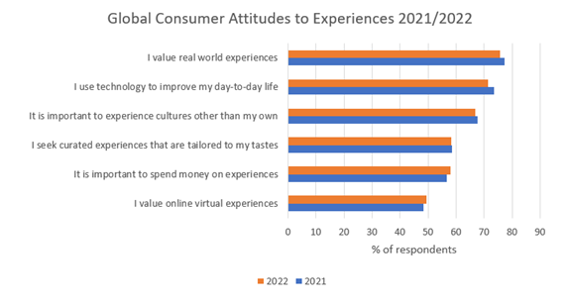

As the world enters a new inflationary chapter, the consumer appetite for new and exciting experiences remains high, with 76% globally agreeing that real life experiences are important to them, according to Euromonitor’s Voice of the Consumer: Lifestyles survey.

Battle for consumers’ attention

However, real life is losing out to the virtual world, as the #IRL trend is down on the previous year. On the other hand, the number of consumers stating that they are interested in online experiences has grown substantially, to 49%, where the metaverse is currently having a moment and shaking up how consumers interact and engage with brands, as well as each other. The blurring of boundaries will continue at pace as the virtual world becomes an ever greater extension of reality; yet for now, in-person dominates.

Joy of discovery drives the search for in-person experiences

When it comes to travel and tourism, pent-up demand is powering unprecedented levels of recovery growth that supply cannot dream of matching, whilst in-destination spending is accelerating as international demand kicks-in alongside the staycation effect.

Domestic tourism was the lifeblood of tourism during the pandemic due to travel restrictions, and as residents rallied to support local businesses and rediscover what was on their doorstep. Despite the reopening of borders, the joy of local is a trend that will remain, in line with the tourism sector transforming into a sustainable business model that puts communities at its core.

Combined, experiences and attractions account for 10% of the USD2.3 trillion in-destination tourism spending, accounting for USD115 billion and USD100 billion worldwide respectively in 2022. Over the next five years to 2027, an astounding USD1.4 trillion will be spent, according to our latest Travel research, with a CAGR of 10.5% over 2022-2027, where tourism recovery clashes with inflationary pressures as the cost-of-living crisis spirals.

In terms of CAGR to 2027, mobility (16%) and wellness (12%) are driving recovery, whilst duty-free shopping is set to rebound strongly (13%) as airports revamp their product offer post-pandemic.

Boost to digital transformation, but still a long way to go

Despite its disparate nature, online sales of in-destination spending jumped by five percentage points over the two years of the pandemic, to stand at 34% online penetration. Despite this rocket-powered boost to digitalisation – in keeping with the connected trip across the different stages of the traveller journey, with mobile as an enabler and pre-booking due to crowd management – intermediaries are stealing a march on direct suppliers, whether online or offline. In fact, the fastest growth will stem from intermediaries’ offline sales, illustrating that the sector is still resisting the fully-fledged digital transformation witnessed in other sectors, such as airlines.

There is clearly opportunity for further consolidation, with the experiences and attractions category having long been eyed by many, including TripAdvisor, Google Travel, metasearch, OTAs, tour operators, hotels, specialists such as GetYourGuide and the like.

New experience platform looks beyond visitors

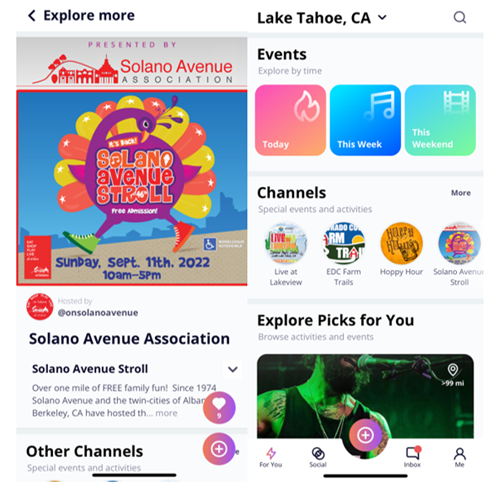

With much potential to explore, whereby visitors will spend an incremental USD115 billion on experiences and attractions by 2027, new start-ups continue to enter this space. MOPO is one such company recently launched, that is taking a holistic view of in-person experiences to capture the resident piece of the pie as well as the traditional visitor market.

Its mobile app aims to inspire and recommend things to do, starting in the US, but with a global game plan in mind. Currently, it is working with destination marketing/management organisations (DMOs) in the US, and also community groups that can create their own customised channels featuring their own unique content to promote activities. Future plans include partnering with transport providers to showcase interesting things to do at various route stops.

Founder Martin Hall explains that “MOPO is a kind of YouTube channel for Things to Do, where we are very focused on enabling consumers to connect in authentic, sustainable ways with places and communities, and for those communities to benefit from increased visibility to locals and visitors”.

Source: MOPO

Co-creation as a powerful tool for sustainability

Empowering local community groups is important not just for promoting local experiences and attractions and building resident engagement, but also an important means of co-creating truly authentic experiences that are steeped in the local community and culture. This is a win-win for DMOs, visitors and residents alike. Almost a third (32%) of travel businesses that we spoke to for our Voice of the Industry: Travel survey said that co-creating products and services with consumers was a strategic priority in 2022, along with 39% investing in sustainable products and services, compared with 58% who are improving the customer journey and user experience.

For more insight, read our report Evolution of Physical Space in Hospitality, or contact Senior Head of Travel Research, Caroline Bremner