The role of the store has been challenged by consumers in both the physical and digital space, becoming destinations for discovery, inspiration, and experiences. Even grocers are being challenged to rethink their positioning to compete with retailers across other sectors that have set the bar for consumer engagement. Grocery retailers in the US, big and small, are finding new ways to encourage repeat visits, regardless of economic pressures, by offering a wider selection of products and services to fulfil consumer needs around convenience, premiumisation, and experience more.

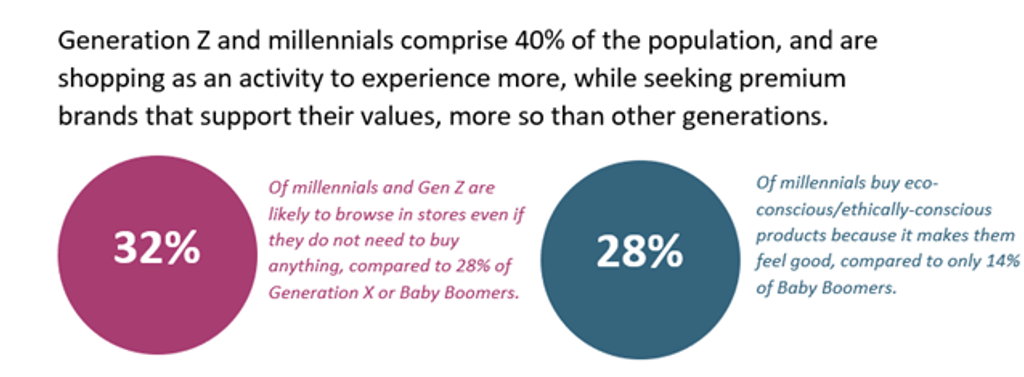

Convenience, premiumisation and experience more are central to purchasing decisions for Generation Z and millennials, with their willingness to browse in stores without immediate purchases and focus on spending that best aligns with their values and needs.

To cater for a younger, exploratory, and largely value-driven cohort, stores such as the Pop-Up Grocer are, quite literally, popping up across the US for a limited duration. The experimental store offers a unique assortment of innovative, niche products and brands organised by consumer need state or occasion, such as “mood boosters” or “happy hour". Seeing success in New York City, Chicago, and Miami, this traveling grocer will continue to temporarily rent out space in urban areas. These stores are less about essential grocery trips, and more about attracting consumers to learn about and try the most fashionable brands on the market that cater for their growing and changing needs.

On a larger scale, the chain Trader Joe’s has inspired a new generation of grocery shoppers, gaining their loyalty through experiences, both in-store and with their private label products. The chain tempts the curious consumer through a constant rotation of healthy, fashionable, and globally-inspired offerings. Helpful staff in addition to shelves and open product cases, are designed for consumers to easily browse and explore at their leisure.

Beyond innovative stores targeting shoppers around need states, the desire for quality is a priority among the same consumer group. With retailers such as New York City’s Gourmet Garage and, the recently expanding national premium convenience store Foxtrot Market, consumers have access to top-quality sauces, produce, and other staple goods, curated and often used by top chefs themselves, including Momofuku’s David Cheng. Given the elevated appeal, these products are sold at much higher price points than traditional grocers. This sort of premiumisation makes consumers feel elite, an experience encouraging them to return for more, regardless of price.

These trends are even beginning to manifest outside of major urban areas, as cafés, convenience stores, and spaces not traditionally considered as grocery, such as petrol stations across rural US, are giving their stores a refresh to include higher-end options and experiences. For example, Alltown Fresh convenience store chain in the Northeast offers local produce and a professional kitchen with made-to-order fresh and healthy offerings to appeal to younger consumers on-the-go. Upop in the South is a petrol station-meets convenience store that is similarly experimenting with a full food menu, and further offering a membership to bring younger consumers back. This trend of premium yet convenient experiences and offerings for consumers is challenging traditional grocery as new spaces to shop for products from anywhere become increasingly available and specialised.

Convenience, premiumisation, and experience more are manifesting in different types of retail channels, most recently affecting grocery retailers and adjacent stores, with this trend expected to expand and mature over the next several years to all corners of the US.

To be able to innovate, businesses should monitor up-and-coming generational differences across key megatrends with a careful eye on how competitors are already responding. Utilising these sources of information, businesses can stay up to date and better plan for the future ahead.

For further insight, read our report, Megatrends: Shopping Reinvented and Generation Z