The increasing cost of necessities has been a hot topic for discussion in 2022. According to Reserve Bank of India’s Consumer Confidence Survey September 2022 (fielded 1-10 September 2022, n= 6,062), respondents expressed pessimism about their current income compared with the same period the previous year, while 85% of respondents said that there was an increase when asked about their current perception of spending on essential items. As incomes are not rising in line with the prices of essentials such as food, housing, and energy, the cost of living is increasing.

Consumers are clearly showing signs of distress as costs of essential products, especially food and non-alcoholic beverages, continue to increase. This is further accentuated by strategies adopted by players to stay afloat amidst global difficulties doing business. Thus, Indian consumers are modifying their behaviour to ensure cautious spending, which in turn impacts businesses. Hence to thrive and grow, manufacturers need to closely monitor consumer behaviour as the world moves closer to a cost-of-living crisis.

Consumers are agitated by price hikes on food and non-alcoholic beverages

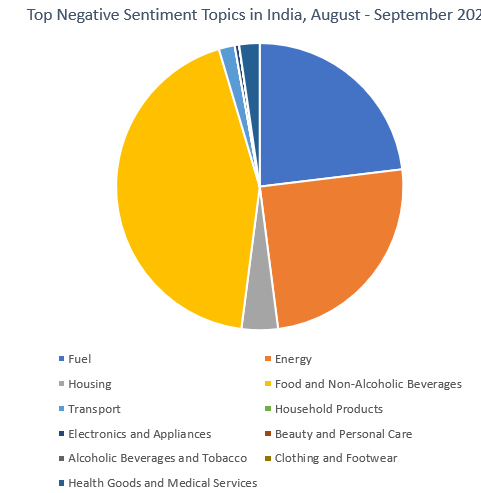

In India, consumers are mulling over a largely worrisome macroeconomic environment. To understand their reaction, Social Listening was performed. Social Listening falls under social media measurement or analytics, and is a way of tracking information from social media channels. It is focused on capturing mentions and conversations related to the topic chosen, and then analysing these to get insights based on the objective of the study. In this case, Social Listening was limited to Twitter posts in India from 8 August 2022 to 8 September 2022. The results indicated that words such as “Inflation”, “Recession” and “Price” had the highest volumes and displayed clear negative emotions. In terms of sentiment, of all the social media posts under consideration for cost of living, 47% had negative sentiment associated with them. On looking at the top negative sentiment topics in India, “Food and Non-alcoholic Beverages” dominated the discussions, as consumers were extremely worried about the increasing cost of edibles. This makes sense, because the category forms a large proportion of households’ monthly expenditure.

Source: Euromonitor International from Pulsar Trac, 8/8/2022-8/9/2022

Consumers are adapting by changing their behaviour

With concerns over the increasing cost of essential products, consumers have been moderating their consumption patterns in terms of volume, brand and channel. They are trading their purchases down, consuming less, and shopping for bargains and discounts. Discretionary goods are the easiest to cut, while redirecting the money to indispensable products. Even within these products, whenever possible consumers are considering non-branded, local, and private label products. One in three Indian respondents, according to Euromonitor International’s Voice of the Consumer: Lifestyles survey 2022 (fielded January to February 2022), planned to purchase private label goods in the next 12 months. The growing interest in private label is evident across all categories. Such products not only help satisfy consumers’ interest in finding deals and discounts, but also contribute to overall higher value perception.

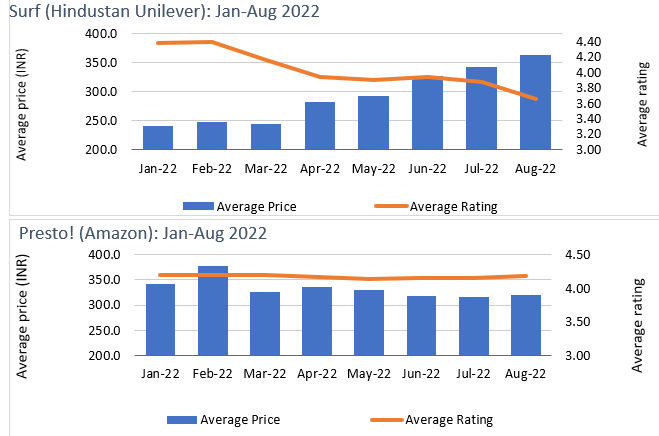

In terms of perceived value derived from consumption, consumer satisfaction seems to be negatively impacted when the prices of products are increased. In India, Surf Excel, which is the leader in liquid detergents, saw an increase in its average price from the beginning of 2022. During the same period, the brand’s average rating took a hit as its number of reviews increased. On the other hand, Presto! which is an Amazon brand, did not see a lot of price fluctuation, and its average rating remained almost consistent. This indicates a relationship between increasing prices and customer satisfaction as reported by average ratings.

Businesses will need to closely monitor consumer behaviour

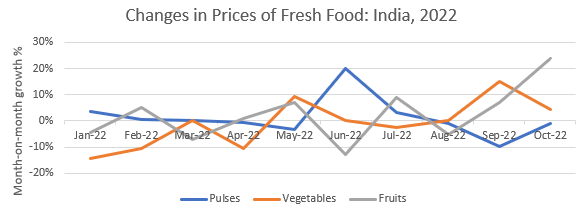

Along with global pressures, owing to excessive rainfall and crop damage in India, the cost of doing business continues to be impacted. This presents challenges for businesses, as they need to find sustainable ways to operate in the market. Indian players have been adopting popular strategies such as direct price hikes, shrinkflation, and streamlining product portfolios, amongst many others. However, these have severe repercussions on consumers.

Thus, spotting and understanding changing consumer behaviour and new preferences is no longer a competitive advantage, but rather a way to survive. Opportunities lie in creating better value perception. Consumers seek the highest value from their purchases, hence the benefits of convenience, efficacy and seamless service integration while leveraging the digital space are necessary for both branded and private label companies. For brands, a good mix of low-, mid- and premium-tier products is essential. Offering additional services, such as speedy delivery, bundling, or club membership, might justify the extra costs and yield higher margins.

To learn about how global consumers and businesses deal with rising cost of living, purchase Euromonitor International's report Navigating the Cost of Living Crisis.