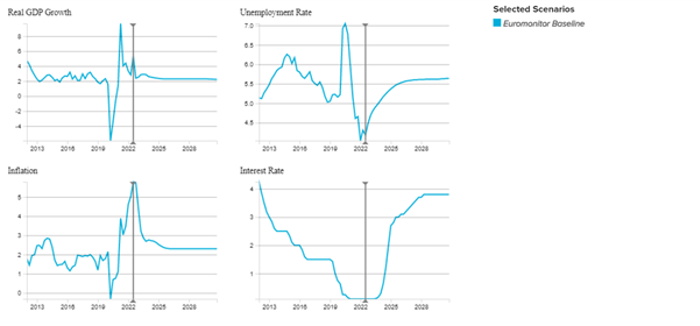

The Australian economy is expected to maintain some momentum in 2022, with annual real GDP growth forecast to be 3.5%. This will particularly be helped by the reopening of Australia’s borders to international travellers, which will both aid tourism and ease some supply chain disruptions.

However, inflation is likely to be a challenge for Australians, driven by a combination of domestic and international factors. Inflation is largely due to government stimulus payments during the pandemic, supply chain constraints caused by border closures, as well as the more recent impact of the war in Ukraine, which has caused a significant spike in oil prices, that will have a knock-on effect on all aspects of the economy, ultimately leading to higher prices for consumers and increasing operating costs for businesses.

Damage caused by extensive flooding over summer 2021/2022, and poor harvests following heavy rains in Queensland and New South Wales, have impacted food supplies and prices have skyrocketed. Limited coal-fired electricity generation is expected to cause production disruptions and lead prices to soar even further. The Reserve Bank of Australia first lifted the official cash rate in May 2022, and again in July 2022, which is expected to pose significant mortgage concerns for average Australians.

A tight labour market caused by the crippling of immigration since the outbreak of the pandemic in 2020 is also contributing to inflationary pressures, as wages remain on an upward trajectory. This means that inflation has already exceeded the central bank’s target rate of 2-3% for 2022.

Australia Quarterly Forecast

Prices on the march

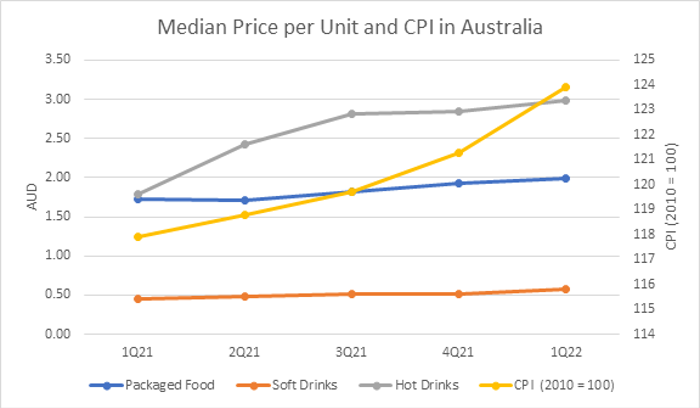

According to Euromonitor International’s Economies and Consumers data, the index of consumer prices increased by 2.1% in the first quarter of 2022, and by 5.1% over the 12 months to March 2022. This can also be seen in Euromonitor’s Via pricing system in key groups in the CPI basket, such as packaged food.

The median unit price (100g) of packaged food increased strongly, by 15.0%, from January 2021 to 31 March 2022. For fresh food it increased by 6.9%, soft drinks increased by 26.7% and hot drinks by 66.5%.

With almost 40% of Australian budgets allocated to non-discretionary items such as food, non-alcoholic beverages and housing, inflation will impact Australians’ purchasing power over time. Furthermore, lower-income families will be worse-off than other income brackets, as their source of income has been the most affected during COVID-19.

Everyday items become luxuries

As prices increase, consumers’ ability to spend on discretionary items is expected to nosedive, with the rising costs of living turning everyday items into luxuries.

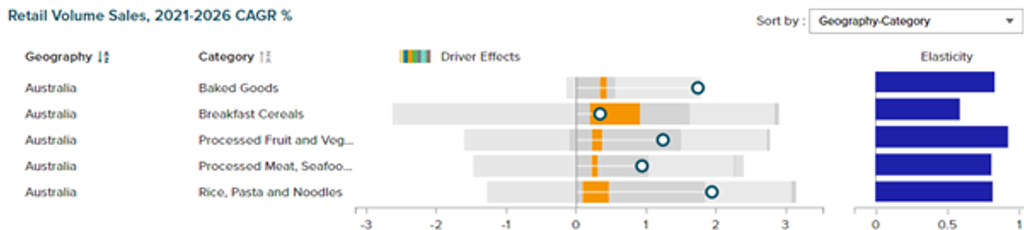

Source: Euromonitor International Snacks Forecast Model

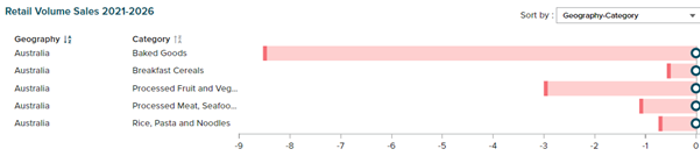

Source: Euromonitor International Staple Foods Forecast Model

As seen in Euromonitor International’s Forecast Model, among the different packaged food categories, confectionery and savoury snacks have high price elasticity of 0.86 and 0.78 respectively, meaning that Australians are more sensitive to price changes for these products. This is not surprising, as they are not necessities like staple products, and are more spontaneous, impulse purchases. Most staple products, such as breakfast cereals, tend to be comparatively more inelastic, and it is less likely that consumers will skip them if they are cutting back on spending, since they are deemed as essentials. For basic staple food items, consumers have limited options for substitution and therefore they are willing to sacrifice other discretionary spending to afford these items.

Macro scenario: Global stagflation

Source: Euromonitor international Staple Foods Forecast Model

However, in a pessimistic global stagflation scenario, expectation of stagnant economic growth and inflation are likely to bring about a strong decline in volume sales in categories such as baked goods. As can be seen from the charts above, staple items such as baked goods are witnessing high elasticity of 0.83 in Australia, amidst rising prices due to the impact of the war in Ukraine and wheat export bans imposed by India.

Restricted spending power and industry responses

Inflation and the soaring costs of living, including energy and mortgage bills, are expected to get worse before they take a turn for the better. This will impact foodservice, as consumers become sensitive to the higher prices of eating out, and with retail prices going up, consumers will increasingly search for the best value for their money. Consumers are likely to opt for private label products to save on food costs as affordability becomes more crucial for Australians than staying loyal to their beloved brands. As Australians search for value for money, private label products from retailers such as Woolworths and discounters like Aldi will be better equipped to meet the demand for affordable essential food items. Major retailer Woolworths is implementing price freezes on essential household items such as eggs, oats, flour, and bread rolls, amongst others, until the end of 2022 to help relieve the pressure of the surging cost of living for Australian consumers. To compete with private label lines when consumers are price-sensitive, some other players are reducing pack sizes to maintain the same price, which has coined the term ‘shrinkflation’.

In a developed economy such as Australia, the expectation is that consumers will continue purchasing food items, considering they are reasonably priced, although reduced frequency of price promotions is expected to impact grocery shopping for Australians. However, despite inflationary pressures and the rising cost of living, sustainability is a key feature that consumers consider when making their product choices. Hence, it is imperative for industry players to continue driving innovation and offer sustainably produced and packaged food choices.

For further insight, watch our video Tracking Product Prices and Availability to Monitor Inflation.