A food crisis is brewing in 2022, with wheat supply and pricing playing major roles. Soaring agricultural input prices, increasingly unpredictable weather conditions during harvests and the war in Ukraine are all pushing up the key commodity price and in turn leading to inflation across most staple foods.

Trade disruptions and weather conditions hurt wheat supply in 2022

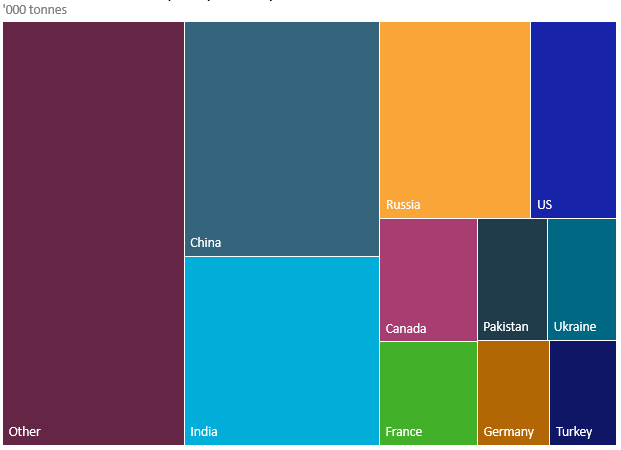

Undoubtedly, the largest catalyst for uncertain global wheat production and trade has been caused by Russia’s invasion of Ukraine. The two countries accounted for approximately 15% of total global wheat output and around a quarter of global exports in 2021; as a result, the sanctions against trade with Russia and halting agricultural practices in the warzone in Ukraine have dealt a major blow for the world’s wheat supply. Meanwhile, Australia and Argentina are also set to contribute to falling global wheat trade, with their harvests pressured by unfavourable weather conditions.

According to FAO, the UN’s Food and Agriculture Organisation, 20-30% of winter wheat crops in Ukraine are likely to remain unharvested during the 2022-2023 season, largely depending on limited fuel availability. Ukraine's wheat trade through Black Sea ports is also experiencing significant limitations during the year, adding to tightening global supply.

While Russia’s harvest for the 2022-2023 season remains optimistic, uncertainties exist over the ability to export, possibly leading to lower income for farmers and putting future planting prospects in jeopardy.

Overall, global wheat production in 2022 is likely to decline from record 2021 levels; as a result, the reduced harvests in some of the major exporting countries and export suspensions by such markets as Ukraine and India provide the main pressuring force on wheat commodity prices in 2022.

Chart 1. Wheat Production Output by Country, 2021

Rising input costs add to wheat supply challenges

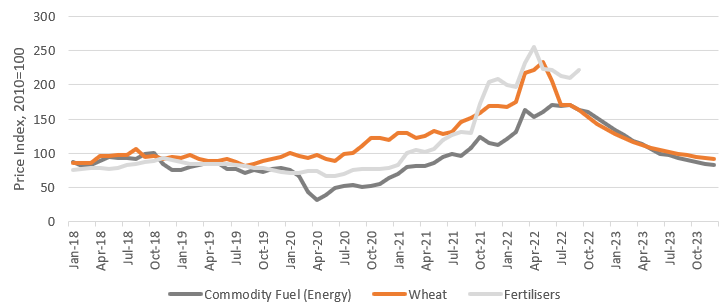

Other factors are also contributing to inflating commodity prices. Increasing input costs for energy and labour, shortages of fertilisers and pesticides, and gradually shrinking agricultural land as urban sprawl expands are all leading to further possible wheat supply disruptions.

Russia and Belarus are among the leading suppliers of fertilisers, and trade sanctions after the invasion of Ukraine in 2022 are driving up global prices. According to the World Bank, fertiliser prices surged by approximately 30% over January-May 2022, after an 80% increase in 2021. Meanwhile, elevated fuel prices in 2022 are inflating input costs for grain farmers through transportation expenses as well as machinery operation. Farming profit margins are further squeezed by rising global interest rates.

Chart 2. Wheat Price, 2018-2021

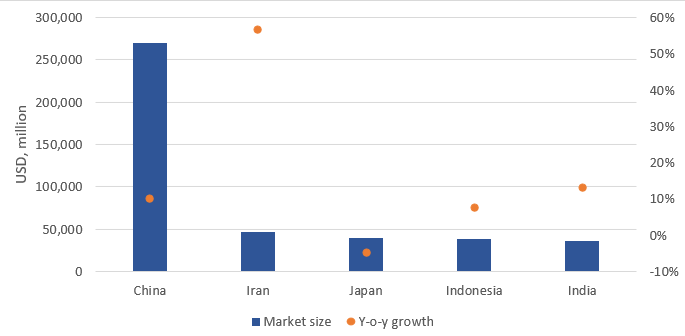

Asian countries are most impacted given their fast-growing wheat demand

Asia Pacific is set to drive wheat consumption growth, as the increasingly affluent consumer base in the region is also branching out from traditional rice-based foods towards Western cuisine, including pasta, bread, and pastries. Meanwhile, wheat is increasingly used in animal feed, as rising appetites for meat call for rapid expansion in animal husbandry. Lastly, the significant population growth rates are pushing for governments to ensure sufficient food security in the future, with stable supply of staple grains being among the top investments.

Overall, China and India are the key Asian markets for the commodity demand growth with other significant opportunities offered by Iran and Indonesia. Nevertheless, the rapidly growing demand for wheat from emerging Asian markets also means they are vulnerable to wheat supply uncertainty and rises in global prices.

Chart 3. Demand for Grain Mill Products in Top Five Asia Pacific Markets

Rising food insecurity in some emerging and developing countries

The disrupted wheat supply has also led to increasing food insecurity in some parts of the world, particularly in emerging and developing countries that are dependent on Russia and Ukraine. Egypt is one the world’s largest importers of wheat, and, according to the World Trade Institute, wheat from Russia accounted for 67% and Ukraine for 20% of Egypt’s total wheat imports in 2021. The rising price of wheat is leading to higher food inflation that hits the country’s vulnerable population. Meanwhile, Pakistan, the sixth largest global wheat producer, is facing a climate-related food crisis as heavy rain and severe flooding in summer 2022 has devastated the country’s farmland.

Overall, global wheat markets continue to face turbulence, considering the ongoing impact of the war in Ukraine and climate change. Emerging markets are most vulnerable to wheat supply shortages and price increases, prompting the need to diversify supply markets as well as enhancing wheat productivity.

For further insight, read Euromonitor International’s full report Global Market Overview of Wheat