This article is part of a new blog post series where there will be an update each quarter linked to the latest Global Recovery Tracker report.

The global economic outlook continues to improve in Q2 2021, owing primarily to a more positive outlook in developed countries, where rapid vaccine deployment, a significant reduction in COVID-19 infection cases, and strong fiscal stimulus measures (particularly in the US) are expected to lead to a stronger economic rebound in the second half of 2021.

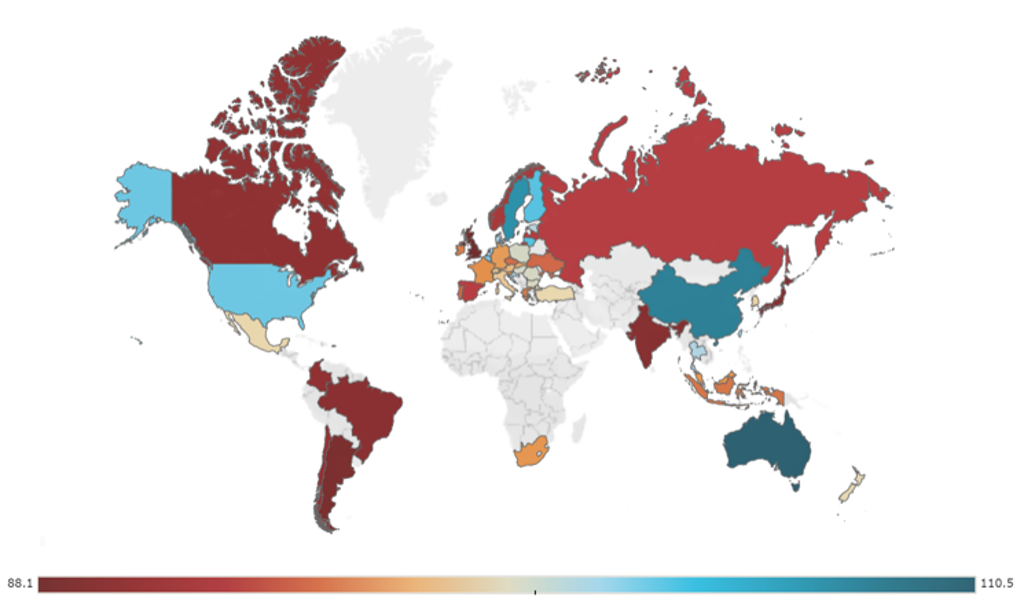

Out of the 48 economies covered by Euromonitor International’s Recovery Index (RI), 13 are expected to have recorded a score of 100 or over, indicating a recovery to pre-pandemic levels. Australia is expected to have overtaken China as the economy with the highest RI score, at 110.5 in Q2 2021. This is an increase from 108 in the previous quarter, driven by a significant improvement in Australian consumer sentiment.

Meanwhile, China has continued to perform well with an RI score of 107.7 in Q2 2021 (up from 106.5 in Q1). China’s recovery is comprehensive, as all pillars of recovery have surpassed pre-pandemic levels.

Global Overview for Recovery Index in Q2 2021

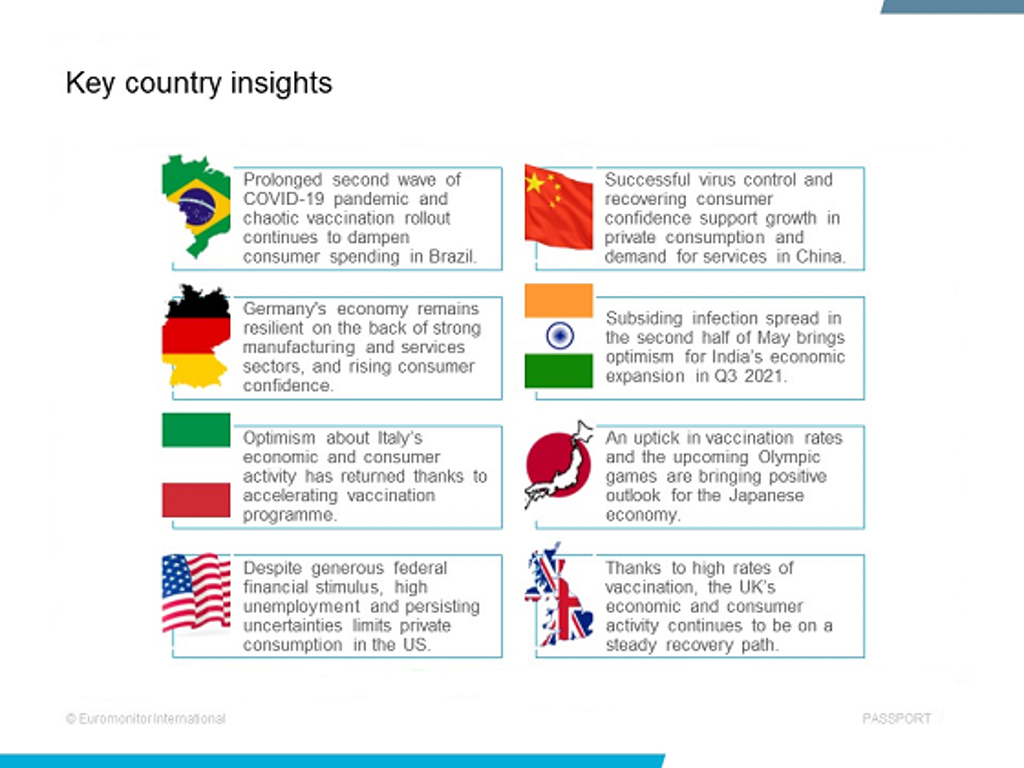

Recovery landscape in key economies: A mixed picture, but with increasing optimism

• The RI score for Brazil in Q2 2021 is estimated to have reached 90.0 (compared to 89.5 in the previous quarter), indicating the country’s economic and consumer activity remains below pre-pandemic levels. A prolonged second wave of the COVID-19 pandemic and chaotic vaccination roll-out continues to dampen consumer spending. In Q2 consumer confidence is estimated to have reached record lows, given persisting uncertainties and elevated unemployment.

• In Q2 2021, the RI score for China is forecast at 107.7, up from 106.5 the previous quarter. China’s real consumer spending continues to grow, supported by strong consumer confidence, recovering disposable income, and the lifting of social distancing measures.

• The RI score for Germany is estimated to have reached 96.4 in Q2 2021 – a considerable improvement from 92.5 in the previous quarter. Germany experienced a third pandemic wave in Q2, leading to stricter containment measures nationwide. Nevertheless, Germany's economy stayed resilient thanks to expansive manufacturing and services sectors.

• The RI score for India is expected to have slipped to 89.7 in Q2 2021, significantly down from 93.4 recorded in the previous quarter. The weakening index score is a result of rapidly increasing COVID-19 cases during April-May 2021. The pandemic wave peaked in the second half of May, bringing optimism for economic expansion in Q3 2021.

• The RI score for Italy is estimated to have increased to 98.0 in Q2 2021, up from 95.3 in the previous quarter. During Q2 2021, with a sudden jump in the number of COVID-19 cases, Italy experienced a third pandemic wave and had to undergo another period of strict lockdown. Nevertheless, thanks to an accelerating vaccination program, optimism about Italy’s economic and consumer activity has returned.

• Japan’s RI score is estimated to have improved slightly, to reach 89.6 in Q2 2021 (from 88.1 in the previous quarter), despite yet another wave of rising COVID-19 cases during April-May 2021 that led to the government declaring the third state of emergency. Nevertheless, a pick-up in vaccination rates and the upcoming Olympic games are expected to bring a more positive outlook for the Japanese economy in Q3 2021.

• While the US showed one of the fastest vaccination rates globally, the process has lost pace after reaching over 50% of the population. Despite a setback in vaccine deployment, the US Recovery Index score is forecast to improve to 102.6 in Q2 2021 from 97.0 in Q1.

• The RI score for the UK is estimated to have reached 88.2 in Q2 2021, up from 86.4 in the previous quarter. The UK has one of the highest COVID-19 vaccination rates globally in Q2 2021, allowing the economy to continue on a steady recovery path over the period.

Source: Euromonitor International

Outlook

Of the 48 countries covered by Euromonitor International’s Recovery Index, 27 countries are still not expected to see their economic and consumer activity rebound to 2019 levels in the last quarter of 2021.

The biggest and immediate challenge to global recovery is to achieve rapid and widespread vaccine deployment, especially in major developing countries with ongoing strong pandemic waves and slow vaccination rates, such as Brazil and India, in order to control and stem the spread of new, potentially vaccine-resistant, COVID-19 strains.

Another major challenge is to facilitate and boost global investment for inclusive and sustainable growth that is less dependent on government debts, in order to create jobs and boost business and consumer confidence.

Overall, the outlook is improving thanks to rising vaccination rates and the fact that additional pandemic waves will leave a smaller mark on economic development as businesses and individuals adapt.

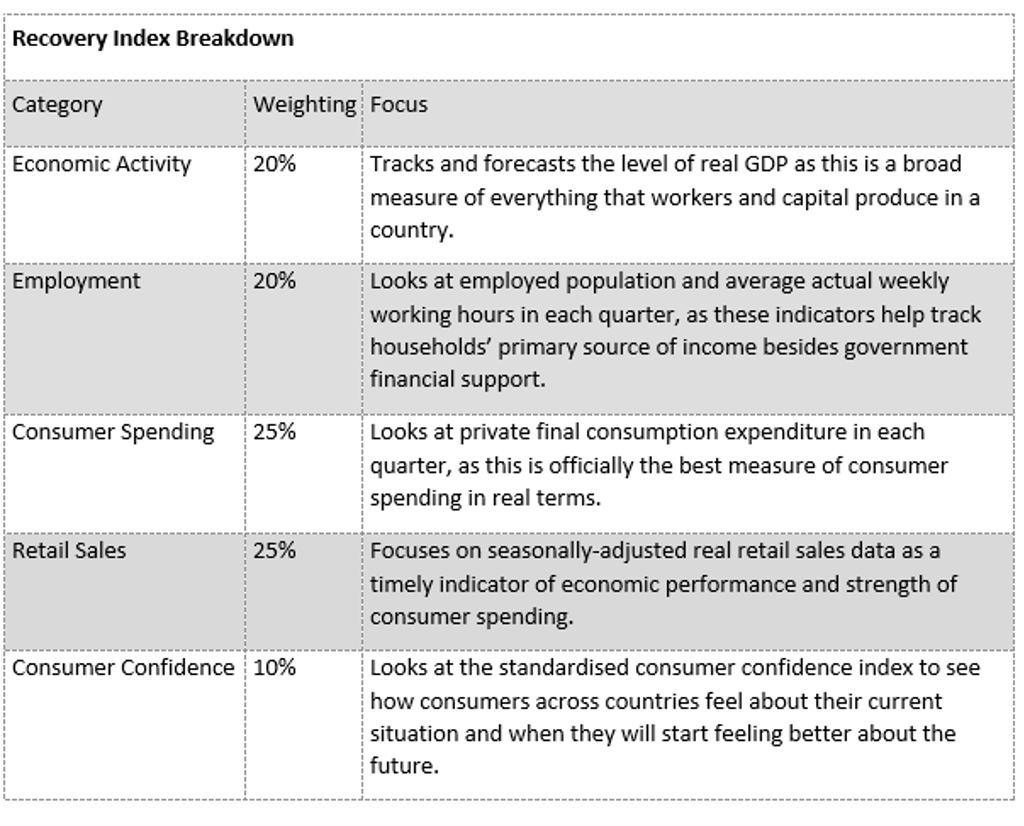

Euromonitor Recovery Index

Euromonitor’s Recovery Index is a composite index that provides a quick overview of economic and consumer activity and helps businesses predict recovery in consumer demand in 48 major economies. The index takes into consideration total GDP and factors that determine consumer demand – employment, consumer spend, retail sales, and consumer confidence.

Index scores measure the change relative to the average per quarter for 2019. A score of 100 and over indicates a full recovery in which economic output, labor market, and consumer spending all return to/exceed 2019 levels.

Source: Euromonitor International