As Euromonitor’s Global Consumer Trends (GCTs) 2021 show, Coronavirus (COVID-19) has forced a reimagining and redesign of processes, products, physical spaces and human interaction. Although the pandemic is driving global trends, the responses of consumers to those trends have often conformed to regional patterns and individual country conditions. Our team of specialists in Cape Town have identified two of Euromonitor’s Global Consumer Trends which are having the biggest impact on Sub-Saharan African (SSA).

Workplaces in New Spaces: the omnipresent office

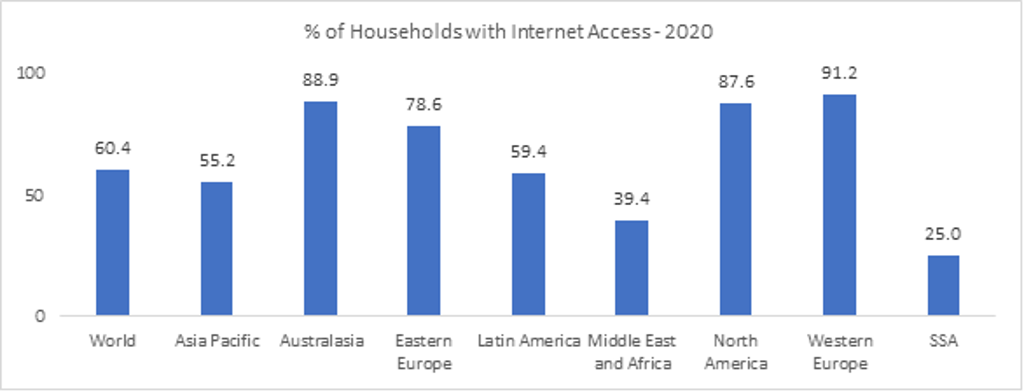

Prior to COVID-19, remote work in SSA was underdeveloped due to low internet penetration - just 25% of SSA households have internet access - and expensive data plans. Another reason was the widespread notion that productivity is synonymous with employees’ physical presence in brick-and-mortar offices. The COVID-19 pandemic, however, has changed this, for both employers and employees.

Suddenly, unprepared employers scrambled to equip their workers with internet/mobile support in their homes; where it was essential for workers to be in the office, people started to work shifts, on rotation and/or shorter workdays due to lockdown, while those already supporting remote work (e.g. one day per week) simply implemented processes to ensure longer-term efficiency out of office.

Source: Euromonitor International Passport Database

So, the concept of the office is taking on a more fluid meaning – from makeshift spaces in storage rooms to corners of bedrooms propped with a display shelf of unread books, to kitchen countertops and cars/garages for others (thanks to background blurring functions on call platforms).

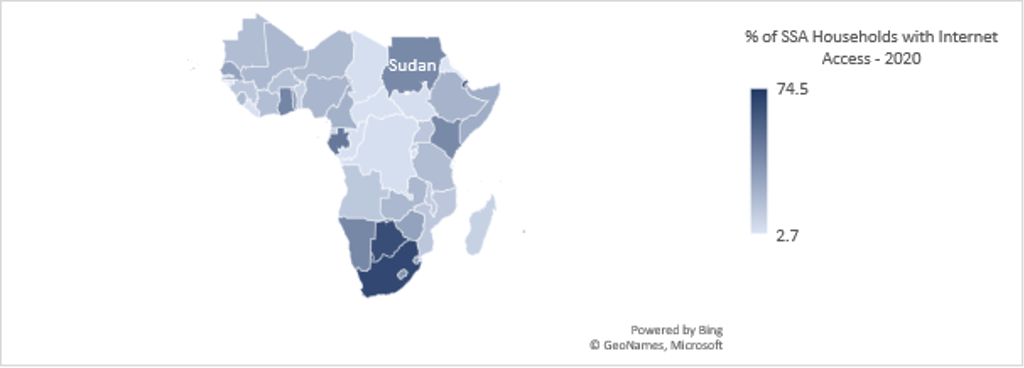

Access to technology and a more relaxed work culture drives remote work in South Africa

One year after the pandemic started, the responses to workplaces in new spaces are playing out differently across SSA. In South Africa with a currently bearish real estate market, some consumers are seeking new residences with extra space for a home office, other millennial remote workers are enjoying a form of early retirement by moving to so-called “zoom towns” - smaller locations offering quieter lifestyles, more spacious homes, serene outdoor spaces possibly closer to beaches or nature reserves - yet within reasonable commuting distance of central business districts and cities. Furthermore, some establishments are not renewing leases due to expire, or are opting for smaller offices.

In contrast, in Nigeria and Kenya, entrenched traditional-style workplace practices have seen most employers and workers trying to adhere to the 9 to 5 physical office routine, especially as poor technological infrastructure limits the efficiency of remote work. Still, patronage of co-working spaces is steadily rising in Nigeria and in Kenya, where telecommuting is emerging. These spaces offer various options from day and week passes to monthly subscriptions for private and shared workspaces – an attractive offer for start-ups and the few remote workers seeking convenience plus a solution to poor infrastructure. Some offer perks such as photocopying and printing services, free beverages or personal lockers.

Source: Euromonitor International Passport Database

Provision of goods and services to meet consumers at their new workplaces is key

As employers explore pathways to safe work for employees, opportunities abound for businesses: from reconsidering mixed-use developments or renovations in otherwise commercial areas to catering to zoom town needs – for example with ghost kitchens. Others include establishing on-site refreshment kiosks, pre-paid order service for beverages and snacks in co-working spaces and key suburbs, as well as developing physical and mental wellbeing events in safe spaces to support work-life balance.

South African companies like Ergotherapy, Formfunc and Ergolab offer ergonomic furniture, for example, sit-stand desks, with flexible monitor arms to support the shift from traditional and static workplaces to a more active environment. Goods and services that support rotational or remote/home working, such as weekly-based cab subscriptions, pay-per-use meeting spaces and equipment rental, are also important.

Thoughtful Thrifters: slimmer, value-focused budgets

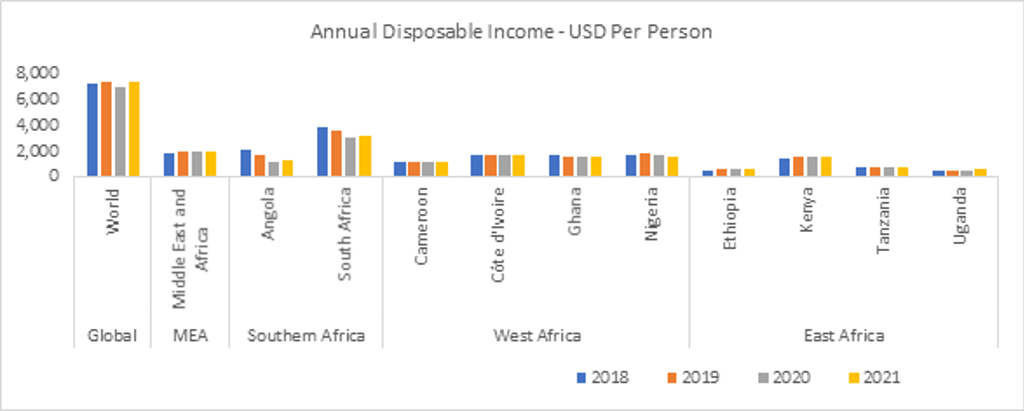

Pre-pandemic, consumers in the region were relatively frugal given their low disposable incomes. The pandemic heightened this frugality due to loss of livelihoods, meaning many consumers dipped into their rainy-day savings - if they had any - and discretionary spending took a backseat to meeting basic needs.

Traditionally, the definition of a household in SSA transcends nuclear family lines, physical cohabitation and geographic borders, as remittances from diaspora relatives are commonplace. Familial support is now more important due to dampened economic conditions, widespread financial squeeze (especially for rural kin) and increasing health challenges for an already medically-insecure majority with informal work and livelihoods. All this necessitates consumers to further stretch already lean financial resources, making value-for-money offerings the most attractive.

Source: Euromonitor International Passport Database

Retailers leverage digital services to bridge barriers of distance, price and payment for consumers

The search for value plays out in different ways across SSA. In South Africa, where consumers tend to have higher disposable incomes and stronger spending power, bulk offers and private label commodities have gained prominence – aimed at reducing shopping trips while getting a prudent bargain. Value-retailers like Shoprite Group have appealed even more to cash-strapped consumers through the introduction of a virtual voucher sent directly to relatives via SMS; while premium retailer Woolworths increased promotions especially for staples, for example by slashing chicken prices. Mobile coupons are also budding, such as through partnerships between financial services providers, Sanlam Group and Shoprite Group, and by manufacturers like Unilever through its Wuhu Deals initiative.

In Nigeria where traditional and informal retail channels dominate, consumers have leveraged credit sales by their neighbourhood grocery retailers. In Kenya, value-offerings entailed process improvements other than price cuts and product discounts. Modern channels have partnered with delivery firms for value offerings related to consumers’ increasing use of M-PESA for e-commerce. In March 2020, foremost grocery retailer, Naivas Ltd in partnership with Glovo offered free delivery on orders under KES1,000. Tuskys also partnered with Sendy to deliver orders placed via WhatsApp; traditional grocery retailers (Dukas) are increasingly partnering with Copia, a catalogue B2C retailer to facilitate self-pick-up sales to consumers in rural and peri-urban areas.

Product and process improvements are key to appeal to value-seeking SSA consumers

Varying levels of COVID-19 lockdowns, the uncertain health landscape and economic fluctuations necessitate that businesses adopt agile systems and tailor offerings to evolve with consumer buying habits, thrifty pockets and rising digital consciousness. The implication and opportunity spectrum for businesses and support services are wide, including utilising social media to streamline in-person engagements (such as WhatsApp for orders/billing/customer engagement, Facebook Marketplace and Instagram for marketing), improving omnichannel presence, offering speedy contactless last mile delivery (free to a specified purchase threshold), improving product portfolios and service baskets through regional and country partnerships that enable utilising provisions of the African Continental Free Trade Area (AfCFTA). The expansion of private labels and value brands with quality products is also key.

Exploring these can, in the long-term, help dust the lingering post-pandemic damper on sales while retaining decent margins.

Businesses need to anticipate and prepare for disruptions by leveraging technology

Convenience, innovation and technology are big influences in Sub-Saharan Africa, as 21% of the population are young adults aged 18 to 29. Nonetheless, high levels of poverty, inequality and unemployment influence how these trends play out from country to country.

The two GCTs we have examined spotlight the increasing need for business solutions, goods and services to meet SSA consumers physically closer to their homes, and financially, to the varying strengths of their spending power. Even as economies start opening up again, Euromonitor’s GCTs highlight the need for resilience and adaptability by all stakeholders across spaces. So, beyond 2021, the question is not how long these consumer trends will last, but how they will evolve and impact or trigger other trends in the still-adapting global environment.

Learn more about the trends Workplaces in New Spaces and Thoughtful Thrifters from our Top 10 Global Consumer Trends 2021 white paper.