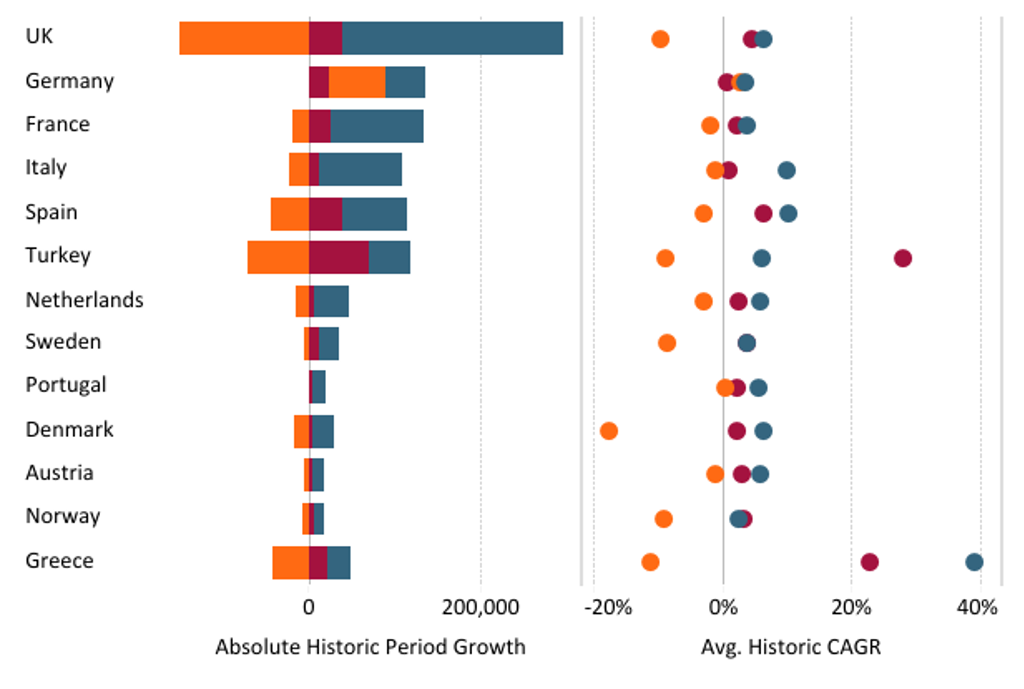

Western Europe is the third largest market in the world in terms of payment transactions. Strong regional differences in the payment habits prevent the uniform development of payment methods across countries. The underlying differences between the historic performance of the economies, as well as the migratory influxes and the uncertainty generated by Brexit, limit the growth potential of consumer and card payment transactions.

Consumer Payment Transactions in Western Europe: Breakdown by Category 2013-2018 (Retail Value RSP USD million)

Source: Euromonitor’s International Passport Consumer Finance

Cards in the north, cash in the south

The major rift in Western Europe’s payment landscape concerns the preference for payment methods among Southern and Northern countries.

While in Scandinavia, the UK and France card payments lead transactions and mobile payments are well established, Southern European countries are still rooted in cash. In the last few years, reliance on paper payments in the area has substantially decreased. Governments in cash-based societies have introduced incentives to make citizens adopt card and electronic payments. Still, Western Europe is far from becoming a cashless society.

Debit cards dominate, but pre-paid cards are on the rise

Card payment transactions are experiencing regional growth, with Spain and Italy being at the forefront of this trend. Changing habits of Southern European consumers and the reduction of interchange fees by the European Union in 2015 have fostered this rise.

Among card payment transactions, the role of debit cards is prominent. The convenience of the contactless technology that most debit cards feature make these cards suitable even for small, daily purchases. In addition, debit cards allow a tighter control on spending, which is highly appreciated by customers who experience uncertainty over their spending.

It is also important to mention pre-paid cards experienced double digit growth over the last five years. In addition to be a safe online payment method, pre-paid cards have been used by governments to distribute government benefits, and by companies to reward employees.

Regulatory changes will shape future growth

During the next five years through 2023, regulatory changes and actions implemented by the European Union are going to influence the payments market to a large extent.

The Payment Service Directive 2 (PSD2) implemented in January 2018 is expected to shake-up the payment landscape in Western Europe. The establishment of Open Banking will give authorised companies the possibility to access consumers’ accounts and initiate payments. The ease and speed of this prospective payment method is likely to challenge card payments in the future, especially in the online setting.