On 11 August 2022, Johnson & Johnson Inc announced that it will cease the global sales of talcum-based baby powder in 2023. The announcement comes after more than a decade of public outcry, an onslaught of lawsuits, and the halt of talcum-based baby powder sales in certain markets, leading to the introduction of cornstarch-based baby powder as a substitute item. The timing also comes before Johnson & Johnson makes its consumer products division a separate company in 2023.

Significant implications for body powder’s leading global brand

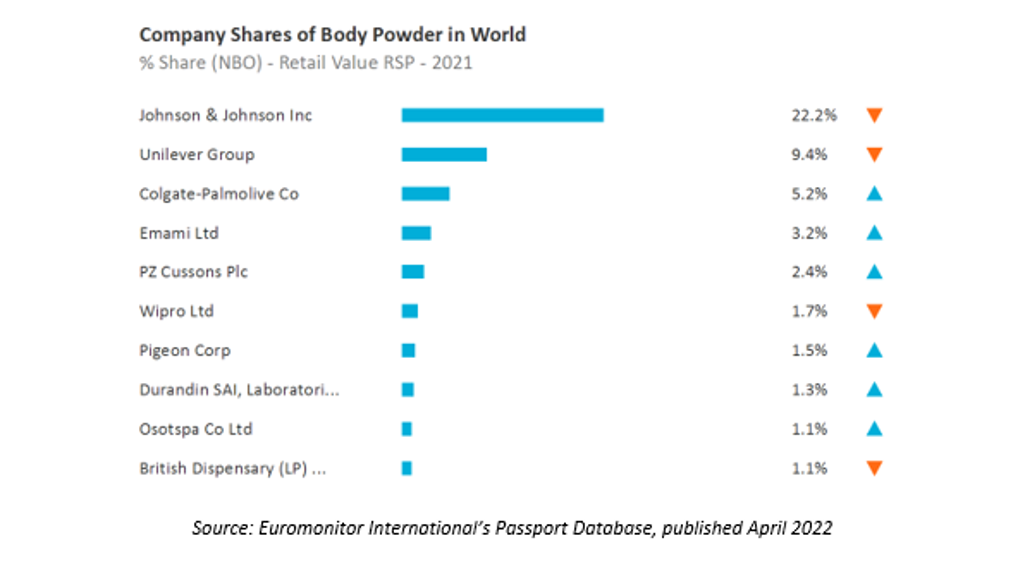

According to Euromonitor International’s Beauty and Personal Care data, last updated in April 2022, Johnson & Johnson leads global sales of body powder, holding a 22% share in 2021, down from 26% in 2016. The company’s body powder sales have declined on a global level by a 2% current value CAGR from 2016-2021, but experienced faster declines in its second most important region of North America, recording a -5% CAGR. While the company registered USD273 million in global body powder sales in 2021, the impact of the announcement will likely affect body powder differently across markets.

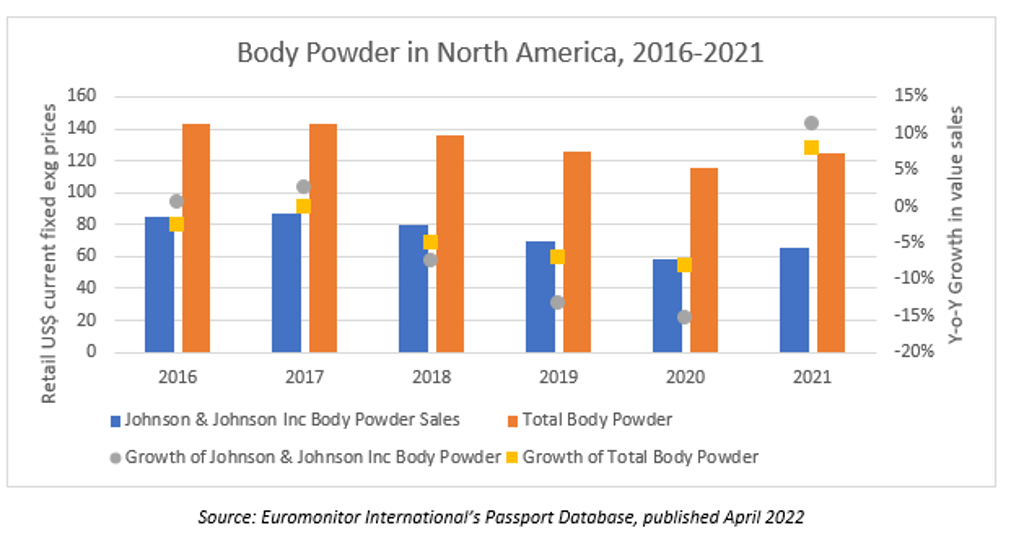

Sales rebound following switch to cornstarch in North America

In North America, body powder sales had been trending downward from 2018 to 2020, due in part to controversy surrounding the ingredient talc. Talc-based body powder brands and producers experienced a particularly turbulent 2018 and 2019 as lawsuits mounted over the potential risk of mesothelioma and ovarian cancer associated with prolonged use. As a result, there has been a deterioration of consumer confidence in talc-based products, reflected in body powder leader Johnson & Johnson’s declining sales in North America over the same time period. However, the category - and Johnson & Johnson’s body powder sales - turned to growth in 2021, impacted by the company’s announcement in 2020 that it was phasing out remaining inventory of talc-based powder and replacing it with cornstarch-based powder in the US and Canada.

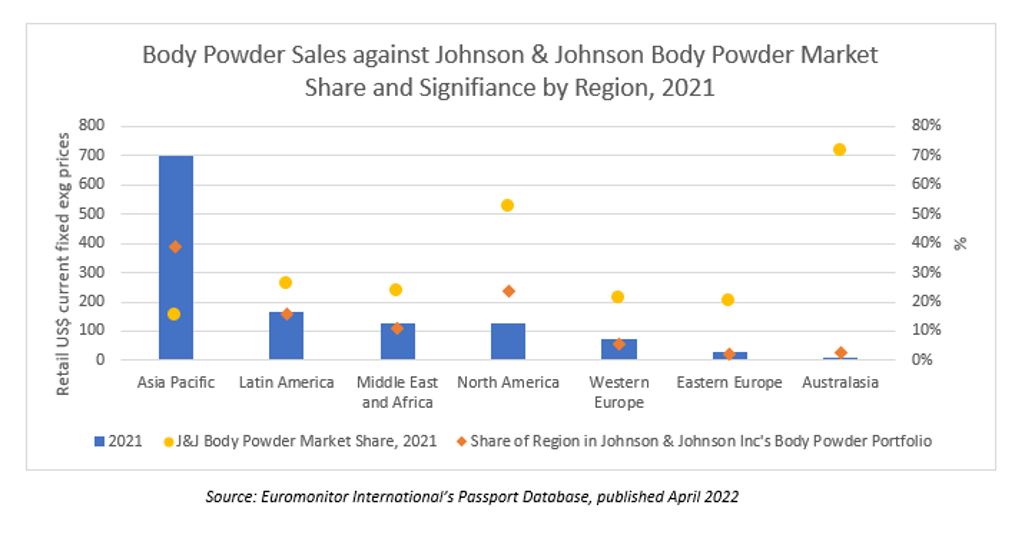

Asia Pacific to be most impacted, where Unilever Group is closing in

The largest region for body powder in 2021 is Asia Pacific, registering USD701 million and dwarfing the second-largest region, Latin America, by quadruple the level of value sales. Up from a 4% decline in 2020, body powder sales in Asia Pacific grew by 3% in 2021, of which Thailand, Pakistan, China and Indonesia were the largest contributors. The easing of pandemic restrictions across most markets in the region (although there are some exceptions) should support improved results for body powder from 2022 onward, as consumers return to their usual places of work and start to socialise outside of the home more frequently.

In addition to being the most important body powder region globally, Asia Pacific is also Johnson & Johnson’s most significant region for body powder sales with a 15% share in 2021. Although the company leads the category in 2021 in Asia Pacific at USD106 million, second-ranked Unilever Group is closing the gap at USD105 million, while Colgate-Palmolive Co follows at a distant third. Johnson & Johnson’s body powder performance in Asia Pacific follows a similar trend witnessed in North America, registering declines in 2019 and especially in 2020, before returning to 4.4% growth in 2021.

Johnson & Johnson Inc (and any other players encouraged to switched from talc to cornstarch) will need to ensure seamless substitution among consumers, rather than risk them switching to other brands. Euromonitor International’s Via online sample, which tracks 1,500+ online retailers in 40 countries, revealed that talc-based body powder holds the majority of the market outside of North America. The transition in the supply chain from talc to cornstarch will take time and is likely to face supply chain disruption, which has worsened in 2022 due to geopolitical events that are constraining ingredient supplies in addition to COVID-19 lockdowns.

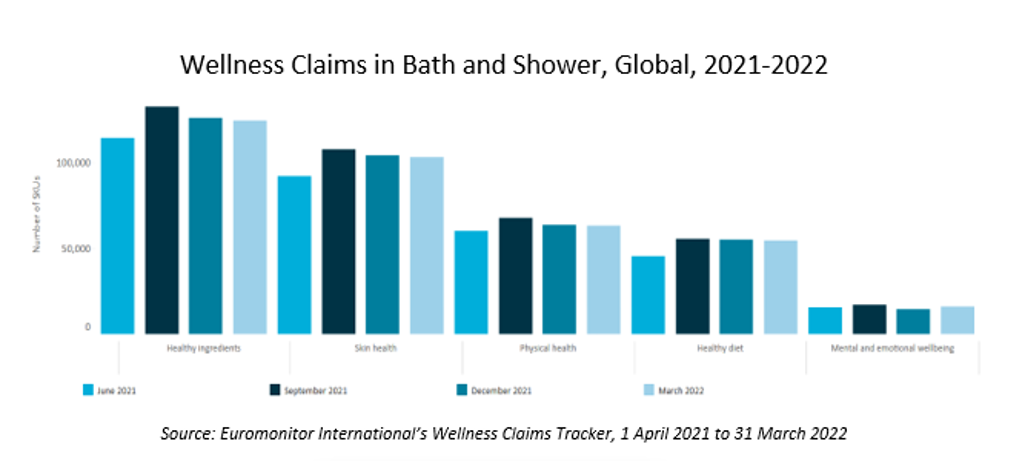

A precursor to a category-wide movement towards talcum powder alternatives

The pandemic-induced focus on health and safety will continue to foster a closer examination of beauty ingredients, as consumers continue to question the composition of the products they use daily. Johnson & Johnson’s decision to pull talc-based body powder from its portfolio is likely to accelerate consumer appetite for “healthy ingredients”. Globally, “healthy ingredients” have the highest concentration among wellness claims in bath and shower. Consumers have also expressed a growing desire for products with a clean slate and no history of marketing, quality control, or ingredient controversy - which further paints a more positive picture for newer “clean beauty” brands to gain share from key body powder players.