Since the emergence and popularisation of plant-based alternatives to animal-derived foods, consumers have reported turning to these options for a number of reasons. The three most often highlighted are health concerns, interest in improving environmental footprint, and concerns regarding animal welfare. While there are plenty of other motivators (friends/family reasons, for example), research indicates that these are the “big three”.

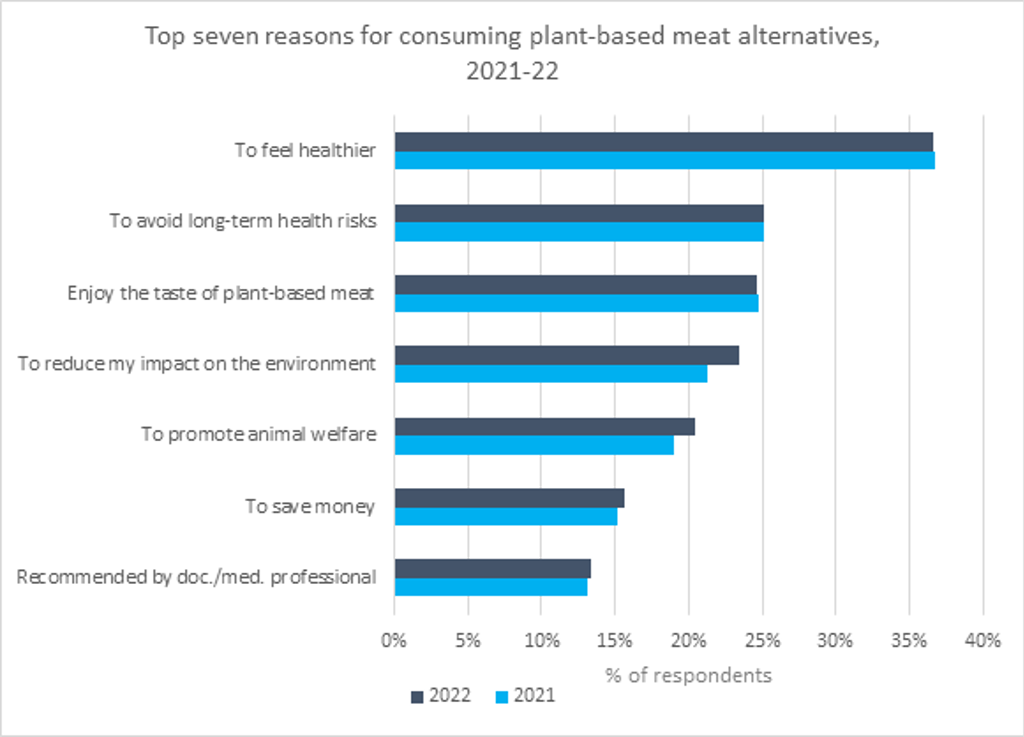

In 2021, Euromonitor International’s Voice of the Industry: Health and Nutrition survey definitively established that health was the key growth driver for plant-based meat alternatives. At that time, 37% of respondents who ate plant-based meat alternatives stated that they did so “to feel healthier”, while 25% stated that they ate these foods to “avoid long-term health risks”. These were the top two responses overall.

Why meat alternatives in 2022?

The publication of Euromonitor International’s Voice of the Industry: Health and Nutrition survey 2022 edition offers insights into whether these motivating factors have shifted year-on-year. Since the 2021 edition, the COVID-19 pandemic has receded in many peoples’ minds due to factors such as vaccination rates, and an easing of restrictions, which might have meant health concerns had diminished. In addition, eating occasions have returned to foodservice to some extent, although this of course differs by market – in China, for example, severe restrictions and city-wide lockdowns persist. Moreover, economic concerns have come to the fore and inflation has led to surging food prices. This is a particularly relevant issue as plant-based meat alternatives have yet to achieve price-parity with animal-derived options.

Consumers were asked “what are some of the reasons why you consume processed plant-based meat alternatives?”

Source: Euromonitor International’s Voice of the Industry: Health and Nutrition survey, fielded Jan-Feb 2021 & 2022, n=14,197

It is clear that health remains the primary driver for those consuming plant-based meat alternatives. 37% state that they eat these products to feel healthier, and 25% to avoid long-term health risks. These are once again the top two responses, ahead of wanting to reduce environmental impact (23%) and promoting animal welfare (20%).

However, while health concerns are clearly prominent (indeed, the seventh most-likely response is also health-based) the number of consumers choosing plant-based for the environment and for animal welfare is slowly growing, while health as a motivator has stayed static year-on-year.

The dairy picture

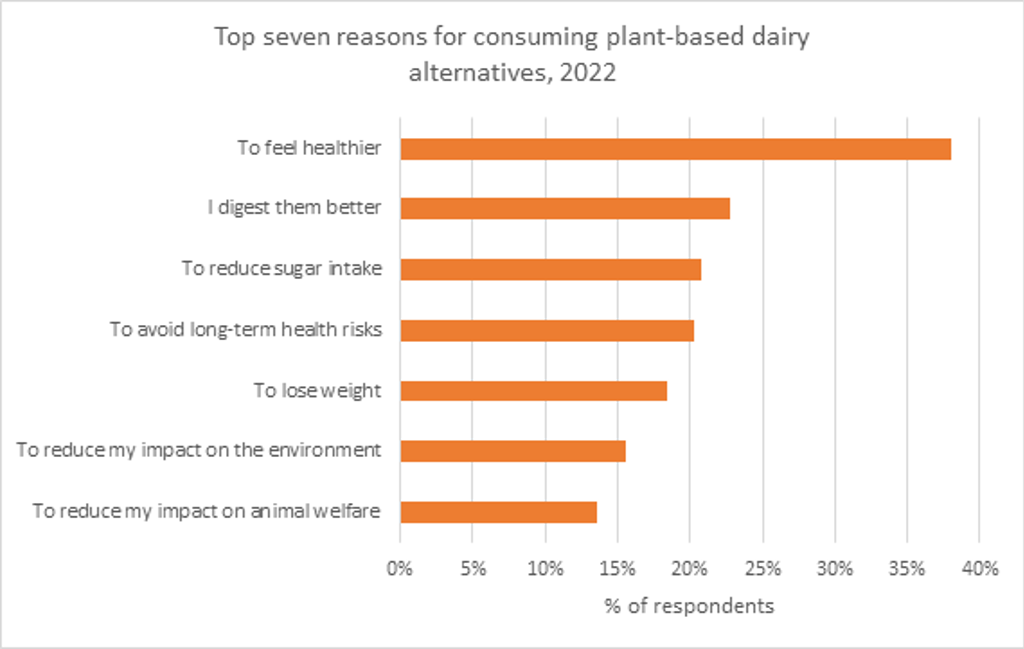

New to Euromonitor International’s Voice of the Industry: Health and Nutrition survey for 2022 are questions which interrogate dairy alternative motivations in the same way. Health concerns regarding consumption of processed red meat (such as obesity, heart disease, even cancer) are not the same as for animal dairy consumption. However, the latter is associated in many consumers’ minds with skin complaints, digestion problems, weight gain, allergies and even concerns with GMO feed in the food chain. Moreover, the environmental impact of dairy farming is much discussed, and animal welfare is increasingly considered – in the US, for example, there have been recent, high-profile lawsuits regarding treatment of dairy cows.

Consumers were asked “what are some of the reasons why you consume plant-based dairy alternatives?”

Source: Euromonitor International’s Voice of the Industry: Health and Nutrition survey, fielded Jan-Feb 2022, n=14,565

Once again, health concerns are clearly key. Just under two in five say they consume these products to feel healthier. In fact, the top five responses could be grouped under the health concerns banner, with reducing sugar intake just ahead of avoiding long-term health risks. After health comes the other “big two” reasons: 16% state that they consume plant-based dairy alternatives to reduce their environmental impact, and 14% due to animal welfare concerns.

The other side of the coin

Euromonitor International’s Voice of the Industry: Health and Nutrition survey also reveals why consumers who do not eat these products choose to avoid them. For both plant-based meat and plant-based dairy, not enjoying the taste (re)emerges as the most likely reason (28.8% of non-plant-based meat eaters, 30.4% of non-plant-based dairy eaters). However, this objection appears to be diminishing over time, a testament to product development and improving flavour due to efforts by producers as the category becomes increasingly established. In 2021, 32.3% of respondents stated that they did not like the taste of plant-based meat alternatives, making 2022’s result a fall of 3.5 percentage points.

Health halo endures… for now

It is clear that, for now at least, health concerns remain the chief motivator for choosing plant-based alternatives to meat and dairy. This does however, suggest a particular challenge for the future; will this health halo remain in place as consumers increasingly reject processed foods in favour of what they consider to be “natural”? As regulators in some key markets appear to be edging towards some sort of labelling system that gives consumers an easy-to-understand comparison showing which foods are “healthy”, producers may face a future in which simply adding “plant-based” to their labels is not enough to convince potential consumers that buying such products is good for their health.

For an insight into our global survey methologies, click here.