Coronavirus (COVID-19) has put health and food safety front and centre, increasing demand for greater transparency in food sourcing and transportation. This has reinforced a back-to-basics approach, accelerating trends around food provenance and traditional and well-known ingredients that deliver on nutrition and functionality. Going back to basics also brings fundamental principles to the table, such as accessibility and affordable nutrition in the context of universal wellness. This now becomes key in light of COVID-19 as disposable incomes fall.

Local sourcing comes to the fore

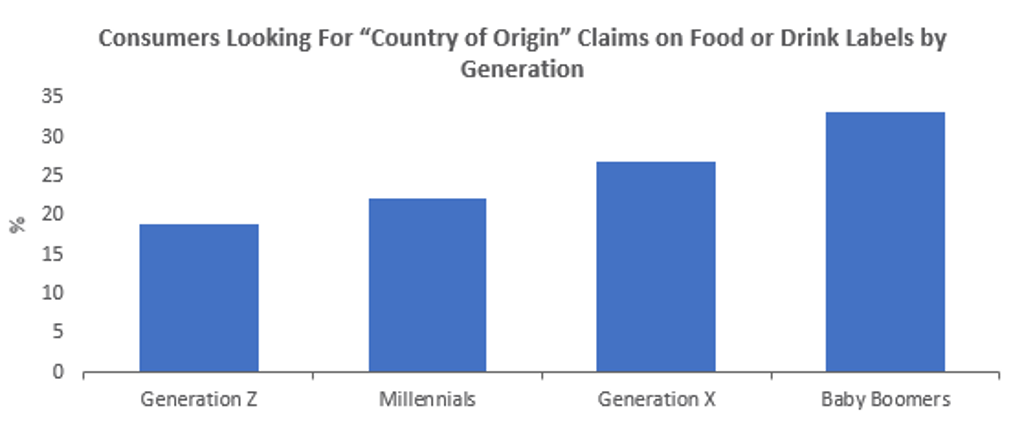

A renewed interest in locally-sourced products has been expedited. In the last couple of years, the use of local ingredients, food grown on local farms and country of origin claims have been in demand, mainly from older generations. The pandemic has accelerated the interest in locally-sourced food, in connection with transparency, high quality and food safety, as well as a means of supporting the local economy.

Source: Euromonitor International Health and Nutrition Survey, fielded February 2020, n=21,739

A wide range of initiatives have arisen following the pandemic in order to support local food production. The Dutch initiative “Support your locals” is one of them. The aim is to help local food producers and encourage short and hyperlocal supply chains, which ultimately supports the local economy and community. This initiative serves as a platform for businesses such as Maaltojdboxen Groningen, a service that delivers organic fruit, meat and vegetables grown by local farmers from the Groningen province to the consumer’s doorstep.

Natural and traditional wisdom weave well in current consumer demands

Health has taken precedence for consumers, and traditional ingredients that are nutritious (eg ancient grains like amaranth and buckwheat) and naturally functional (eg turmeric or ginger) are seeing an increased interest. Demand for targeted functionality as a key component of wellbeing has been expedited and the shift from treatment to prevention is increasingly evident, which brings the concept of “food as medicine” higher up the agenda than ever.

Consumers are increasingly seeking traditional ways of preventing an illness in which the diet plays a key role. According to Euromonitor International’s Health and Nutrition Survey, in 2020, 48% of global consumers seek natural and traditional solutions for preventing illness versus 30% that take over-the-counter medicine.

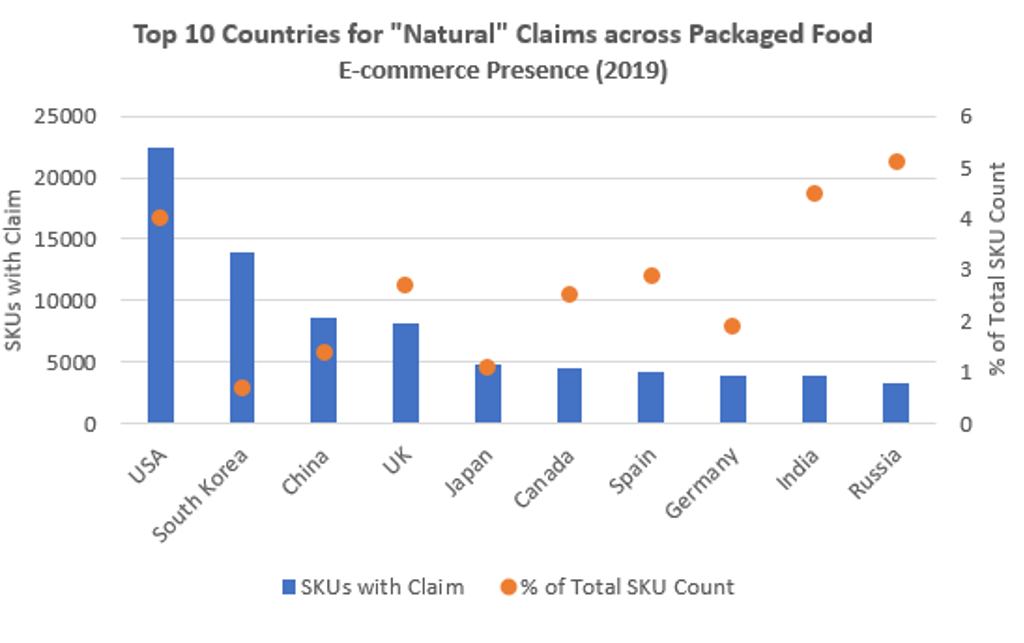

Packaged food manufacturers have leveraged “natural” claims to target such positioning in the last few years and those that incorporate well-known and traditional ingredients that deliver on various functionalities will benefit from the increased demand for natural and traditional solutions in connection with preventative health.

Source: Euromonitor International Product Claims and Positioning

Spotlight on value reassessment and inclusive nutrition

Economic recession across many countries in 2020 puts accessibility and affordable nutrition in the spotlight. Food is a universal human right, sitting at the base of consumer needs. Ensuring that healthy food is affordable will be crucial to achieve good nutrition amongst all segments of the population.

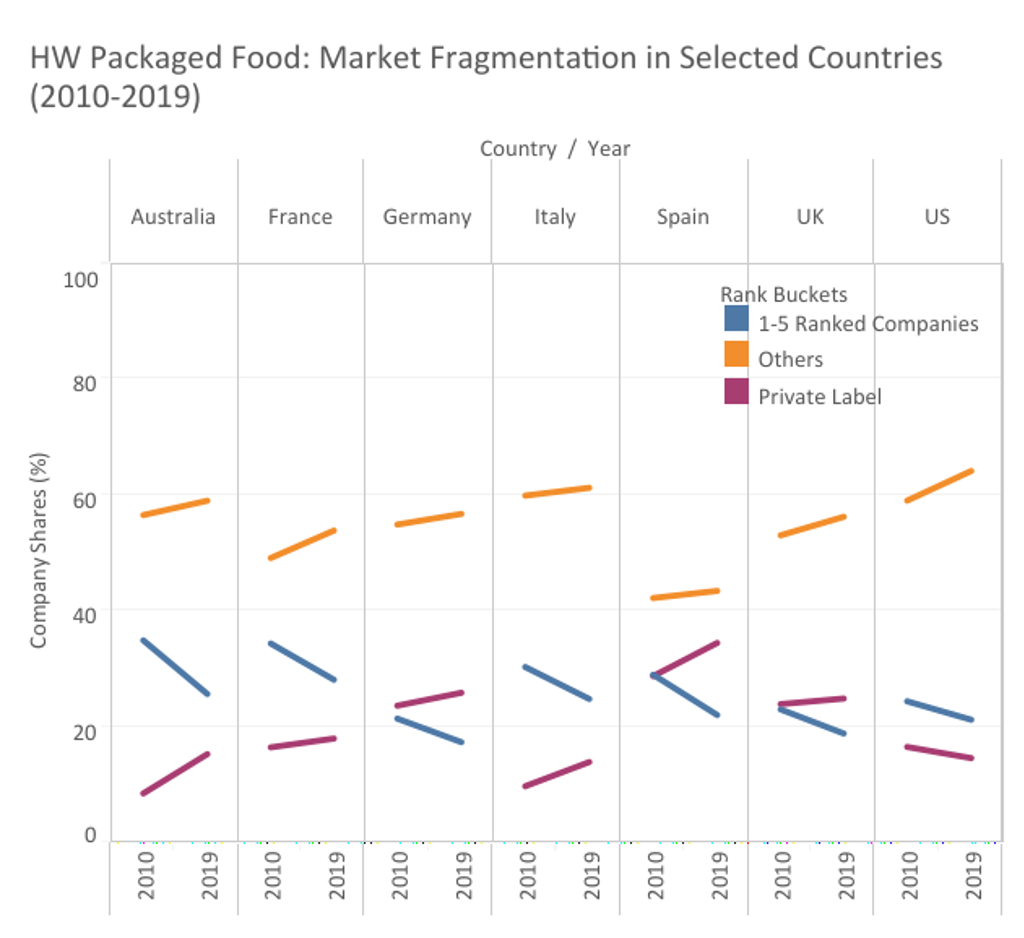

Demand for private label and affordable wellness brands was already on the rise pre-pandemic and it has been boosted further during the global lockdowns. This demand is expected to continue as disposable incomes fall.

A good example of added-value innovation at inclusive price points comes from the company Junlebao, which accounts for a 5.5% share of the milk formula category in China. Junlebao has launched value-for-money offerings in areas traditionally targeted at high-end consumers, such as organic and formulas for babies with special conditions.

In December 2019, it launched its new A2 milk formula and in March 2020, it launched a new organic milk formula with probiotics. With competitive price points, both achieved over USD14 million sales in the first month of launch. Organic milk formula has been hugely sought out in China, perceived as high-quality and safe. These attributes have been increasingly demanded in light of the COVID-19 health crisis. Junlebao’s positioning combined with the affordability of the products brings a unique advantage against competitors.

Added value can reduce price sensitivity though. Integrity and transparency of the food supply chain, local sourcing, as well as products able to deliver on health multi-functionality add value to the offering. A clear brand narrative to communicate this is essential.

Another area of focus includes strategies targeted at the “bottom of the wealth pyramid”, which will be key to support low-income socioeconomic groups, mainly in emerging economies. Enhancing basic foods with key micronutrients (eg iron, calcium) will be more important than ever as a means of minimising nutritional gaps.

What should food and nutrition businesses focus on?

The initial demand for locally-sourced food products will continue to be under the spotlight. Investments in localised food supply chains are set to become more important to avoid future potential disruptions in transportation but also to enable more carbon-efficient supply chains in the long-term.

Re-imagining traditional functional ingredients is gaining momentum on the back of COVID-19 and this should create further growth opportunities for manufacturers. Value-for-money food products that deliver on good nutrition and functionality (eg immunity, emotional wellbeing) will continue to be in high demand.

For more insight on how COVID-19 is impacting healthy eating trends in the food industry, see the report “Healthy Eating in a Post-Coronavirus World: A Holistic View”