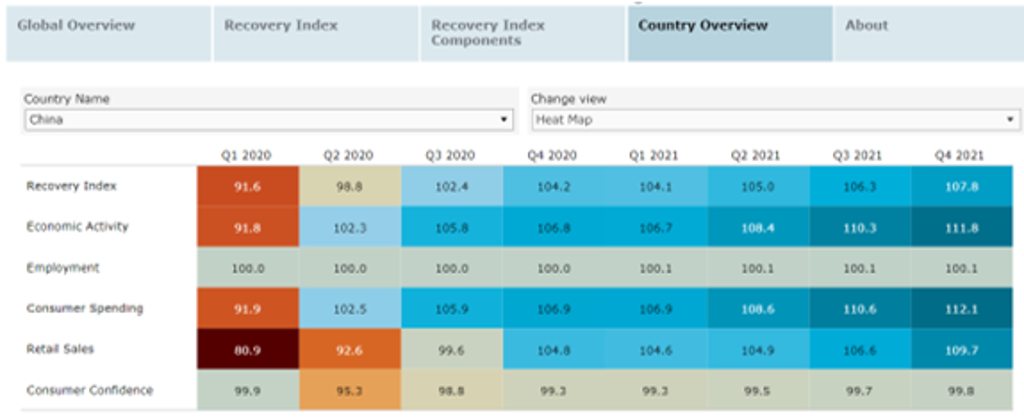

Euromonitor’s Global Recovery Tracker shows that China was the first major economy to see its real economic output, labour market, and consumer spending return fully to pre-pandemic levels, as of Q3 2020. Coronavirus (COVID-19) has left a profound impact on China’s consumer goods and service sectors, disrupting the consumer mindset for hygiene, immunity, and spending behaviour.

Massive lockdown and store closures in the first quarter of 2020 led to a dramatic decline in retail sales and real GDP decline of 6.4% for the quarter, according to Euromonitor International’s Macro Model. However, as new COVID-19 cases started to fall from Q2 2020, venues reopened and business activities resumed; China’s economy has since witnessed a robust v-shaped recovery.

Source: Euromonitor International - Global Recovery Tracker. Note: Score of 100+ indicates a full recovery back to 2019 levels.

Consumer goods and services follow a similar pattern but show distinct industry-specific features. Some industries have been on a roughly expected growth trajectory - consumer health, for example - while others are outliers; luxury goods, for example, which showed unusual resilience. Retailing in 2020 offered an unprecedented opportunity for e-commerce to grow, which has in return helped companies to transform with digital agility. The insights in the following sections come from our analysts on the ground in China, characterised by their sharp industry knowledge. With the global pandemic continuing into 2021 but with more countries stepping into recovery, the pattern in China can provide lessons for businesses to plan ahead.

Beauty and personal care: Strong resilience driven by demand for healthy beauty and local players’ agility

Analyst: Kelly Tang

China’s beauty and personal care market quickly picked up in April 2020. Brands were able to engage with consumers through e-commerce channels, coupled with new marketing tactics and aggressive promotion. Given the absence of duty-free and reduced opportunity for overseas spending in 2020, local consumption of premium beauty products was significantly boosted.

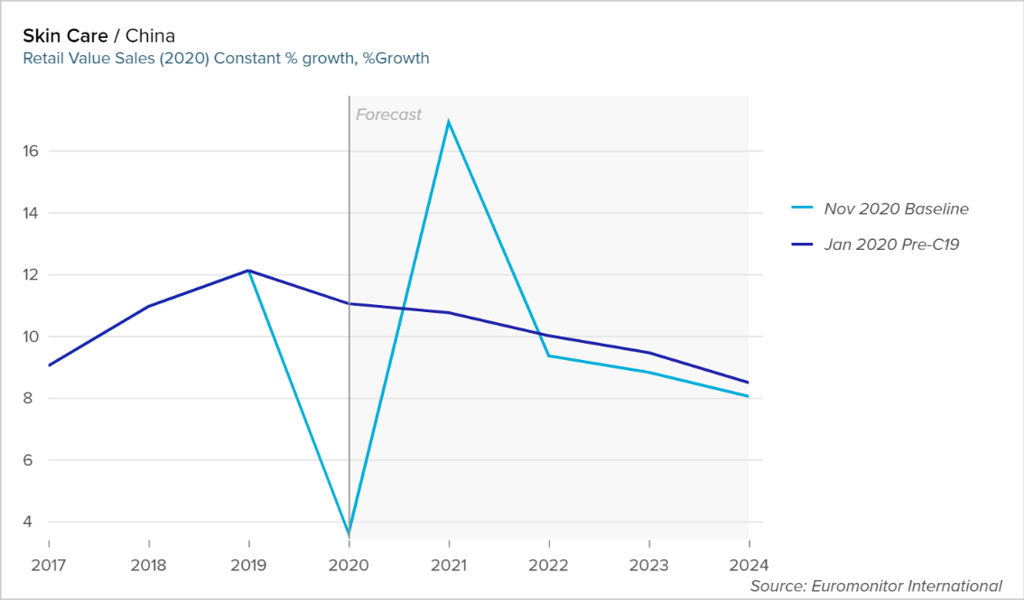

Skin care is one of the most resilient categories. Brands actively leveraged the concept of skin immunity, with frequent mask-wearing prompting consumers to take action against skin irritation. The rising demand for healthy beauty is expected to last, evolving into more sophisticated needs for different skin concerns, with more frequent face mask-wearing expected. After April 2020, some bounce back for colour cosmetics was also evident, driven by eye-makeup, which has become more of a focus given the rest of one’s face is typically obscured by a mask – arguably, the eyes have never been more important.

Source: Euromonitor International - Beauty and Personal Care Forecast Dashboard

Looking forward, accelerated digital transformation will be one of the key ways for beauty and personal care players to adapt their business strategies to remain resilient in face of uncertainty. The notable performance of several disruptive local brands has also proved the importance of digital agility in order to win in a rapidly evolving market.

Consumer appliances: Resurgence of construction and offline coupled with health-targeted product launches fuels recovery

Analyst: Leo Chen

China’s consumer appliances market has witnessed strong rejuvenation since Q2 2020, leading Euromonitor to take a more optimistic stance for future growth.

Source: Euromonitor International - Consumer Appliances Forecast Dashboard

Offline physical stores have been crucial for purchases of large ticket major appliance products, which benefitted from eased lockdown restrictions and more outdoor visits in Q2 2020. The resumption of construction work has given rise to recovery under China’s Fine Decoration Policy. Meanwhile, the pick-up of postposed redecoration demand has also stimulated retail purchases. Manufacturers also chose to launch new products after Q2, heightening consumer interest in upgrading and replacement purchases. Targeting rising health consciousness, a series of new products aimed to realise healthy eating via advanced food storage technologies, healthy laundry via steam treatment and healthy air environment via 56℃ self-cleaning and ventilation features on air conditioning units. The focal point of product launches is expected to remain health fortification in the long term, as healthy living demands are here to stay, given a year of intense health concerns.

Consumer health: Unprecedented interest in immunity and strong online presence sustain growth

Analyst: Kelly Tang

Retail sales value of vitamins and dietary supplements in China grew by 4% in current terms in 2020, despite offline store closures in the first quarter. Business picked up relatively quickly in Q2 2020, as bricks-and-mortar stores gradually resumed operations and consumers returned to pre-lockdown activity. Consumers’ rising propensity to healthy-living and increasing attention to preventive health will continue to sustain demand for vitamins and dietary supplements in the forecast period.

Chinese consumers are demonstrating an unprecedented interest in immunity, sustaining growth of immunity-boosting products throughout 2020, even after the initial wave of panic-induced stockpiling in Q1 2020. The COVID crisis further blurs the boundary between beauty and health, and more consumers are looking for beauty-related supplements that evoke the sense of beauty from within. Some of the latest trends in 2020 include skin-detoxing, anti-ageing and anti-glycation, which address maximising skin elasticity and improving skin metabolism.

E-commerce platforms and digital health apps were able to cushion some of the loss from offline stores in Q1 by offering free consultations and quick delivery of medicine. E-commerce is currently the biggest channel for vitamins and dietary supplements in China and is expected to continue to grow over the forecast period.

Home and garden: Digital solutions and hygiene-driven innovation key to recovery and growth

Analyst: Rachel He

Home and garden suffered in 2020, as the industry is reliant on offline channels, with considerable importance attached to the in-store experience. E-commerce is not yet an adequate alternative to offset loss triggered by lockdown in Q1 2020, for categories like furniture and floor coverings. However, with new cases of the pandemic dropping significantly and economic activities resuming from Q2 2020, home and garden sales staged a partial comeback, leading to a quick recovery quarter-on-quarter. Home office furniture and homewares were unusual exceptions, performing well in the wake of the pandemic, due to rising demand from home seclusion, with more consumers working from home and dining at home.

Manufacturers have reacted to the challenges posed by the pandemic and lockdown by mapping out digital and new product strategies. They have blueprinted digital solutions, beyond routes to purchase, to tackle pain points of traditional design and measure procedures. To cater to consumers’ rising attention to hygiene, manufacturers have also geared their focus of innovation towards sanitisation and have launched products that focus on home hygiene.

From 2021 and beyond, home and garden will continue its path to recovery, with consumer confidence warming up further. COVID-19 will have a long-term influence on consumer perception and behaviour: interest in eco-friendly and anti-bacteria products will continue, while functional and aesthetic demands for home environment quality will also sustain due to the home-as-a-hub trend.

Home care: Mixed performance across categories with downtrading and hygiene craving

Analyst: Leo Chen

In 2020, COVID-19 gave rise to squeezed personal disposable income, heightened price consciousness and shopping reprioritisation, but consumers’ instantaneously improved hygiene awareness led them to put disinfectant efficacy in the spotlight.

Laundry detergents and hand dishwashing are of high usage frequency but not perceived as direct disinfectants. As a result, they became part of consumers’ downtrading targets. In response to these consumer preferences, fierce price competition has intensified, both online and offline. According to Via, Euromonitor’s pricing intelligence platform, liquid detergents, detergent tablets and other detergents suffered great SKU median price slumps online. Consequently, the unit price drop dragged down the value growth of these two categories in 2020. However, the downtrading trend is projected to reverse, with an improved economy and diminishing influence of home seclusion over time.

Source: Euromonitor International - Via

Strongly improved hygiene awareness has propelled the adoption of laundry sanitiser, home care disinfectant and in-cistern devices. However, consumers have shown reluctance to sacrifice disinfectant efficacy in the pursuit of saving money when purchasing products, directly targeting hygiene needs instead. With climbing demand and unswerving unit price rises, these categories showed higher year-on-year value growth compared to 2019. Demand could normalise post-pandemic but catapulted hygiene awareness will persist and sustain solid growth in the long term.

Luxury: Repatriated spending and rejuvenation nurture domestic luxury market

Analyst: Kemo Zhou

China’s luxury market saw a whirlwind of ups and downs in 2020. After the sales slump in Q1 due to strict social distancing measures, the luxury market rebounded faster than expected.

Repatriated luxury spending, compounded by the growing influence of younger consumers, more than offset losses in Q1 2020, heating up the market in the second half of the year. The policy is another notable growth driver. The Chinese Government was already dedicated to revitalising domestic consumption pre-COVID. Upgraded duty free policy, lower import tariffs and a free-trade port in Hainan have paved the way for domestic revenge shopping post-COVID, especially with severely restricted opportunity for overseas purchases. The global pandemic will inevitably leave some permanent change to consumption patterns and keep part of luxury spending at home.

Accelerated digitalisation and proactive interaction with young generations plays a part in regaining consumers post-COVID. Besides the initiatives launched by luxury groups, domestic technology conglomerates have also worked closely with luxury brands, propelling the surge in luxury shopping. The global pandemic is reshaping the luxury industry and China has become a testing ground for new retail. The luxury industry might not be the first to regain customers but is among industries that witnessed the most radical change and an unstoppable rebound in 2020.

Retailing: Digital transformation leads the way for retailing recovery

Analyst: Feiqi Luo

In 2020, retailing had already recovered to almost the same level as the year before, with just a minor decrease of 0.8% value growth in current terms, thanks to effective control of the pandemic and strong consumption stimulus policies. E-commerce saw an unprecedented shift which largely offset the setbacks in bricks-and-mortar stores, with by far the highest value growth (20% in current terms) among retailing categories.

Subjected to decreasing offline traffic, retailers sped up the shift to online sales by adopting new business models like omnichannel, O2O, etc. One of the most popular means has been using livestreaming as a selling platform. Social commerce has been trending during the crisis as a way to foster communities via social media while consumers isolated. The emerging social commerce model, community group buying, where a designated group leader creates a WeChat group and coordinates orders on behalf of others in the group, has been adopted by retailers to boost sales of grocery goods.

In the near future, the scale of e-commerce is likely to expand further, while bricks-and-mortar stores might play more of a role as an experiential centre. Given changing consumer behaviour, digital transformation is a vital strategy for most companies in 2021 and beyond.

Travel: Domestic travel as a growth engine

Analyst: Han Hu

China’s travel and tourism industry has shown remarkable resilience, after grounding to a near halt in February 2020, but bouncing back in April. Chinese consumers’ pent-up demand for overseas travel products has shifted to the domestic market, making domestic travel a key driver of recovery. With lockdown having led to widespread yearning to reconnect with nature, Chinese travellers are displaying a preference for destinations with mountains, lakes or coastlines.

All modes of transportation are showing a strong recovery. Total traffic volume recovered to nearly 70% of pre-crisis levels by November. Airlines offered heavy promotions, contributing to the V-shaped recovery of domestic air travel.

Looking ahead, people still have great enthusiasm for travelling but prioritise safety. The Chinese Government has encouraged people to stay put for the upcoming Chinese Lunar Year holiday in 2021 amid fears of a resurgence of the pandemic. Though a nationwide lockdown is unlikely, travel and tourism during holiday periods might not recover to pre-crisis level since most consumers are still cautious. Domestic tourism is expected to be the main growth engine with the number of domestic trips expected to recover to the pre-crisis level within the next year or two.

Focus on digital agility and consumer wellbeing is crucial to corporates for recovery

Corporates need to rethink going digital. Strengthening e-commerce is merely one aspect of building digital agility in the post-COVID era – boundless engagement with consumers and digital solutions that redefine offline business are also crucial to shape agility and grow resilience in the face of disruptive incidents like the pandemic.

Consumer awareness and growing prioritisation of emotional and physical wellbeing has intensified, and this trend can be expected to escalate. Despite cautious spending likely to linger for mass consumers, holistic health, home hygiene, and internal happiness are nevertheless long-term shifts and should be the focus of corporates’ recovery and innovation strategy.