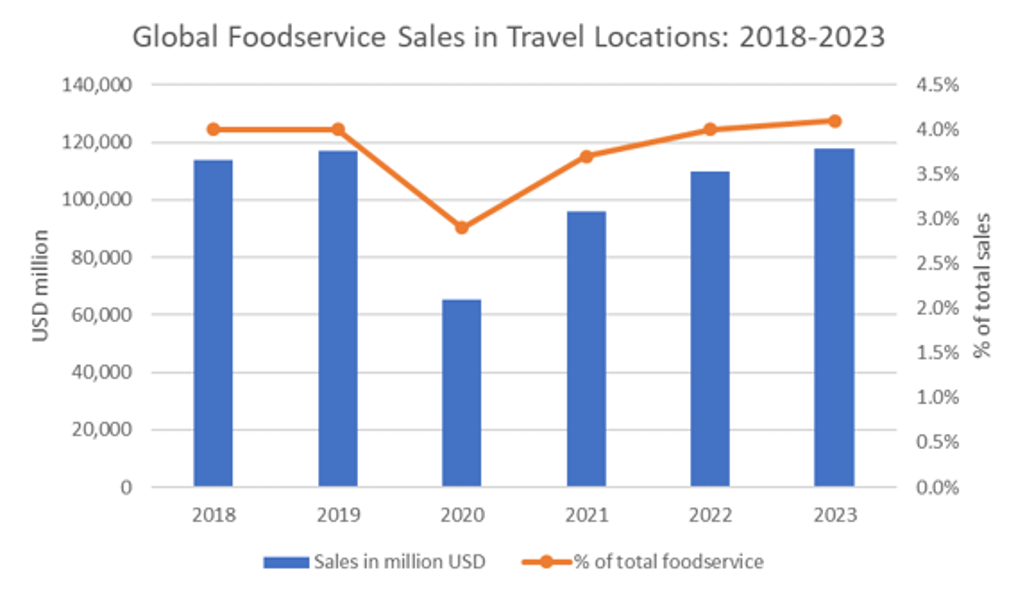

According to Euromonitor International, in 2019 before the pandemic, 4% of all foodservice sales globally occurred in travel locations such as eating joints along roadways, train stations, and airports amounting to USD117 billion. Multinational chains like McDonald's, Starbucks, and Prét-a-Manger grew rapidly in this segment, as travel operators licensed these and similar brands to generate predictable offerings. Commuters might pass by the same foodservice locations every day, which incentivised them to download apps and build loyalty. They may have also searched for the same brands when traveling in new places for the same reasons.

Source: Euromonitor International Passport Industry Data, Consumer Foodservice; Note: forecast years are shown in real term, constant 2019 prices

The pandemic disrupted those patterns and a new normal is already appearing. At a recent US conference, Dunkin’ Brands reported a shift in traffic from mornings to early afternoon. Consumers working from home are driving to Dunkin’ for a mid-day break rather than driving by each morning on their way to the office. What may have been a breakfast order might have become something else for lunch or an after-lunch daypart, changing the demand for certain products. In the Philippines, McDonald's introduced a "Ride-Thru" option during the pandemic, a drive-through window accessible to bikes, scooters, and pedestrians. The predictable flow of morning commuters by car has become a less predictable flow of more spontaneous and diverse trips, and McDonald's has had to adapt to capture a broader range of possible occasions.

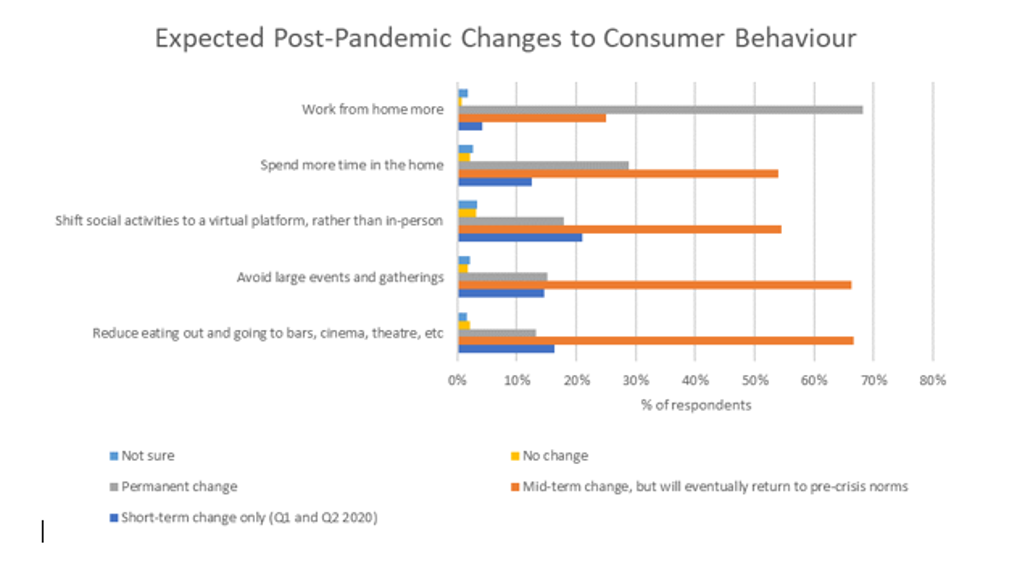

Source: Euromonitor International Voice of the Industry COVID-19 Survey, October 2020

Business travel was another important driver of travel foodservice sales, especially in train stations and airports. Foodservice operators in these places relied less on loyalty but benefitted from the sheer volume of foot traffic from regulars and non-regulars alike. Business travel faces an uncertain future, and 23% of total global trips attributed to business travel before the pandemic are not expected to recover until 2022, according to Euromonitor’s forecasts. This could shift demand to leisure travelers and families who are likely to prefer foodservice outlets – even at the airport – that better reflect the experience of traveling in a culturally-distinct place. Multinational chains with predictable offerings may lose out to local chains with unique offerings to highlight the experience of traveling that drives holidaymakers.

Pent-up demand will drive spending in the future

Moving forward, convenient foodservice occasions will likely diverge along two distinct paths. On one side will be a whole new set of home-orientated convenience occasions, bringing together innovations in delivery, ghost kitchens, and grocery retail adaptations catering to consumers in their homes. On the other side is travel foodservice or foodservice options for consumers on-the-go. These occasions will cater to a new kind of convenience, as consumers look to make the most out of the trips they eventually, and probably less frequently, take in the future.

Commuting to work after the pandemic may become more sporadic, occurring only once or twice a week if at all. Business travel is likely to be less frequent as companies look to cut travel costs and rely on technology to connect virtually. Consumers will be moving around less often and in less predictable patterns. When consumers do leave home they will want to make the most of it, choosing foodservice options that are worth waiting for and spending more on. Those "once in a while" commutes could wander to generate the foodservice opportunities consumers hope to have, rather than those that happen to be available along the quickest and most direct path to and from the office.

Leaving home, in the future, will be an occasion maximised for experience driven by the excitement that foodservice can generate. If convenience alone is not enough to attract consumers passing by, things like the brand, the story, and the products need to find a new way to stand out, differentiated for the experience that the consumer will look for in those on-the-go moments. Travel foodservice operators that match the right location with the right offering will enjoy higher transaction values and a new kind of brand loyalty.