While tech-driven innovation is the natural path of evolution for commerce in the digital era, digital innovation in a highly unpredictable environment such as a global pandemic is a different playing field. The implications on return and profitability in a challenging business atmosphere, the longevity and relevance of the technology hold prime importance in decisions around investment in technology. An overwhelming reason hindering digital effectiveness as reported by industry professionals is lack of dedicated funding and no clear return on investment, according to Euromonitor International’s Voice of the Industry Digital Consumer Survey, 2020.

However, with the need to continue operations amid store closures, safety protocols, reduced mobility, lack of community and remote working, companies have found opportunities to redesign their services to become more relevant and reliable. Shorter time to market and the need for agile implementation has required firms to use fit-for-purpose technologies innovatively for optimal gains.

While cloud, Internet of Things and artificial intelligence were the most relevant technologies supporting process upgrades and business functions during 2020, three technologies leveraged most widely to support digital innovation were augmented reality/virtual reality, robotics/automation, and QR codes/barcodes. Biometrics also saw wider applications beyond fingerprint technologies.

The following analysis explores how some companies are using these technologies to innovate in this most challenging of times:

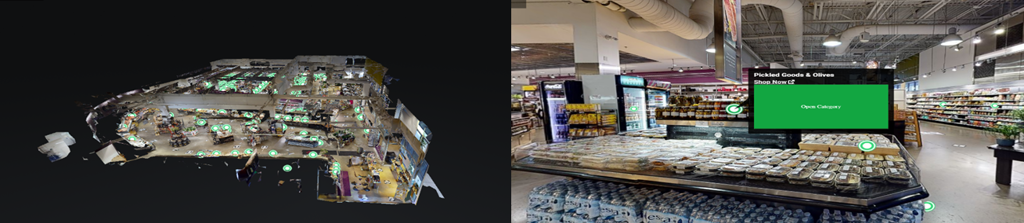

INABUGGY.com launches 3D virtual shopping experience in Canada

INABUGGY.com is an online grocery and alcohol delivery platform that offers fulfilment via partner grocery stores across Canada. During 2020, together with Canadian retailer McEwan Fine Foods, INABUGGY launched a 3D virtual shopping experience. Touring store aisles online, customers can navigate through the virtual store environment, clicking on products to view details and then add them to the cart. This provides users with an in-person shopping experience from their home, in which they can discover products that might be overlooked in the traditional interface of an online store.

Source: Inabuggy.com

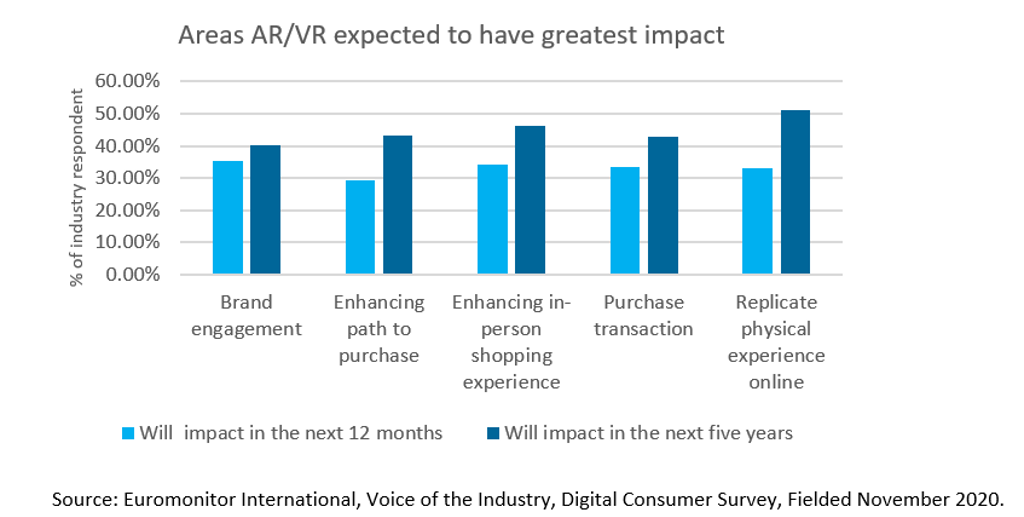

With the crisis highlighting the value of alternative shopping interfaces, more businesses used virtual immersive experiences to offer engagement beyond the transactional e-commerce experience. More than 38% of the industry professionals mention that their companies plan to invest in AR/VR over the next five years, according to Euromonitor International’s Voice of the Industry Digital Consumer Survey, fielded in November 2020, with replicating physical experience online to be the leading use case. While it may be difficult for most retailers to deploy such technologies independently at scale, partnering with third parties can offer cost and service optimisation.

Carrefour implementing robots to pack online grocery orders in key Gulf countries

Majid Al Futtaim, Carrefour's Middle East franchise holder, rolled out automation of online grocery fulfilment in the United Arab Emirates and Saudi Arabia in 2021. With technology from US-based Takeoff, the retailer is establishing micro-fulfilment centres deploying robots at select Carrefour stores. With the average time to prepare an order reduced to five minutes, the technology is said to be able to process 2,000 orders per day from a space of 1,500 sq/m, giving Carrefour an edge in a competitive grocery ordering market.

With the pandemic boosting online grocery, both order accuracy and delivery time will be key to retaining customers in an evolving market. During 2020, grocery retailers required more staff to pick items within stores to prepare online orders, thus increasing fulfilment costs. Grocery stores are increasingly looking to optimise through automation and robotics to reduce expenses. This shift will become much more important as grocery stores increasingly service e-commerce orders on their own sites as well as partner with multiple last-mile delivery platforms.

Takeoff’s Robots at a fulfilment center

Source: Takeoff Technologies/Knapp

PayEye launches first iris biometric payment platform in Poland

PayEye, a Polish payment processor, launched the first full payment ecosystem based on Iris biometrics in 2020. The platform utilises a proprietary eye POS payment device and algorithms detect the biometric pattern, dubbed the PayEye code. Users register and top up a virtual wallet at payeye.com. Customers then need to generate their biometric template at a partner merchant that has a PayEye payment terminal. Within a few months of its launch, PayEye was available across hundreds of outlets such as cafés, grocery stores and hotels. The concept is expected to be available across wider European markets.

PayEye speaks to the broader shift towards cashless payments. While mobile is the device of choice, biometrics could address consumer groups currently underserved, such as older consumers who are not as digitally-savvy and thus might benefit from a solution that does not require a passcode. The added security feature can offer some advantage but the same time many users may not be comfortable with biometric authentication due to privacy concerns.

Café using PayEye to receive payments from a customer

Image Source: The photo shared by PayEye Sp zoo

With accelerated changes in consumer behaviour, digital capabilities are becoming increasingly relevant. Nearly 68% of industry professionals expect consumers to be more concerned about a company's digital capabilities in the aftermath of the COVID-19, according to Euromonitor International’s Voice of the Industry Digital Consumer Survey, 2020. Watch our webinar Top 5 Digital Consumer Trends in 2021 to better understand which tech-driven trends will most impact commerce this year.