The apparel and footwear industry was among the worst hit by the COVID-19 pandemic. Global retail value sales declined by 19% in 2020, with a full recovery to pre-pandemic sales levels not expected until post-2025. While there is a general consensus across the industry that pent-up savings and demand, as well as improved consumer confidence, will help support the recovery, the fashion industry still faces huge challenges, not least because overall consumers are continuing to exercise cautious spending.

Whilst vaccine rollouts, effective containment measures and reliable national healthcare will all be needed to improve the outlook for apparel and footwear for the remainder of 2021 and into 2022, innovation is at the heart of recovery for key players and fashion retailers as they consider new business models for survival.

Get ready for next generation technology across the path to purchase

E-commerce is expected to be a primary driver of sales growth in the short to medium term. The pandemic was a pivot point for the industry, as brands and retailers quickly shifted towards the development of e-commerce.

The recovery of growth in 2022 is expected to be largely driven by e-commerce, as consumers are still showing reluctance to make physical store visits, due to safety concerns as well as ongoing lockdowns. However, fashion retailing overall in many key regions is no longer defined by physical versus e-commerce, and the growing trend among apparel and footwear retailers and brands to offer a unified experience is becoming increasingly apparent. This is a process that involves studying the entire consumer journey and merging all aspects – online, offline and payments – into a seamless experience.

However, as consumer behaviour changes, remaining relevant has never more difficult. Come tomorrow, what it takes to win today may already have changed and during this time of crisis the pace of change has only increased. Based on Euromonitor International’s Voice of the Industry Survey completed in April 2021, which examined the digital technologies set to have the biggest impact on the way the industry conducts business over the next five years, almost half of industry professionals stated that robotics/automation is expected to be the most impactful. In addition, more than half of those surveyed said their company is planning to make an investment in these technologies.

Indeed, although digital and e-commerce will be intertwined across the path to purchase, in the medium to longer term, fashion consumers will no longer turn to smartphones for help in navigating their next commerce step, as other technologies become increasingly relevant. Bots will craft individualised experiences; for example, a concierge bot will provide input for those needing fashion recommendations. Other visual information traditionally provided by smartphones will be available through holographic glasses or watches that will project the internet search of tomorrow into a consumer’s virtual world. The lines between real and virtual will blur, as fashion consumers layer such virtual elements over real life to gain information or engage in “gamification” and NFTs for rewards or fun. In some cases, consumers will leave the real world and step into a virtual one for branded fashion and luxury experiences.

Fashion brands respond to the needs of the new and growing number of “glocals”

In the next 10 years, all aspects of life will converge for a more localised, tech-infused neighbourhood. This new view of community will take shape on the back of an urban planning movement where large cities shift to a series of “20-minute neighbourhoods”. Most activities, including commerce, work, education, recreation and sport, will become accessible as consumers embrace “living locally”.

Indeed, the COVID-19 pandemic has encouraged more people to move away from large cities in favour of suburban areas. To this end, retailers must reconsider their distribution strategies and retail models. If e-commerce is key, having a strategic network of physical stores offering unique experiences is also critical to allow them to continue engaging with customers, despite the convenience of online purchases. Whilst continued technological advancements will of course give consumers the ability to execute more, from work to shopping to entertainment, without leaving their homes, the new urban consumers in the world’s most developed markets will continue to drive the advancement of such services, which will lead to more isolationist tendencies.

The world-famous and iconic British department store Harrods has been at the heart of this change: after the successful September 2020 opening of its inaugural concept store H Beauty in Lakeside, Essex, Harrods launched its second and largest concept store in Milton Keynes in April 2021, which is said to be one of the UK’s fastest growing commuter towns. Located in a former House of Fraser department unit within a shopping centre, H Beauty brings premium luxury beauty brands and experiences together to local consumers outside of London.

Emblematic of the suburbia phenomenon triggered by the pandemic, the H Beauty concept stores in Essex and Milton Keynes have both thrived since opening and Harrods announced that it would open three more H Beauty stores by 2022 in Edinburgh, Bristol and Newcastle. Other department stores are set to emulate this suburban strategy and business model.

Purpose-driven brands resonate well with affluent fashion consumers

The impact of the pandemic has led to other shifts in the behaviour and mindset of fashion consumers. There has been a clear drive to resist a return to the volume-driven model across the apparel and footwear industry. Instead, more companies and communities are looking at ways of opening up in a more sustainable way. This was clear in Euromonitor International’s Voice of The Industry Survey, where a higher number of consumers stated that they want companies to care beyond revenue and to build back better.

Issues around ESG is now a major conversation in the boardroom. Diversity, inclusivity and equality are now at the top of the agenda. Young consumers in particular are challenging business norms and above all are demanding equal opportunity, diversity and social inclusion. This was highlighted in a Euromonitor International Consumer Lifestyles Survey, where there was a clear shift towards spending on purpose-driven brands. This was particularly notable amongst higher-income groups, which suggests that there is a real opportunity for luxury and designer fashion brands to become tomorrow’s next leaders.

The digital transformation has changed the rule book and the need for more versatile business models is rising. The wholesale model is under threat and the rise in e-commerce is challenging long-held principles, including the role of the retailer. Explore new business models that are more sustainable is now as an imperative, before it is too late

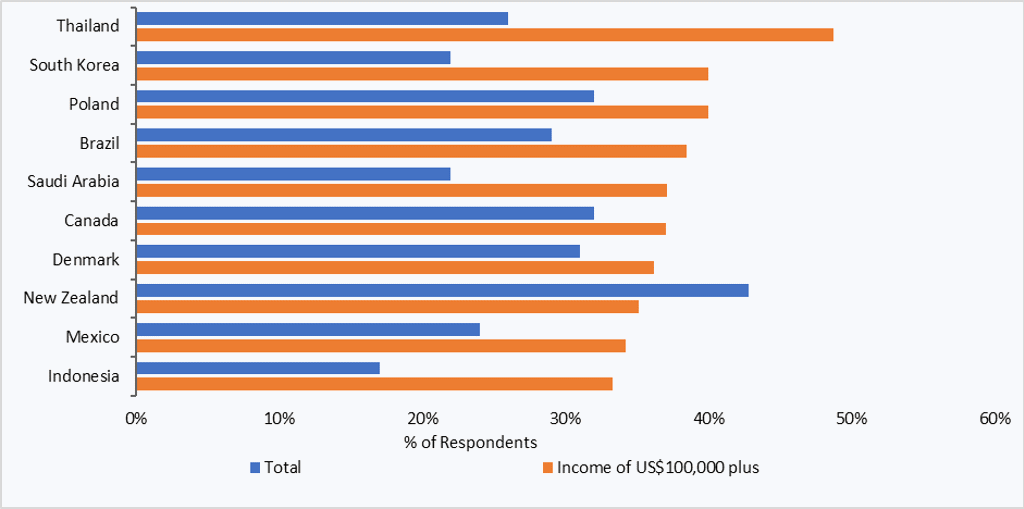

We are already seeing a number of luxury players are experimenting with new concepts such as the resale and rental model as well as on-demand manufacturing. These new business models help to support sustainable initiatives but also help to manage the volume of unsold goods, Consumer interest in sustainable and ethical fashion brands has undeniably peaked in the last few year which was highlighted in one of our surveys where there was a clear shift towards buying second-hand goods. Again, our results showed that this was of particular note from those in higher income groups.

Top 10 Countries: Consumer Who Buy Secondhand Goods 2021

Indeed, new ways of thinking and doing will now be key to building resilience in fashion. If anything, the pandemic has highlighted the need to convert words into actions: People, Prosperity, Planet Peace and Partnership will be the five Ps to build back better.

Read more about Euromonitor International's Apparel and Footwear research by downloading Euromonitor International’s World Market for Apparel and Footwear report

For further information, please contact Fflur Roberts, Industry Manager – Luxury Goods, on fflur.robertsr@euromonitor.com