With the Coronavirus (COVID-19) pandemic forcing many people to stay at home for protracted periods of time, consumer demand for food delivery has been growing massively in China’s Guangdong-Hong Kong-Macau Greater Bay Area (GBA), which will be illustrated by a comparison of mainland Chinese cities with Hong Kong in this article.

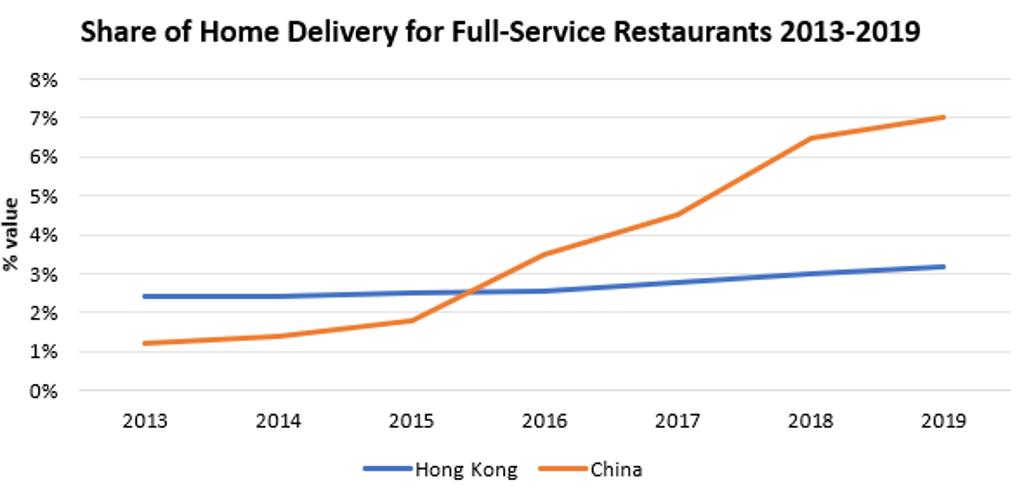

Before COVID-19, food delivery was growing faster in mainland China than in Hong Kong. While the home delivery share of full-service restaurants in Hong Kong steadily increased from 2.4% in 2013 to 3.2% in 2019, mainland China saw a more rapid jump from 1.2% to 7.0% over the same period. The difference in growth was due to a much higher penetration rate of food delivery applications on the Chinese mainland. From a much larger base, mainland China’s total value CAGR (in real terms) for mobile digital spending on consumer foodservice between 2014 and 2019 was 47%, almost double that for Hong Kong, at 24%, over the same period.

Source: Euromonitor International (Consumer Foodservice 2020 edition)

During the COVID-19 pandemic, Deliveroo, one of the leading delivery platforms in Hong Kong, pointed out in a media interview that the frequency of placing food delivery orders among its active Hong Kong users increased from the usual 2.5 times to four times a month in March 2020. This growth in demand clearly illustrates the changes in consumer behaviour in terms of food delivery services.

Diversification and premiumisation of delivery menus across the GBA

Delivery menus are becoming increasingly diversified and premiumised in the region. Due to concerns that food quality would be difficult to maintain, and a fine-dining experience would be impossible to replicate via delivery services, high-end restaurants at first were unwilling to join delivery platforms. However, due to the lockdown measures imposed during the pandemic, many fine-dining establishments tapped into the delivery segment as a way out of the downturn.

In Hong Kong, when most of the citizens, including high-net-worth individuals and other more affluent ones, were locked down during the pandemic, Michelin starred restaurants had to explore different ways to survive, such as utilising food delivery services to continue to serve their target customers, giving birth to a new trend of delivery menu premiumisation in the industry. For example, Mandarin Oriental Hong Kong launched a roast menu featuring the hotel’s signature roast meats, side dishes and desserts for takeaway and delivery during the pandemic. Delivery platforms were proactively expanding their partner networks to absorb these eateries to strengthen their offerings to consumers. It is reported that between January and March 2020, around 1,500 eateries joined Deliveroo, raising the total number of its partners to about 6,500, which is almost 40% of the city’s licensed restaurants and factory canteens.

On the mainland, premium eateries also gradually joined the expansive network of delivery apps. For example, Tao Tao Ju, one of the most celebrated Cantonese restaurants in Guangzhou, launched a takeaway menu on Meituan, one of the leading apps in China, after the COVID-19 outbreak. Since then, the restaurant has been reportedly flooded with orders from consumers via delivery apps. As the region is ready to embrace the post-lockdown stage, it is expected that more close collaboration between a wide variety of eateries and delivery platforms will occur, as well as menu premiumisation.

Fresh food delivery: Hong Kong catches up with mainland China

In mainland China, food hygiene and safety are a long-standing concern, and during the pandemic, most consumers were highly cautious about the potential risk of infection with food. Therefore, many Chinese consumers switched to purchasing vegetables and raw produce instead of cooked meals on food delivery apps. According to media reports, between 21 January and 8 February 2020, deliveries of frozen food via Ele.me, a Chinese delivery giant backed by Alibaba, surged by more than 600% year-on-year. While mainland China has prepared to enter the post-lockdown stage, with everyday life gradually returning to normal, consumers will continue to remain cautious for a while longer and will incorporate fresh and frozen food delivery into their regular routines.

Most Hong Kong consumers still prefer convenient meal delivery, since food safety and infection through contaminated food is not a concern in the city. Nevertheless, local fresh food delivery-focused platforms, such as Jou Sun and Fresh To Go, began to gain traction as consumers started looking for more delivery options other than cooked food after staying indoors for a long period of time. It is reported that sales of some fresh food delivery apps experienced a spike amid the pandemic. Therefore, it will be no surprise if Hong Kong fresh food delivery companies catch up with their mainland peers by tapping into these emerging opportunities.

Contactless delivery: the technological white space for Hong Kong

In mainland China, delivery apps began to introduce contactless delivery in January 2020. In order to reduce the possibility of catching the virus by limiting close personal contact, companies started developing the function further by using robots to perform tasks. For example, Meituan started its project of utilising autonomous vehicles and robots for food delivery in Beijing in February 2020, and it is widely thought that Meituan will expand the geographical scope of this project to other parts of the country, including the GBA, following the pandemic.

Likewise, delivery companies in Hong Kong, such as Deliveroo and Foodpanda, launched contact-free delivery amid the pandemic, allowing customers to retrieve their orders at designated locations. The concept was widely accepted by consumers in Hong Kong and was later adopted in grocery delivery, as evidenced by the launch of “click-and-collect” delivery from the local retail giant ParknShop, whereby consumers can pick up their shopping ordered online at designated locations. Based on mainland China’s experience, it is possible that the next phase of development in Hong Kong will be the deployment of advanced machines to perform contactless delivery. This will encourage companies to be early adopters of technology, filling in the white space in Hong Kong.

As both mainland China and Hong Kong are ready to move on with the “new normal” post-lockdown, the food delivery industry in the GBA will enter a new stage of development, with numerous opportunities presented in 2020 and beyond.