Brazil is the largest Latin American e-commerce market when it comes to remote purchases, totalling USD79.7 billion in 2020. Digital inclusion in Brazil was led by the increasing penetration of smart devices over the last decade, especially smartphones, as a large portion of the population had access to the internet for the first time using a smart device rather than a desktop computer or laptop. For its strong mobile appeal, it is key that e-commerce solutions in Brazil are responsive and mobile-friendly. Still, e-commerce remote purchases in Brazil are far from maturity and still account for a low portion of consumer spending when compared to geographies that leveraged digitalisation of goods and services early on – like the US, the largest e-commerce remote purchases market worldwide (USD1.7 trillion).

It is also worth noting that Brazil’s staggering income inequalities have resulted in unequal access to high-speed internet connection and high-end smart devices. Therefore, although digital inclusion is a fact, it is also true that a large part of the population, mostly those from less affluent classes, have poor or limited access to quality digital services. For these consumers, e-commerce of goods and services tends to be limited to retail purchases, foodservice online ordering and requesting rides via car-hailing apps.

Convenience and contactless nature help boost proximity transactions

E-commerce in the proximity environment in Brazil is seeing strong growth, as most of the country’s network of POS machines counts on Near Field Communication technology. For that reason, growth in proximity transactions is driven by consumers’ increasing awareness and willingness to use contactless payment methods to carry out transactions. Although retail establishments lead the way in the proximity environment, the solution is becoming more widespread elsewhere, as consumers grow familiar with the technology and see it as an alternative worthy of consideration in times of social distancing and hygiene concerns relating to the transmission of Coronavirus (COVID-19).

In addition to this consumer behaviour, other considerations have contributed to the wider adoption of proximity payments in Brazil. For instance, regulators have increased the value limit for transactions without password from BRL50 to BRL200, so as to make it even more convenient for consumers in the process of carrying out a purchase transaction. Also, retail banks have been making efforts to replace old cards with NFC-enabled ones, as well as partnering with digital wallet players such as Apple Pay and Samsung Pay, which entered the Brazilian market during the review period. Still, on the digital wallet space, local player PicPay is a prominent player in the proximity environment through the leverage of QR codes for payments.

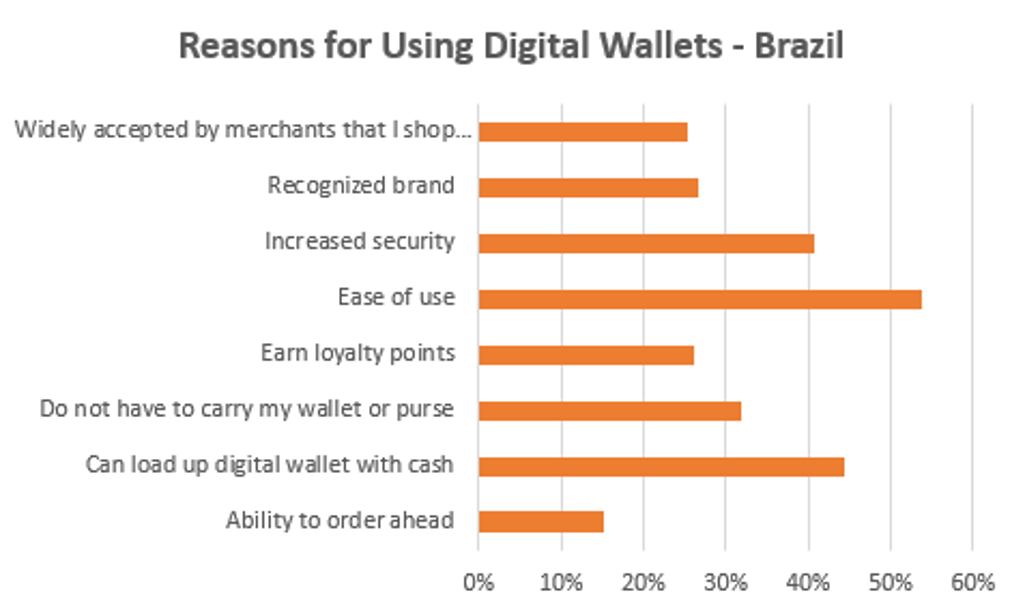

Source: Euromonitor Voice of the Consumer: Digital Consumer Survey, fielded March to April 2021; Q. What are some reasons why you use a digital wallet? Select all that apply.

Diversification of services available online to mark the new normal

As mass vaccination progresses slowly in Brazil, social isolation measures are expected to remain the norm for a prolonged period of time. For this reason, Brazilians are expected to continue to look to e-commerce solutions for demands they would typically have met through in-person experiences. Digitalisation is therefore progressing to include a myriad of new services in the country, other than just traditional sectors such as retailing and travel.

Although retailing and travel account for most e-commerce in the remote environment in Brazil, Brazilians are growing accustomed to spending their money online on on-demand services like foodservice, car-hailing, media streaming, and even massages and workout lessons. As a result, e-commerce in Brazil is expected to witness a diversification of services available online to ensure that services that are typically enjoyed away from home, such as massages and workout lessons, will be available to be enjoyed at home.

One example of such a trend is Singu. In August 2020, beauty and personal care company Natura&CO announced investments in Singu, which works as a digital hub for on-demand beauty services, such as make-up, waxing, massages, manicure, among others. Singu’s uniqueness relies on being a digital marketplace for Brazilian consumers who seek at-home beauty and personal care services. With the feature Singu Now, customers can have a professional beauty service provider at home in under 40 minutes.

Consumers are longing for those experiences that were part of their usual discretionary spending but were halted when social isolation measures hit, such as going to beauty salons. Therefore, Singu’s concept and business model enable consumers to continue social distancing while still enjoying this type of experience, which could normally be enjoyed only away from home.

Instant payments to help drive e-commerce transactions

PIX, an instant payment system launched by the Brazilian Central Bank in November 2020, has provided consumers and businesses with an alternative payment method that charges low or even zero fees to carry out digital transactions, without the use of any financial card. PIX can be used either for money transfers, bill payments, or purchases of goods and services, and the transaction is completed instantly.

Despite its recent launch, PIX has rapidly gained traction within digitally-savvy consumers and establishments seeking low-cost alternatives to traditional payment arrangements and is set to reshape the landscape of consumer digital payments in Brazil over the following years.

Looking ahead, Brazilians expect not only improved connection quality to become more widely available but also that future developments in remote e-commerce consider facilitated payment methods, either when shopping for goods or making foodservice orders or even paying utility bills online. In that sense, players will need to pay close attention to a rapidly changing landscape in the retail and payments space to succeed, factoring in Brazilians’ increasing willingness to experiment with digital to bring more convenience into their lives.

To learn more about the strongest obstacles and opportunities retailers and consumer brands will face this year, actionable steps to build a more resilient customer experience and how to future-proof your business, watch the Retail in Transition: Capitalising on Future E-commerce Opportunities webinar.