Prioritising wellness from a holistic perspective is a common theme across several of the Top 10 Global Consumer Trends of 2022, but three trends in particular stand out.

- The Great Life Refresh: Consumers are reconsidering career choices and prioritising what matters most to them

- Self-Love Seekers: Consumers are making decisions based on their personal growth and development, indulging in goods and services that elevate their sense of self

- Financial Aficionados: Wellness has also grown to encompass financial security, as investment (instead of consumption) becomes a must-have

A New Lease on Life

The pandemic triggered consumers to make the Great Life Refresh, resulting in drastic personal changes and a collective reboot of values, lifestyles and goals.

What does a good life look like to you? Euromonitor’s Lifestyles Survey found in 2015 only 12% of respondents prioritised “time for myself” but in 2021 that number increased to 24%. It is unlikely that there will be one single lifestyle shift that characterises the pandemic, but we can be certain that the dominant trend is change itself.

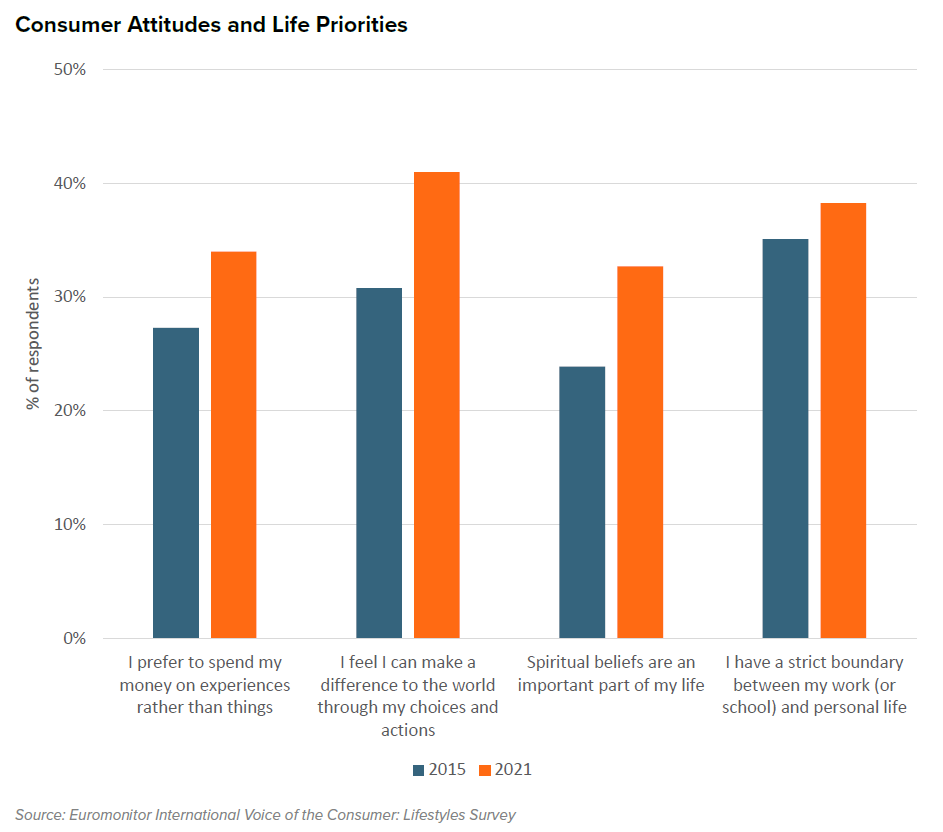

Consumers also seem to have a higher appreciation for the boundary between work and personal life. Consumers are re-evaluating how their activities affect their mental and physical health, adopting pets or traveling to exotic locations via remote work.

Businesses should embrace the tumultuous moment via innovations in goods and services (or experiences) that respond to this once-in-a-generation moment, coupled with marketing that acknowledges and embraces the upheaval.

Attitudes / Life Priorities Reflect the Great Life Refresh

Individuality and authenticity drive happiness

Acceptance, self-care and inclusion are at the forefront of consumer lifestyles. More than ever, consumers are focusing on accepting who they are and embracing a love for themselves. The Self-love Seeker prioritises their happiness, feeling comfortable in their own skin and indulging in themselves. When thinking about their actions, they ask themselves ‘who am I doing this for?’

Consumers want to invest in taking care of their bodies and mind, splurging on cannabis-infused products, luxury handbags, salon-quality beauty products or even low- or non-alcoholic drinks.

To succeed with Self-love Seekers, businesses must innovate products and services that stimulate joy be it physically, emotionally or spiritually. Creating a deep connection with the customer and helping to enhance their life is a must.

Supporting personal growth via democratised money management

The Financial Aficionados trend is reflected in the easy-to-use investment and banking platforms designed for the everyday investor rather than the Wall Street trader.

Consumers are taking control of their finances to a greater extent as a reaction to the lack of security created by the global pandemic. This business response has facilitated the democratisation of money management across the globe, at a time when financial security is increasingly being seen as essential to holistic wellbeing.

In the US, user-friendly trading app Robinhood became so popular among everyday retail investors that it listed on the stock market in 2021. EasyEquities, a South-African trading platform for retail investors wanting to increase the value of their savings, became so popular that its users were banned in February 2021 from buying shares in Nokia, reflective of the amount of money being traded on its platform and its potential to impact the global stock market.

Businesses also responded by providing services that increase financial security for the unbanked or underbanked. In the UK, Revolut allows its customers to easily track, categorise and visualise spending patterns, making it easier for them to control their finances. In Brazil, Nubank is a 100% digital banking offering which allows consumers to access banking services without the usual fees and bureaucracy associated with having a traditional bank account in the country.

In India, FamPay offers a payment app for teenagers that allows them to get used to using a debit card without actually having a bank account, which in turn increases their financial literacy at young age. In El Salvador, Bitcoin became legal tender in 2021, giving large swathes of the unbanked population access to cashless payments and online shopping.

Want to learn more?

To dive even deeper, you can download our Top 10 Global Consumer Trends 2022 report, where you will find an overview of each trend, case studies and future outlooks.