One year on from the onset of the Coronavirus (COVID-19) pandemic in March 2020, India is in the throes of a devastating second wave, now the country with the second-highest number of cases, with a record-high number of infections and complete or partial lockdowns in select states as of April 2021. Three main trends have emerged from the pandemic which is shaping the consumer market in India – the pivot to e-commerce, reduced dependence on exports with a focus on local supply chains, and reverse migration increasing demand from rural areas. These trends will continue in 2021 and beyond.

Indian economy bounces back before being battered by the second wave

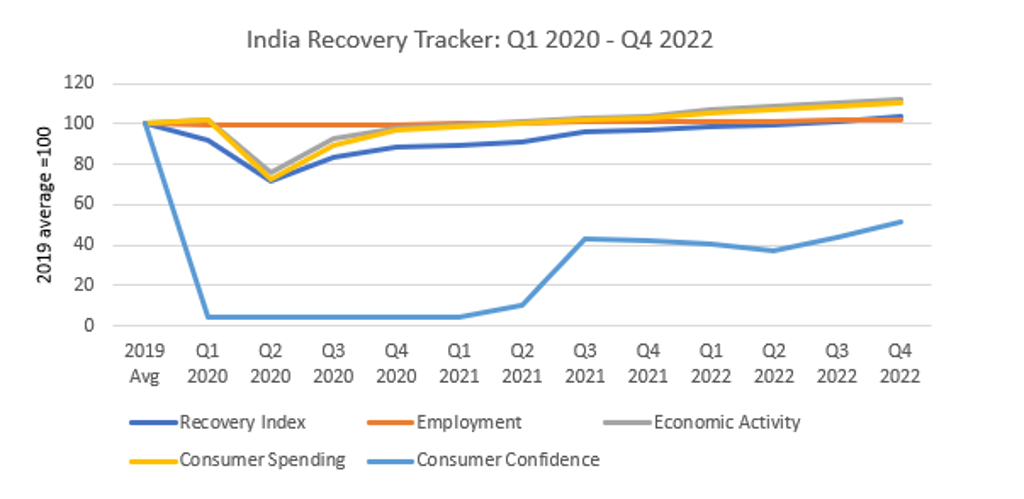

From being one of the fastest-growing economies prior to the pandemic, India saw one of the largest real GDP declines globally in Q2 2020, down 25.9% from the previous quarter, due to measures imposed to control the spread of the virus. Manufacturing facilities were shut down and supply chains disrupted affecting economic output. By May 2020 economic activities started to resume and by Q3 2020, India saw one of the fastest growth rates, up 23.8% from the previous quarter. However, given the rise in infections, India’s recovery is now expected to slow.

Source: Euromonitor International – Global Recovery Tracker.

Note: Score of 100+ indicates a full recovery back to 2019 levels. Figures for Q1 2021 onwards are forecast

Despite the expected recovery in the employment rate in Q1 2021, consumer confidence remains low due to uncertainty about the pandemic and an increase in the prices of essential goods such as edible oils, pulses, spices, as well as petrol and diesel. Electronics and appliances are also expected to get expensive, due to increasing raw material prices.

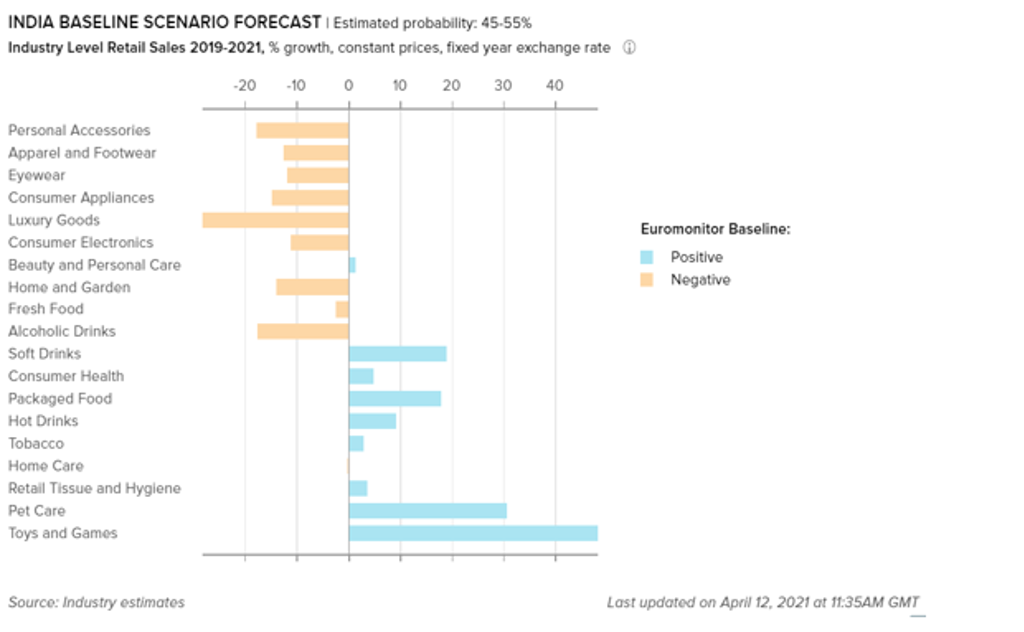

Recovery of non-essential goods delayed in 2021

While non-essential fashion categories like personal accessories, eyewear, apparel, and footwear were expected to witness a strong recovery in 2021, the resurgence of the second wave coupled with lockdown restrictions is expected to delay this. Some retailers are looking for innovative ways to reach consumers. For example, apparel and footwear players Westside and Bata contact consumers directly through WhatsApp by sharing product images and video calling and taking orders over calls. Jewelry and eyewear retailers such as Tanishq and Lenskart allow consumers to book a visit from the company to their home via the company’s website. However, despite such efforts, discretionary spending is expected to remain low, with demand dampened by consumers staying at home, unable to wear such goods out and about.

On the other hand, with consumers staying at home, essential goods and health and hygiene products continue to be prime consumer priorities and are expected to account for a rising share of spending in 2021. Learning lessons from last year, companies are now better prepared to tackle the situation of supply chain disruptions and mobility restrictions.

Source: Euromonitor International COVID-19 Dashboard

Companies becoming digitally ready to remain future-proof

The first of three clear trends which have emerged from the pandemic, and which will continue to impact India, is the accelerated shift to digital. The lockdown and restricted mobility of 2020 has seen the rapid development of cultural and operational shifts in the way companies do business, placing digital at the heart of everything. With multiple states in India under lockdown or increased restrictions, leading brands are focused on ensuring supply through e-commerce, having learned from experience in 2020. Leading grocery brands in India are leveraging the existing delivery networks of pure-play e-commerce companies like Amazon, Flipkart, or Big Basket to expand their e-commerce service. Further, leading companies like Dabur India Ltd, Marico Ltd, and Emami Ltd have been launching products exclusively for e-commerce, to reach consumers faster. While partnering with pure-play e-commerce companies remains a key strategy, an increasing number of brands are strengthening last-mile connectivity by focusing on direct-to-consumer models which will continue to be relevant in 2021. Some notable examples include ITC Ltd, PepsiCo, and Bisleri India Pvt Ltd.

In 2020 e-commerce sales of food and drink saw exponential growth of 80%. With India’s second wave, growth momentum is only expected to continue with the category expected to grow by a further 60% in 2021. Despite dynamic growth, e-commerce accounts for less than 10% of overall retail sales in India, showing that the Indian e-commerce space has yet to explore its full potential.

In line with e-commerce, digital payments are growing as a greater number of consumers look for contactless payment options. India being a mobile-first country, scan and pay with wallets and UPI (Unified Payments Interface) options are emerging as popular alternatives among consumers, given wide acceptance in traditional retail channels.

India on its way to becoming self-reliant with brands going proudly local

The second major ongoing change is the focus on local supply. In 2020, Indian FMCG businesses, especially consumer appliances and consumer electronics, suffered due to an over-reliance on imports and the resulting disruption in manufacturing and supply chains. Business disruptions in 2020 due to a shortage of raw materials surfaced a clear need to localise supply chains and make businesses more resilient.

The Indian Prime Minister, Narendra Modi, has announced a special economic package to encourage local manufacturing, local sourcing, strengthening the local supply chain, and finally the consumption of Indian-made products, aiming to make India self-reliant. There is also a push on selling locally-produced products to international markets, and to position India as a lucrative country and a serious competitor in the global supply chain.

With import restrictions, delays in shipments, hikes in custom duty, and incentives offered by the government for setting up factories in 2020, foreign companies are looking to expand manufacturing in India and looking at India as an export hub. A number of global brands are looking to move their manufacturing units out of China, and India is emerging as the next lucrative option for them. For instance, BSH Home Appliances is shifting the production of top-loading fully automated washing machines to India, followed by blenders and refrigerators with bottom-mount freezers.

Brand owners to look beyond tier 1 cities

Finally, another impact of COVID-19 in 2021 is reverse migration. COVID-19 triggered immediate reverse migration of around 14 million daily wagers back to the rural areas in 2020, within a span of a few weeks. Reverse migration shifted the demand for essential food, drinks, home, and personal care products to rural areas, making rural areas a key priority market for brand owners.

Source: Euromonitor International

Note: Data for 2021 onwards is forecast

Equally, the introduction of flexible working and working from home has allowed mid and high-income urban consumers to move back to their hometowns, shifting demand for FMCG to tier 2 and 3 cities. Given the sheer size of the population, rural demand is expected to play a more pivotal role in the recovery of FMCG companies in 2021. However, poor infrastructure and poor last-mile connectivity remain a challenge. Brand owners are therefore on the lookout for alternative distribution channels and innovative ways to deliver products to rural consumers. For instance, leading soft drink companies PepsiCo and Coca-Cola partnered with CSC Grameen e-Stores in 2020. This platform allows rural consumers to place digital orders and get doorstep delivery of snacks and beverages, thereby ensuring the delivery of these brands direct to consumers. Also, Hindustan Unilever was seen leveraging its Project Shakti, an initiative to empower women as micro-entrepreneurs in rural areas, driving rural demand further. In addition to this, leading e-commerce retailers like Flipkart and Amazon have quickly expanded their grocery delivery services to tier 2 cities to cater to the increasing online demand for essentials. Even if consumers return to cities when restrictions are eased, the rural market will continue to remain a key growth pocket for brands, as the pandemic has increased penetration of many essential categories in rural areas, where availability was limited before the pandemic.

With a stronger second wave, COVID-led trends are here to stay

With the emergence of a much stronger second wave in April 2021, there will be greater demand for hygiene, health, and immunity products and players will continue to focus on immunity and hygiene positioning. And the impact of the three major trends to emerge out of 2020 – digital, local supply chain, and reverse migration – will intensify in 2021. COVID-19 has already brought about drastic changes to consumer lifestyles, and these trends will remain relevant beyond 2021, even when restrictions are eased.