The US meat industry continues to face economic challenges after several years of supply chain disruptions and rising costs. The COVID-19 pandemic led to production issues due to illness and safety precautions, making it difficult for manufacturers to meet rising demand. Ongoing economic and political challenges in 2021 and 2022 have further stressed the industry, as rising input costs, labour shortages and heightened demand have led meat producers to increase their prices. As prices continue to rise, demand for meat in the US may undergo changes as consumer purchasing behaviour shifts in response to inflation.

2020 COVID-19 outbreaks slow production

Meat producers in the US began facing pandemic-related challenges in 2020, with 54,000 workers testing positive for COVID-19 at 569 factories, according to data from the Food and Environment Reporting Network through to February 2021. As a result, several meatpacking plants were shut down for weeks in 2020, and many beef- and pork-packing facilities were operating at significantly reduced capacity. As these facilities struggled to meet demand, animal producers had nowhere to send animals ready for slaughter, and slaughter rates were down through May. Because of the lack of slaughter capacity, many farmers were forced to cull livestock. Although slaughter rates rebounded in June, there was a backlog of animals to be processed. This reduction in slaughter rates, combined with increased retail demand, led to large margins between wholesale meat and livestock prices.

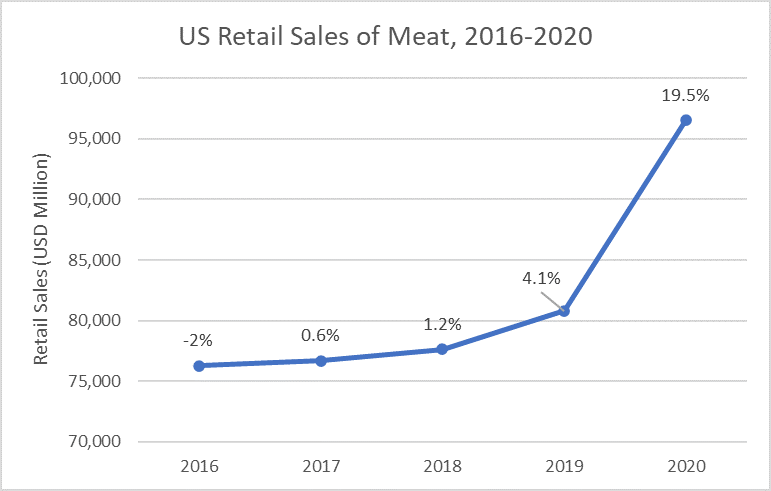

Despite these production disruptions, retail sales of meat were strong. Amid foodservice closures, lockdowns, and meal occasions shifting into the home, many consumers turned to at-home cooking, driving up demand across all types of meat. Total meat retail sales value increased by 19.5% in 2020, with beef and veal increasing 22.1%, pork increasing 18.9%, and poultry increasing 16.9%. Demand was at its highest level in years, placing further pressure on meat producers to increase output.

Shortages and rising input costs present further pricing challenges

Economic challenges continued into 2021 and 2022, with political instability and ongoing global supply chain disruptions making matters worse. Meat producers have faced constrained supplies and rising input costs for products such as grain, corn, hay, and fuel. Animal feed prices have significantly increased from 2020, mainly due to smaller harvests in 2021 and challenges from the Russian invasion of Ukraine in 2022. War between these two major agricultural exporters adds uncertainty to global grain availability and prices. The price of corn, a common grain in animal feed, increased 56.8% in 2021, and is expected to increase a further 8.3% in 2022. The cost of labour has also risen as inflation worsens, and producers are facing a labour shortage.

However, the largest driver of price increases in meat in the US in 2021 was heightened demand. Retail demand remained strong, continuing to track above pre-pandemic levels. At the same time, foodservice demand increased sharply after 2020 declines. Demand for US meat exports also rose, with beef exports to China increasing substantially in 2021. This increased demand placed additional stress on meat producers to maintain high output and drove up prices even further.

Prices of consumer goods have increased across all industries, with US inflation at 4.7% in 2021, and 2022 inflation projected at 7.5% as of May 2022. However, the prices of meat have gone up at rates substantially higher than overall inflation. From March 2021 to March 2022, the prices of beef and veal increased 16.0%, pork increased 15.3%, and poultry increased 13.2%, according to USDA data. Concerns have also risen over the consolidation of the US meat industry, which allows companies some degree of price control. Four companies, Tyson Foods, JBS SA, Cargill, and National Beef, currently control the vast majority of the US meat market. The US government recently announced plans to expand and diversify meat and poultry processing capacity to build a more competitive and more resilient meat and poultry supply chain.

Price stabilisation likely to take time

Although meat prices are expected to begin stabilising by the end of 2022, further increases are expected. According to projections from the USDA, meat prices are expected to increase 4.5-5.5% on an annual basis, with poultry having the strongest increases at 7.5-8.5%, followed by beef and veal at 6.0-7.0%, and pork at 4.0-5.0%. These continued price increases may pose a challenge to industry growth in the short term. Consumers are already facing price increases across all goods, and may be forced to change their purchasing behaviour as a result. They may choose to cut back on meat purchases, or trade down to less expensive meats, such as poultry or pork. The plant-based meat industry may also challenge category growth, particularly if consumers seek out cheaper alternatives to traditional meat products and plant-based can come in under animal-based price points. Although plant-based meat has not impacted the demand for meat thus far, companies are making continued improvements in taste and texture to replicate meat and appeal to a wider base of consumers.

These improvements and the widening availability of plant-based meat at different price points may pose a greater threat to the meat industry going forward, particularly if prices remain high. Inflation is expected to remain relatively high in 2023, at 4.0%, but will slow somewhat in 2024 and beyond, with meat prices likely to follow a similar trajectory.