The traditional, rice-based alcoholic drink sake has always been part of the life and national culture of Japanese people, both on special and daily occasions. However, the Japanese market is shrinking, and sake breweries are looking for future growth in overseas markets. Hong Kong is one such market, with a prolonged history and place in Japanese culture, and receptive to Japanese products. Thanks to promotional efforts and increased retail penetration, sake is proving increasingly popular amongst consumers in Hong Kong and has a growing role in local drinking culture.

Sake in decline in its home market

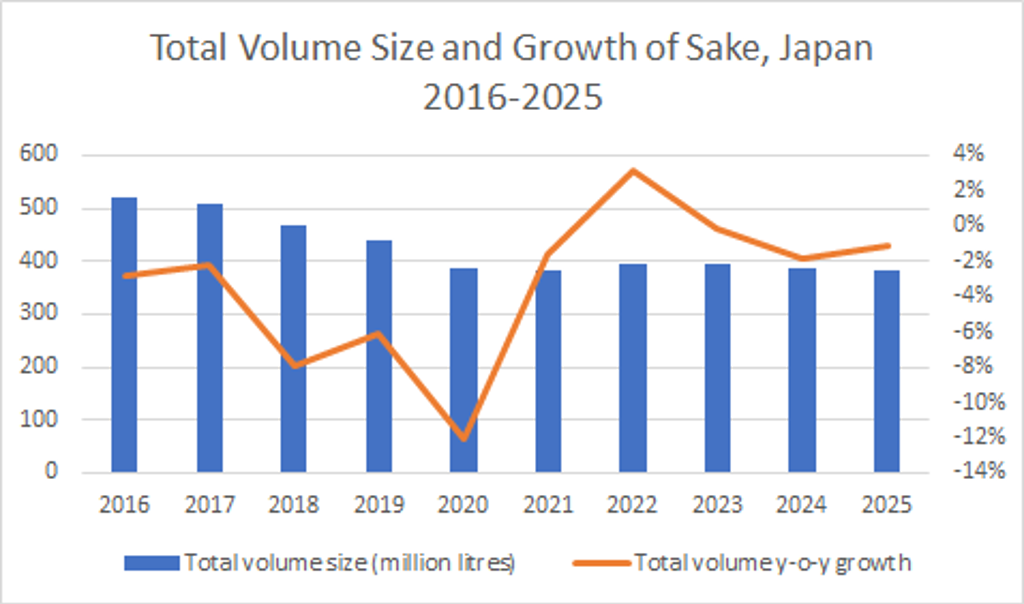

Sales of sake are falling in Japan. Demand tends to be concentrated amongst middle-aged and older consumers, where alcohol consumption tends to decline with age. The sake industry is keen to extend consumption to younger adults, but they tend to prefer sweeter, and lower-alcohol products, such as RTDs.

In recent years, the only bright news in the sake industry has been the increasing popularity of middle to high-end sake, namely ginjo (with a rice polishing ratio of 60% or less) and daiginjo (with a rice polishing ratio of 50% or less). The more rice has been polished, the higher classification level it is given, as this process makes clearer and more fragrant sake. This quality matches growing consumer desire for a premium experience, which is partially raising appreciation among younger adults. However, these products are mainly enjoyed at foodservice, and the foodservice channel was hit hard in 2020, as restaurants and bars were requested to shorten opening hours due to the pandemic. As a result, on-trade volume sales of sake shrank by 40% in 2020, dragging down total volume sales by 12%. Although some recovery can be expected after 2021, the market is expected to remain stagnant, due to reduced drinking occasions in the post-pandemic world and an ageing consumer base.

Source: Euromonitor International

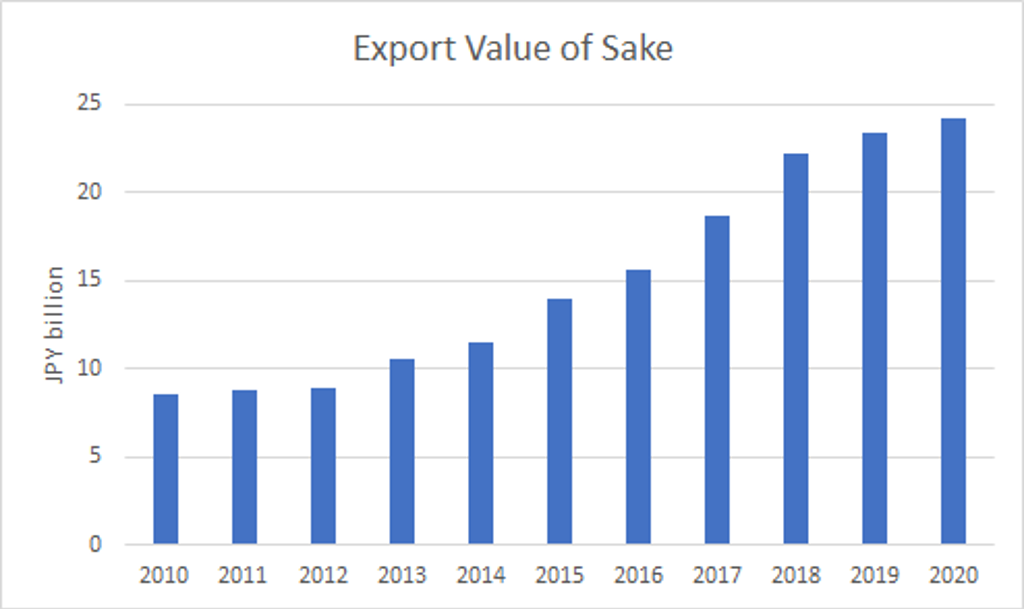

Seeking opportunities in exports

Given declining demand in Japan, sake breweries are looking to exports to sustain future growth. The Japanese Government selected sake as one of its key focus products, under the strategy decided in 2016 to strengthen the export of agriculture, forestry and fisheries products. According to the Ministry of Finance, sake exports reached their highest value in 2020, at JPY24.1 billion, marking the eleventh consecutive year of growth.

Source: Euromonitor International from Ministry of Finance, Trade Statistics of Japan

Hong Kong: Key growth market for sake

Being one of the key cities in the Greater Bay Area, where consumers tend to appreciate Japanese culture and products, Hong Kong offers a highly significant opportunity for sake manufacturers. Hong Kong consumers are well known of their keen interest in Japanese culture, with Japan constantly ranked within the top three destinations. Japanese food and beverages, in particular, are a big favourite to many consumers in Hong Kong, and are often perceived as an industry benchmark in terms of indulgence, quality and premium standing. Surfing on such a pro-Japan tide, Japanese variety stores such as Don Don Donki have found considerable success in Hong Kong.

Because of its wide product variety, clean taste and rich texture, sake enjoys significant appeal in Hong Kong. Popular sake brands like Dassai, Juyondai and Born are not only ubiquitous at Japanese restaurants, bars and specialist liquor stores, but also increasingly present in supermarkets and convenience stores. Moreover, there is an increasing presence of local Japanese sake (地酒) sourced from various Japanese prefectures like Hokkaido in Hong Kong. The entrance of these new sake options has not only diversified the product offering in Hong Kong with local specialities and tastes that are authentic and unique, but has also brought novelty, and consumer interest and demand is rising.

Promotion in Hong Kong

Having seen the potential in Hong Kong, various organisations and merchants are actively promoting sake. For example, the Japan Food Product Overseas Promotion Center (JFOODO) has been aggressively conducting sake promotion in Hong Kong since 2019. As part of its general strategies promoting sake abroad, JFOODO typically tries to establish a strong link between sake and seafood, so that drinking and usage occasions of sake can be expanded and widened beyond Japanese food. During September 2019 - March 2020, JFOODO started a massive campaign, Seafood Loves Sake, through various events and channels to promote sake as the ideal alcohol to be paired with seafood. The campaign was so well-received that JFOODO further developed the campaign between November 2020 and January 2021, focusing on promoting the concept of pairing sake with local Cantonese seafood.

Promotional efforts have also been supported by local retailers. City’super, a premium supermarket chain in Hong Kong, has been promoting sake via its annual sake fairs in 2020 and 2021, where a wide variety of sake sourced from across Japan are displayed in-store. These fairs allow local sake enthusiasts to go on an intoxicating journey through the various sake-producing regions of Japan like Saga, Akita and Kyoto, exploring the unique food and drink of each locale.

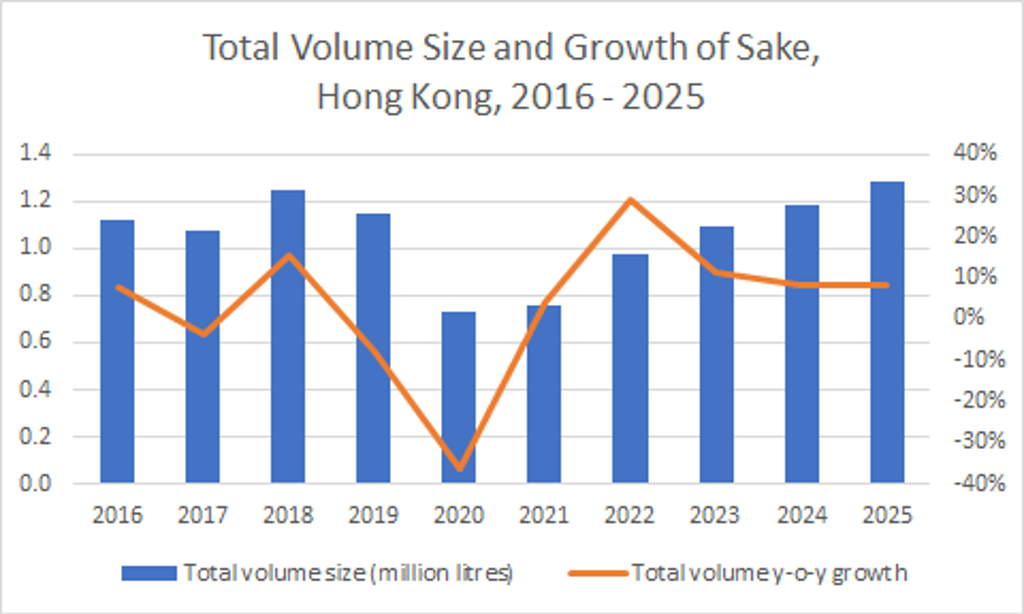

Recovery imminent after extreme circumstances of 2019 and 2020

Demand is expected to continue to rise further, post-pandemic. Indeed, the category had been expanding organically until the outbreak of the Anti-Extradition Bill Movement in 2019, which shook the entire alcoholic drinks industry with the closure of on-trade outlets at the height of the massive Anti-Extradition Bill protests and reduced numbers of mainland Chinese tourists. In 2020, demand was further negatively impacted following the shockwaves of COVID-19 and its devastating impact on-trade demand and tourism. But demand is recovering and expected to surge, with total volume sales of sake expected to rise by a 13% CAGR over 2020-2025, reaching 1.28 million litres by 2025.

Source: Euromonitor International

Premium quality the key to growth

Growth is expected to stem from the perception amongst Hong Kongers of sake as a fashionable, premium alternative. With the influence of mindful drinking and taste sophistication, drinkers will continue to focus more on the quality and less on the quantity of the sake they consume. And they are more than willing to pay a premium for the extra quality these drinks offer. Brands that carry an authentic and distinctive identity, such as premium brands like Dassai and local sake from the more renowned prefectures of Japan, can be expected to perform well.

Looking ahead

The rise of sake in Hong Kong offers an excellent way out of a declining domestic market for Japanese alcoholic drinks manufacturers. This trend will continue to develop and evolve based on what we have observed over the past few years. Success in Hong Kong even teaches an important lesson to the home market. Although sake is a traditional Japanese drink, drinking occasions for sake are not well-established among the young generation, which is one of the major reasons behind market stagnation. Creating new drinking occasions could reinvigorate the domestic market and broaden appeal beyond traditional sake drinkers; success in Hong Kong is a good illustration of how this could be done.