The moment has arrived when travel and tourism can finally return to some form of normalcy, as enormous pent-up demand is unleashed in line with the easing of travel restrictions and mass vaccinations around the world.

Stellar performance for tourism

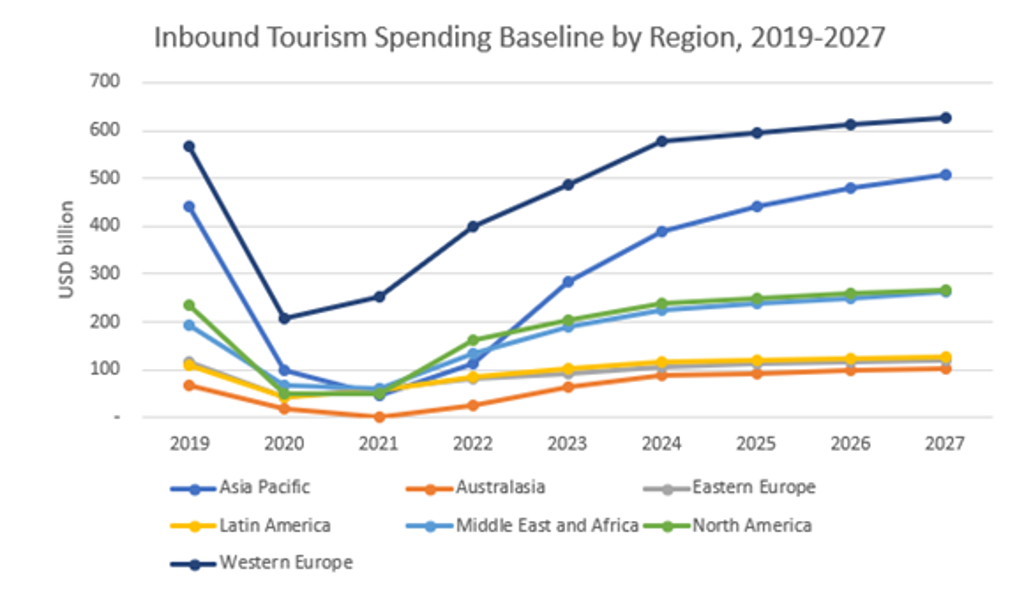

Based on Euromonitor’s latest Travel 2023 research, global inbound tourism spending is set to grow by a stellar rate of 88% in 2022; however, the road to recovery will be long and hard, with 2019 levels not attained until 2025 at the earliest in our baseline scenario.

In 2022, spending by international visitors is forecast to reach only 58% of peak 2019 levels, as the pandemic continues to take its toll following the sheer collapse of the sector at the height of the crisis and the ensuing gargantuan task to build back in a more sustainable and resilient way.

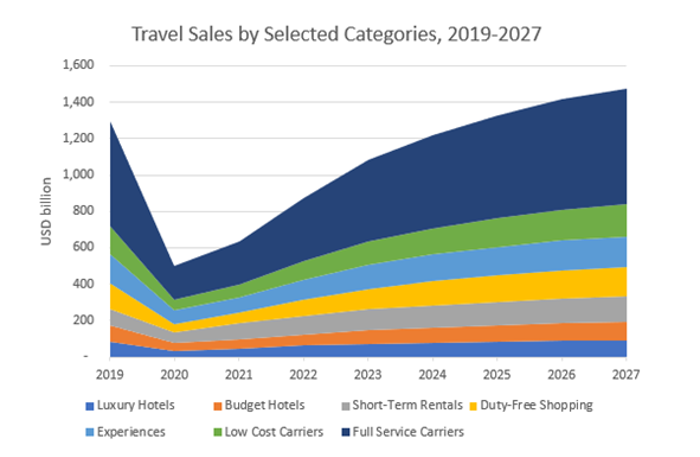

Some areas are moving much faster, helped by the pivot to domestic tourism over the past two years. In-destination spending, that amounts to USD2.3 trillion annually, is expected to ramp up quickly, attaining 70% of its pre-pandemic levels in 2022. Duty-free shopping, and festivals and leisure events are the fastest growing, at 46% and 50% respectively in 2022, as in-person experiences and revenge shopping return with a bang for travellers.

Short-term rentals is accelerating fast, expected to exceed the peak level in 2023, two years ahead of categories such as luxury hotels, duty-free and low-cost carriers, as consumers seek more local, authentic travel experiences off the beaten track. Meanwhile, full-service carriers will take even longer, due to their reliance on long haul, which will be slower out of the blocks, coupled with rising consumer price sensitivity in the face of the cost of living crisis.

Recovery for international tourism spending is therefore going to take more than twice as long as after the last global crisis, when it took three years to return to peak spending levels after the Global Financial Crisis.

Note: Forecasts from 2023 onwards

Major headwinds cause mass disruption

Despite immense pent-up consumer demand, supply is struggling after governments reopen borders, as travel businesses cannot keep up due to challenges such as insufficient flight capacity and labour shortages. This perfect storm has led to airlines and airport queues making headline news due to mass cancellations and flight delays, causing painful disruption to millions of consumers. Thousands of flights are being cancelled from summer schedules across the UK, North America and Europe, from low-cost carriers and tour operators to full-service carriers, as operational headaches persist.

Inflation and rising prices are other major headwinds to the speed and scale of recovery, stoked by supply chain disruptions and war in Ukraine as commodity, food and energy prices soar. This is leading to rising costs being passed on to final customers, as companies are unable to absorb the impact for long. Yet, for now, consumers are resisting tightening their belts, taking full advantage of borders reopening and being welcomed back by destinations eager to recoup staggering losses and jobs after two and half years of hiatus.

So long staycations as departure gates reopen

North America, Europe and the Caribbean are leading the recovery in international travel. Even regions showing more caution, such as Asia Pacific, are reopening, as vaccination rates reach high levels and governments are more at ease with their citizens living with the virus, although vaccine inequity is a threat. Lessons have been learnt, and a reversal from zero tourism to over-tourism is unlikely, as destinations are increasingly adopting sustainable tourism strategies to navigate the new travel normal in line with the need for a net-zero transition.

In line with the majority of European destinations removing the remaining travel restrictions, sun and sea destinations around the Mediterranean and Adriatic are setting the pace for recovery, driven by strong intraregional demand.

However, over the long term, the strength of pent-up demand in the face of ever increasing costs is unlikely to hold up in advanced markets, particularly in the more price-sensitive income segments in the low- to middle-income brackets. Growth in the top-income bracket alone will not be sufficient to sustain growth and recovery, but affluent travellers will be of great interest to travel brands in the near term, as the sector pivots to a quality tourism business model.

Source: Euromonitor International, Travel 2023

Note: Forecasts from 2023 onwards

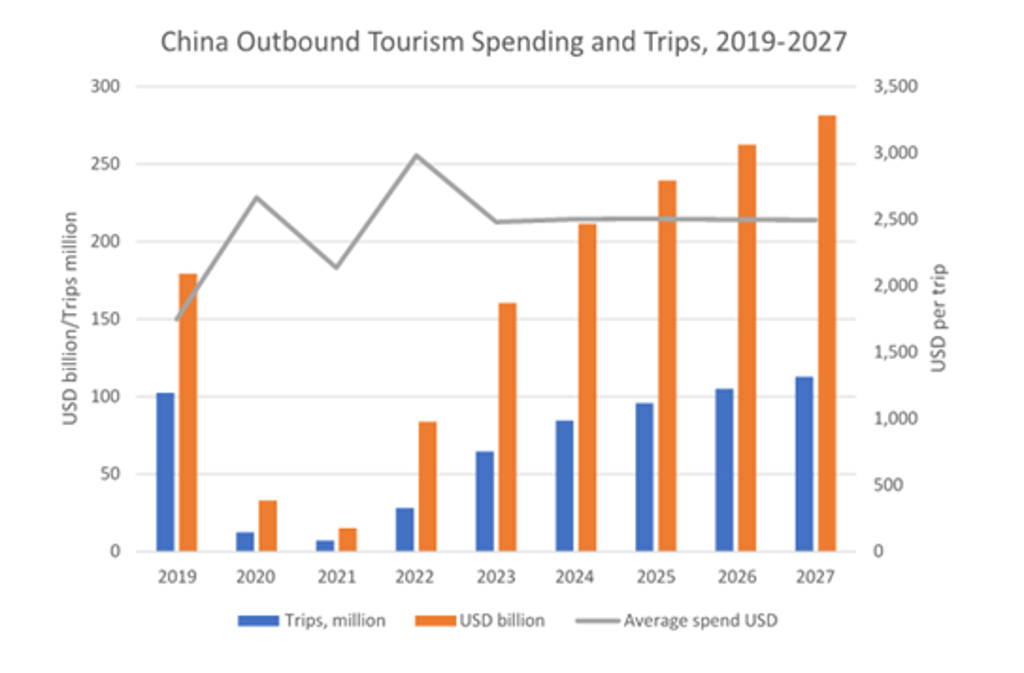

China not yet outbound

China is still under a zero-COVID policy approach, that has put a near stop to outbound tourism, a much-needed driver of recovery for countries around the world, let alone intraregionally in Asia Pacific. In 2022, Chinese outbound tourism demand is expected to remain at 47% of pre-pandemic levels.

There have, however, recently been signs of a thaw, with the Pacific Asia Travel Association reporting that Chinese embassies in countries such as the US, Ireland, Denmark and Spain have eased pre-departure testing, and that business travel can recommence for foreign companies operating in China. Shanghai’s strict lockdown has also been lifted. The expectation is that China will return to international travel by the end of 2022, after the Communist Party conference and potential change in policy.

Interestingly, outbound tourism spending is set to recover faster than trips, underlining the transition to value-driven tourism post-pandemic, with strong interest in sustainable travel features among Chinese consumers. Our Voice of the Consumer Lifestyles Survey highlights that a higher number of consumers (76%) select sustainable travel features, such as immersion in nature and culture vs 73% for mass-market options in 2022.

Note: Forecasts from 2023 onwards

With consumers showing high levels of engagement in sustainable travel, and travel brands increasingly adopting science-based targets, coupled with government net-zero strategies, the future looks bright for travel after such challenging times, despite the near term headwinds.

For further information about Euromonitor’s Travel research, please contact Caroline Bremner.