Asia Pacific Advancing Innovation in Consumer Finance

Asia Pacific has been driving innovation in financial products, services and payments for the last decade. The Coronavirus (COVID-19) pandemic accelerated the pace of innovation and the transition of retail to digital platforms from the traditional in-store model. This transition has further driven consumers towards cash alternatives and financial service adoption. Despite markets rapidly developing throughout the region, there also remain markets which are far less developed, with large rural populations which lack access to basic financial products and services and telecommunication networks, leaving significant opportunity over the forecast period.

Several economic indicators illustrate rapid growth in the region and explain the rise in non-cash consumer payments. Investment in telecommunications, technology adoption, innovation by digital payment platforms and increased access to financial services all have supported the rapid growth.

Growth in investment in the telecommunication industry has exceeded all other regions. This was largely driven by the two most populous countries in the region, China and India. Per household consumer expenditure on telecommunication services in the region is set to rise by 65% in real terms over 2021-2040, compared to the 35% global growth expected for the same period.

Smartphone adoption rapidly accelerated over the previous five years across the region, with most markets increasing from half or two thirds adoption in 2015 to above 80% across all researched markets in the region. The adoption of smartphones has contributed to rising digital commerce and the creation of superapps which have steadily expanded across retail categories and services. The largest of these platforms have moved beyond their founding market and expanded throughout the region. Alibaba of China and Kaokao of South Korea are just two examples of superapps that have expanded beyond their original function to financial services over the past five years and are expanding throughout the region.

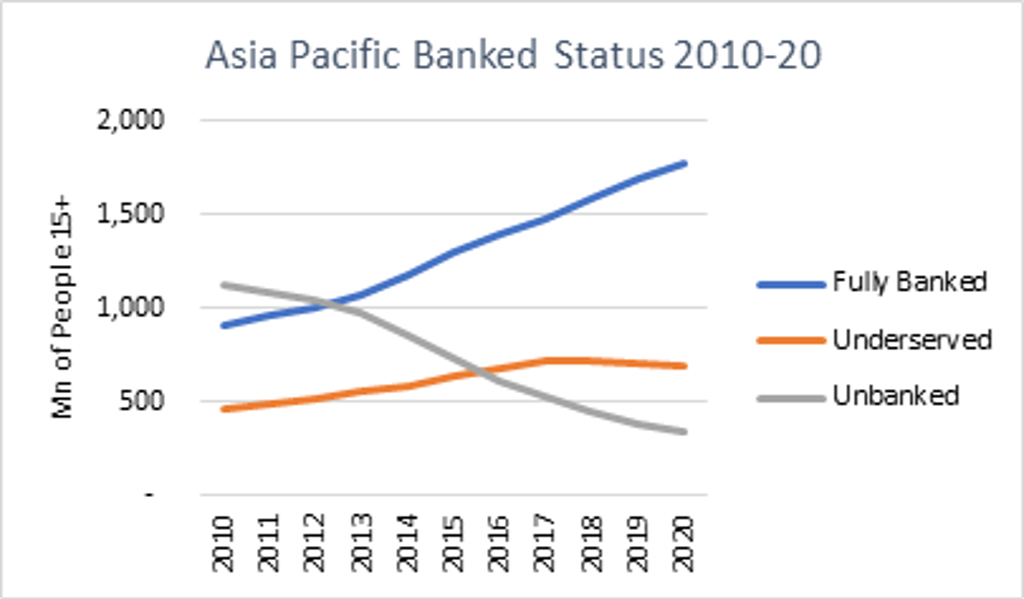

The number of banked consumers in the 12 researched markets in the Asia Pacific region increased by 867 million from 2010 to 2020 and registered additional gains during the pandemic. Financial cards and services have become essential to broader portions of the population – more so than ever before. Digital banks have been able to offer low or no cost financial products and services because they do not have the support of an extensive legacy retail bank branch network and instead form partnerships with retailers or fintech to increase their reach within the market. Despite gains in the banked population in most countries in the region, it is also home to the market with the highest portion of its adult unbanked population, the Philippines. This divide between developed and developing will likely fade over the next few years, as technology makes financial products and services more accessible.

China and India

China generated 49% of global card payment value in 2020, an increase from 36% five years earlier. Active regulation promoting cash alternatives as well as the shift of retail online has accelerated financial card adoption in the market. Due to the rapid rise in card utilization, China now has the largest card network and card issuers by payment value in the world despite these institutions generating a very low portion of their payment value internationally. Having a leading position in these areas means that the region will drive financial card trends both in card function but also in reward and loyalty programs.

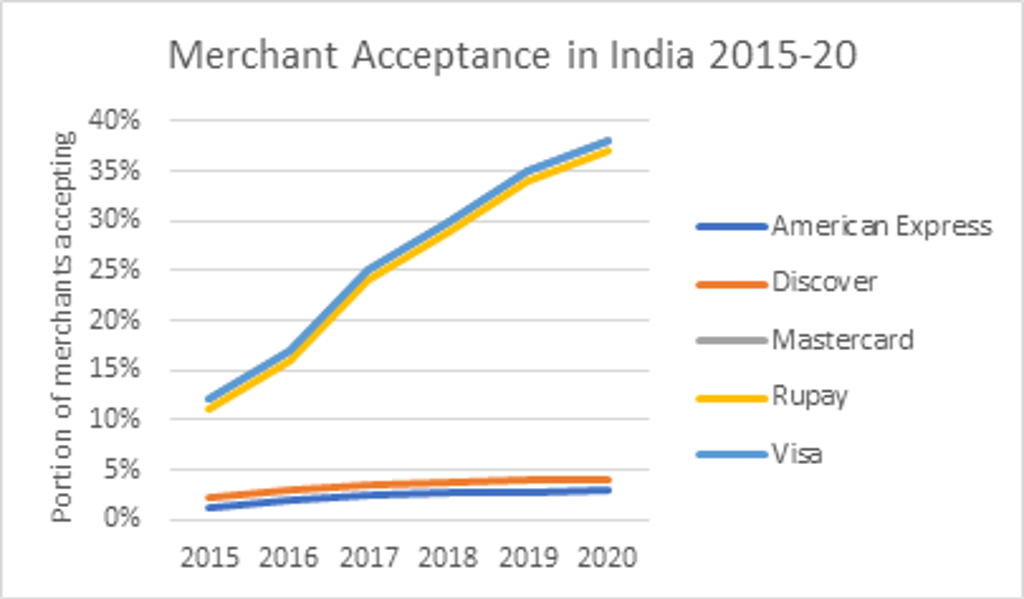

India is set to become the most populous country in the world in 2026, surpassing China. Unlike China, cash accounts for the vast majority of consumer payment value despite aggressive policy supporting cash alternatives. However, over the forecast period the effectiveness of government cash conversion efforts will likely begin to have an impact and increase card and electronic payment value. A greater constraint in India will be reaching rural consumers which despite an 11% decline from 2020 to 2040 are still expected to account for 53% of the population. The convenience, security and overall income levels of rural populations limit the benefits of cash alternatives for both the consumer and the local merchants. The most accepted card networks have made progress in accepting cards but remain far below the regional average. The portion of merchants accepting financial cards increased from 12% in 2015 to 38% in 2020.

Source: Euromonitor International

The Region Going Forward

Strong economic expansion, increasing consumer purchasing power, coupled with rising mobile internet penetration, greater possession of smartphones and active government payment policy will drive cash alternatives for consumer payments and adoption of financial services going forward. The COVID-19 pandemic has accelerated the shift of retail online and innovation in payments and digital platforms. Fintech has bridged many of the access hurdles for consumers to shop online and to transfer money and has reduced the traditional infrastructure requirements of retail branch networks or merchant POS card readers. Going forward many of the successful innovative fintech companies will find greater opportunity in developing markets to replicate the transformation away from cash payments and adoption of financial services.

For additional insight see the global briefing Unleashing Consumer Finance Innovation in Asia Pacific.