Travel Recovery: Peak Sales Not Expected to be Recouped until 2024

The travel industry has been decimated by the pandemic, being the first to close and the last to reopen. Euromonitor research forecasts that international tourism spending is expected to claw back some ground to reach USD635.4 billion in 2021. Nevertheless, it remains precariously 63% below 2019 levels in real terms.

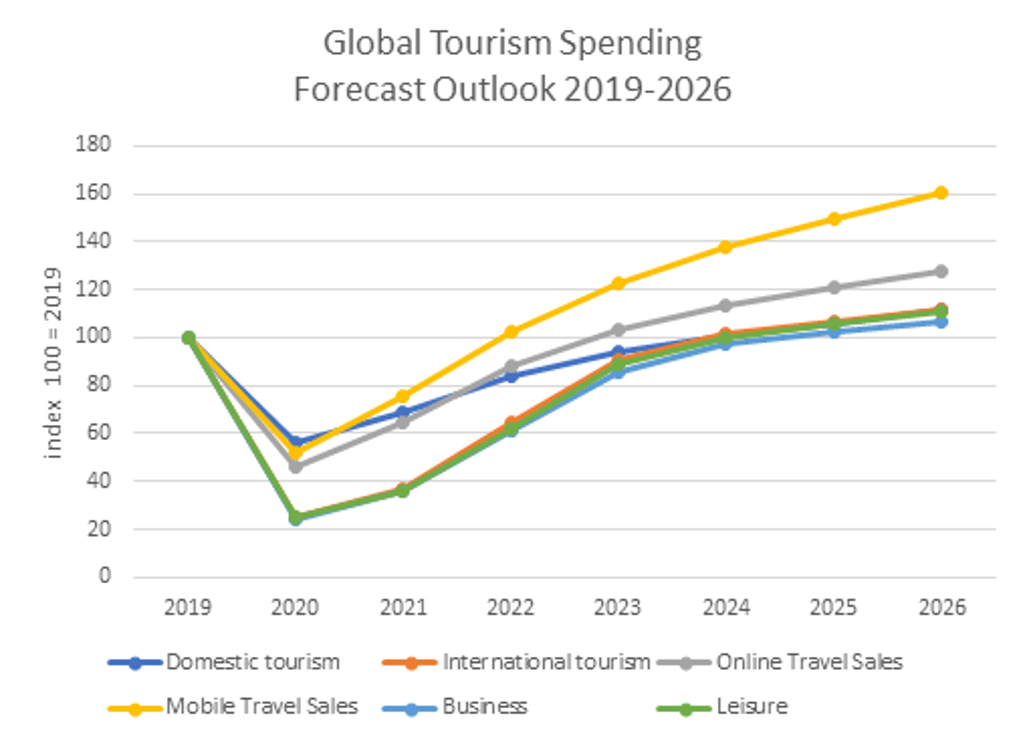

In our baseline scenario, recovery to hitting peak sales is expected by 2024 at the earliest, based on current rates of vaccines, developing herd immunity, rolling back on travel bans, quarantine and easing of restrictions along with improving macroeconomic conditions. This creates a challenging situation for travel businesses and destinations that face a dilemma on when and by how much to reopen supply to meet pent-up demand.

Decoupling for the greater good

A decade ago, income and GDP growth, along with government bailouts, were fundamental drivers to stabilise and recover after the Global Financial Crisis. Yet, the pandemic has torn up the rule book when it comes to policy response where the travel industry has essentially decoupled from the global macro economy. Real GDP growth fell by 3% in 2020, compared to a whopping 75% nosedive for international tourism spending in real terms. The industry is still suffering from being at the mercy of a disparate mess of uncoordinated government actions from cross-border travel to a myriad of digital health passport schemes.

Eighteen months on, frustration levels continue to rise especially in high growth potential regions like Asia Pacific that are beset by over-caution and low vaccination rates due to an unequitable delivery to the most in need. Equally, the disappearance of Chinese high value outbound demand is a major obstacle, especially in Asia, being a primary growth catalyst pre-pandemic and requiring a total rewiring of key intra-regional source markets.

Note: Baseline forecast from 2021, business and leisure for outbound tourism spending, in constant terms

Business travel to lag leisure in returning to pre-pandemic levels

Dark clouds continue to hang over the fate of business travel. For now, business travel is beset by the same challenges as leisure when it comes to factors like government health, travel and transport policies so both are currently following the same trajectory.

Yet, the speed of recovery will begin to diverge between business and leisure from 2023 onwards, where business travel – corporate and unmanaged – will take longer to attain peak sales, only expected by 2025 in a baseline scenario. This is a long and painful time for corporate travel companies where many have sounded its death-knell.

The situation is further compounded by some fundamental consumer behavioural shifts, such as the overnight pivot to working from home and more of a flexible work/life balance off the back of the pandemic. Companies will increasingly be loathe to send their employees abroad, especially considering the heightened legal requirements for duty of care in the post-COVID era. In April 2021, Euromonitor International’s Voice of the Industry: COVID-19 Survey, revealed that 69.5% of business respondents stated that their company was cancelling travel and 50.7% restricting travel to support the health and wellbeing of employees.

Business travel will be characterised by the C-Suite adopting Global Rescue-type services with unique, seamless access throughout the entire customer journey. Lower down, there will be a premiumisation of mass market business travel, with an à la carte approach to products and services that help to facilitate a more contactless, automated service.

Employees are also increasingly looking to their employers to walk the walk when it comes to sustainability, hence, the rejection of non-essential business travel, or at least, having many more sustainable options and transparency about the positive/negative impacts that an entire trip entails. This transition to a quality over quantity tourism model is evident across the entire spectrum of the travel and tourism supply chain.

Global online travel sales break the halfway mark

Digitalisation has been truly accelerated across all aspects of consumers' lives and for the first time ever, global online travel sales % penetration broke the 50% mark in 2020, hitting 53.8% in 2021 - a staggering USD834 billion. There is industry consensus that digital transformation jumped forward five years in travel and tourism because of the pandemic.

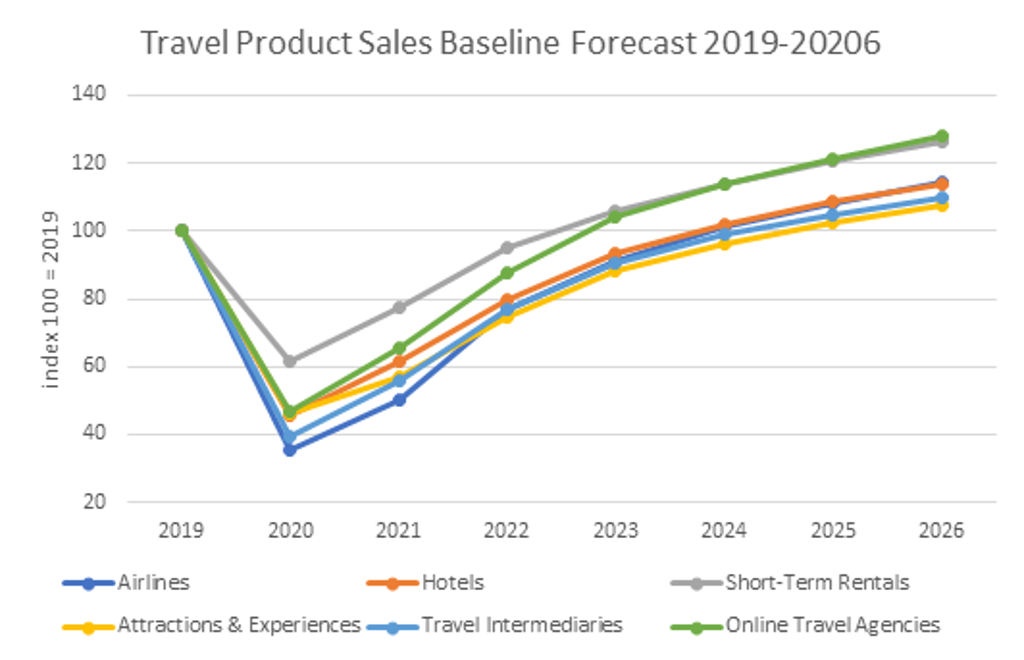

Digital-first brands in short-term rentals and online travel agents were in a prime position to pick up pent-up domestic leisure demand post lockdown, stealing a march on recovery for brands like Airbnb. Short-term rentals and online travel agents are due to breach peak sales by 2023, if not sooner.

Categories like airlines face a double whammy from externalities – curbed by severe travel restrictions, health requirement from government, corporate digital health schemes like the IATA Travel Pass, plus growing public scrutiny due to the climate emergency.

The focus on international aviation is ramping up, especially with the Tourism Declares a Climate Emergency movement gaining steam, whilst countries like France and Germany have banned flights under three hours. Categories such as airlines and hotels that were in a tail-dive in 2020 are expected to take five years, returning to former glory by 2025 at the earliest.

However, the look and feel of many travel categories will differ as the pandemic has ushered in truly transformative change. Many brands and DMOs are aiming to optimise the positive benefits such as jobs, opportunities and social equality, whilst mitigating negative impacts on biodiversity, local communities, capacity challenges and the environment. As ever more travel companies listen to the science, they are pursuing the necessary 1.5∘c pathway to net zero emissions, even far earlier than 2050. Recovery will therefore be seen through a responsible and sustainable lens to ensure that travel can deliver on its promises as a force for positive change that it always shouts about.

Note: Baseline forecast from 2021

For further information, please contact Caroline Bremner, Senior Industry Manager – Travel, at caroline.bremner@euromonitor.com