Plant-based meat snacks have emerged in the alternative meat market in recent years, drawing the attention of consumers, manufacturers, and investors. The once-held confidence that US consumers would adopt plant-based meat alternatives whole-heartedly has weakened as companies such as Beyond Meat have struggled to meet their targets. As plant-based jerky gains traction, it is evident that manufacturers must perfect all aspects from taste and texture to marketing and price point to achieve success. However, many companies are looking to strike the balance and find their market position, hoping to result in strong adoption of plant-based jerky by vegans and flexitarians alike and experience healthy growth in the coming years.

Positive prospects for plant-based jerky

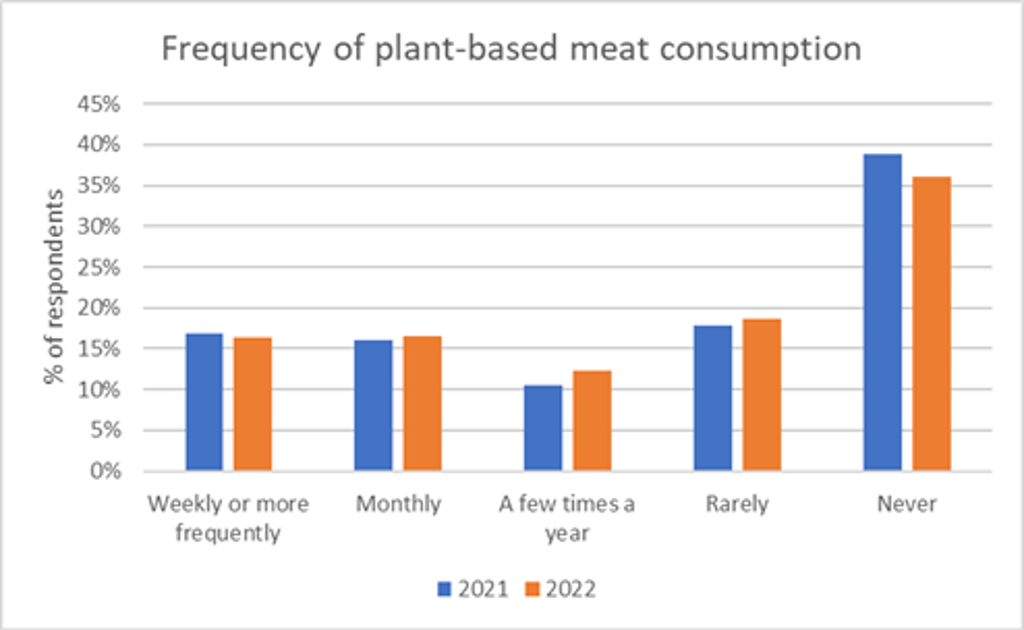

Analysis of alternative meat products and consumer trends indicates that plant-based jerky is only beginning to hit its stride. One such trend is the performance of traditional meat snacks. Millennials, the largest age demographic in the US, alongside Generation Z, often eat multiple small meals accompanied by snacks throughout the day rather than three full meals. They seek high protein, low carb, on-the-go snacks, and have found meat snacks as a preferred choice. The category grew by 8.8% in retail value from 2019-2020 to reach USD103 million, with preliminary research suggesting even higher growth for 2021, a trend that will persist through to 2027. Plant-based jerky ticks the same convenience and nutritional boxes as meat jerky, while avoiding health risks associated with red meat consumption and by using more sustainably-produced ingredients. As the number of consumers trying to limit their meat intake increased in 2021 and 2022, per Euromonitor International’s survey data below, customers browsing the jerky aisle for sustainable snacks could become regular purchasers of plant-based options.

Work remains to ensure success

As it stands, manufacturers and retailers will have to do more for plant-based meat snacks to succeed. Marketing and packaging design must align with the texture, flavour, and consistency that customers should expect from the plant-based snack inside. Existing brands’ primary ingredients range from soy and pea protein to sea kelp, bananas, coconut, mushrooms and beans, resulting in wide-ranging textures – some emulate meat jerky, some are anything but. Some consumers may be discouraged after biting into a “spongy” rather than “meaty” jerky; however, the fact that most customers across savoury snacks now look for innovative products with flavour variety and creative textures could work in companies’ favour. Proper positioning highlighting innovation and honest advertising about texture could boost attention and sales.

Distribution and pricing opportunities ahead

Plant-based meat snacks are not yet widely distributed but are primarily available in specialist retailers or online. The recent entrance of Beyond Meat into this space could change the visibility of the entire category in the near-term by leveraging its partner PepsiCo’s wide distribution network. If Beyond Meat’s popularity can attract greater attention to the category, consumers who follow the brand into the plant-based meat snack segment may branch out to try other brands, as long as they are available on retailers’ shelves. As brands continue to expand their distribution, both in-store and online, the value of plant-based meat snacks will grow, along with greater competition. A key part of competition is pricing.

The traditional price dichotomy between meat and meat alternatives has historically served as a barrier to growth for the more expensive alternative products; however, high inflation is causing the two to near or achieve price parity. Inflation has heightened price sensitivity, so any gap, no matter the size, now matters more to consumers. Plant-based products will still need to stand out among other alternative jerkies but also among all meat snack options. Conveying greater value for a higher price or having or achieving a lower price through promotions and discounts could encourage purchases of plant-based options, but the products will ultimately have to be worth their full price to sustain demand.

Staple status looks promising

It is early days for plant-based jerky, but successful growth seems likely. Manufacturers and retailers will likely look to competitive pricing, create clear advertising, and slowly broaden distribution to gain customers’ attention and retention. As long as consumers find plant-based jerky fairly priced, appetising, and meeting nutritional and functional needs, it should become a staple in the snack aisle.

For further insight, read our report, Plant-based Eating and Alternative Proteins