Digital Wallets Emerging as Strong Disruptor to Consumer Payments

2020 was a milestone year for digital wallets, with COVID-19 providing the impetus for wider adoption as consumers reduced cash usage given concerns over virus transmission, and limited mobility restricting access to ATMs. The convenience and security associated with the contactless experience are key drivers, increasing usage of digital wallets for both in-store and online purchases.

As e-commerce surged, the use of digital wallets for online purchases saw growth across both high-value and smaller transaction purchases, significantly reducing the trend of cash on delivery. This was particularly evident in Asia Pacific, North America, and Middle East and Africa. Nearly two thirds of digital consumers globally used a digital wallet to purchase products in a physical store or online during the past 12 months, according to Euromonitor International’s Voice of the Consumer: Digital Survey, fielded in March 2021.

Non-conventional players lead as governments keen to accelerate digital payments

Governments were already active in fostering market environment and digital infrastructure to achieve financial inclusion and cashless societies prior to the emergence of COVID-19, but these efforts were boosted during the pandemic. This also resulted in governments working closely with private sector banks and fintech players.

Banks, the traditional and dominant group within the financial services sector, have seen varying levels of success in their digital transition journey. With their focus limited to online banking, most banks digitised online services for essential transactions only. Interestingly, the use of online banking also saw different levels of penetration across markets. For example, in the US, where 90% of the population was online in 2020, 80% of the population used online banking. However, in China, where 65% of the population was connected, online banking penetration remained below 20%.

Thus, as banks continue to be daunted by the need for comprehensive re-engineering of systems and services, private sector fintech players and telecom service providers have been disrupting financial payments. Shifting the balance of power in the payments sector, the role of innovative technology has been pivotal as non-conventional players steer most of the innovation within the digital wallets landscape.

Funding mechanism vests power in banks, although shifts are possible

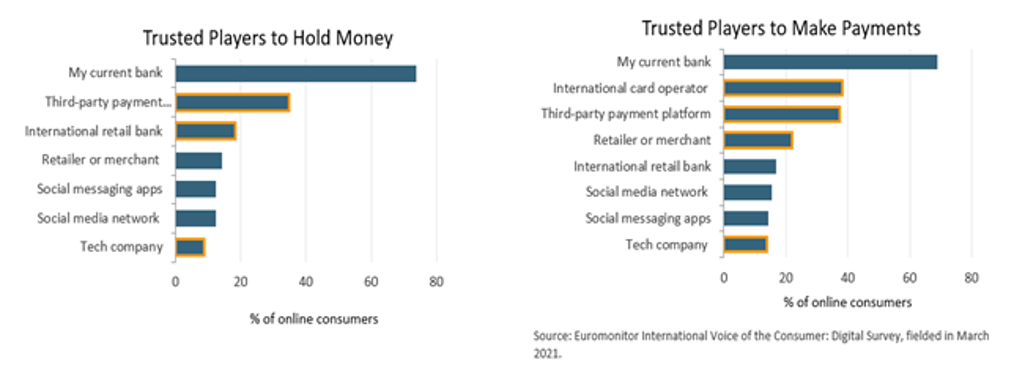

While banks are not driving the innovation in terms of digital wallets, they retain the power given consumer trust in banks to hold money. This sentiment is equally reflected in consumer trust to make payments. Nearly 74% of connected consumers globally state that they trust their current bank the most to hold money, followed by third party payment platforms such as PayPal and Alipay, according to Euromonitor International’s Voice of the Consumer: Digital Survey. On the payments side, international card operators such as Visa and Mastercard are followed by third party payment platforms.

The global competitive landscape of digital wallets features the strong presence of global as well as regional players. While most global players are characterised as tech companies and third party payment platforms such as Alipay and PayPal, regional players are supported by leading national enterprises, prominently banks and mobile network operators.

Global digital wallet players such as Apple Pay and Google Pay benefit from a strong consumer base and consumer confidence as well as greater willingness from banks and merchants to foster partnerships. Tech and mobile ownership largely benefit these players. However, regulations in certain markets limit penetration and merchant acceptance, while in other markets global wallets come with high transaction fees for merchant partnerships. Regional players such as Swish from Sweden and Mada Pay from Saudi Arabia have been often backed by government or a consortium bank. National and regional ownerships ease localisation as well as regulatory processes. National telecom services are also easing use of digital wallets for unbanked consumers and enabling local merchant ecosystems due to a greater focus on peer-to-peer payments and remittances.

Advance use cases, technical sophistication and enhanced trust in security to drive greater digital wallet usage in future

Given the diverse range of players and nature of different entities, there are clear market gaps in how digital wallets have evolved; however, these gaps offer players areas to advance use cases and establish competitive advantages. We identify five key emerging areas below as a focus for digital wallets globally.

Digital wallets are also set to see continued technical sophistication where greater trends are expected across these below five key areas as digital wallets embrace partnerships across merchant segments and make payments convenient and inclusive.

Enhancing security remains imperative, given that three quarters of connected consumers who participated in Euromonitor International’s Voice of the Consumer: Digital Survey reported security to be the most influential feature to support greater adoption and usage of digital wallets in the future.

To learn more about how digital platforms are disrupting commerce, explore Euromonitor International’s Digital Disruptor Series covering Digital Wallets, Digital Streaming Services, Shared Mobility Platforms, Last Mile Delivery Platforms, Social Media Platforms and Foodservice Delivery Platforms.