Middle Class Reset is a key megatrend identified by Euromonitor International’s network of industry, country, economic and consumer experts as having the furthest-reaching impact on industries and consumers in the future.

At its core, this megatrend is about middle class consumers’ reassessment of values, ownership and priorities – all in an effort to stretch their limited resources.

They have become more fickle and less loyal to brands; they are prioritising access over ownership, bargain hunting, and trading down in order to trade up; they are also moving away from conspicuous consumption towards more conscious and selective purchases, in which quality and intangibles such as experience, authenticity, convenience, and sustainability are increasingly important.

Middle Class Reset started off in developed markets, as regions like Western Europe has struggled to maintain the economic position it has enjoyed for the last half a century. This was exemplified by the growth of discounters in grocery retailing since 2009/2010, in the aftermath of the global financial crisis.

Middle Class Reset beyond developed markets

In emerging and developing economies, even as the middle class continues to expand and enjoy rising incomes, their priorities and habits are not dissimilar to their counterparts in developed markets. They are increasingly shifting away from wasteful, conspicuous consumption towards more selective and conscious spending.

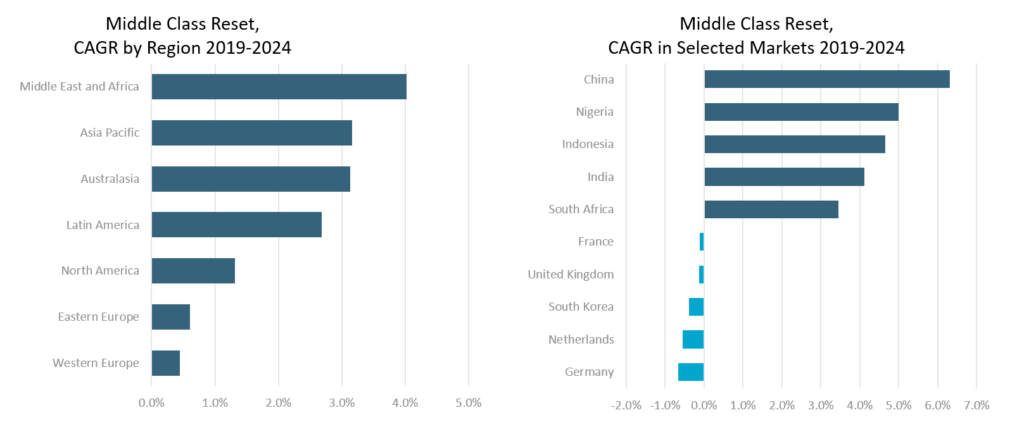

Findings from our Megatrend model reveals stronger future growth in emerging markets across the Middle East and Africa, Asia Pacific and Latin America. China, Nigeria, and Indonesia are expected to witness some of the strongest rates of consumer spending growth on products and services shaped by the Middle Class Reset megatrend.

Source: Euromonitor International

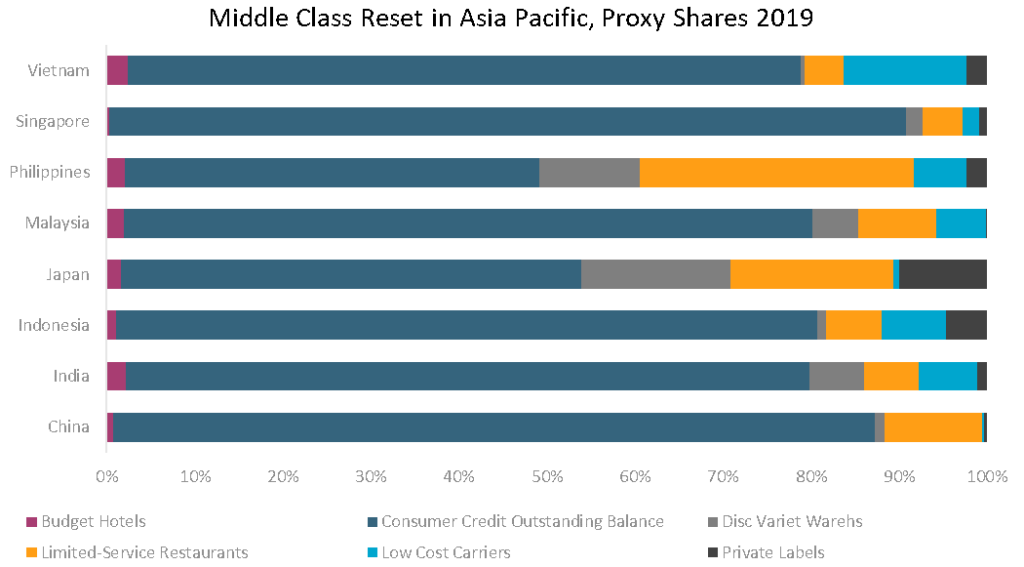

In Asia, middle class spending is associated with consumer credit

Looking at factors that constitute, shape and drive the Middle Class Reset in Asia Pacific, our model reveals that a large proportion of middle class spending across this region is associated with consumer credit.

For a region that is traditionally characterised by a high propensity to save, this points to a class that is confident about future financial prospects and is increasingly inclined to spend rather than save. Consumer credit is an important growth driver for consumer spending in Asia.

Combined with the fact that technology is a big driver of the region’s Middle Class Reset, it explains in part the evolution and exponential growth of Asian technology giants such as Alibaba, Tencent, JD.com, and Sea Ltd (parent of Shopee), companies which have innovated and disrupted to be more than just online shops, but ecosystems of e-commerce and financial services, including consumer lending.

Source: Euromonitor International

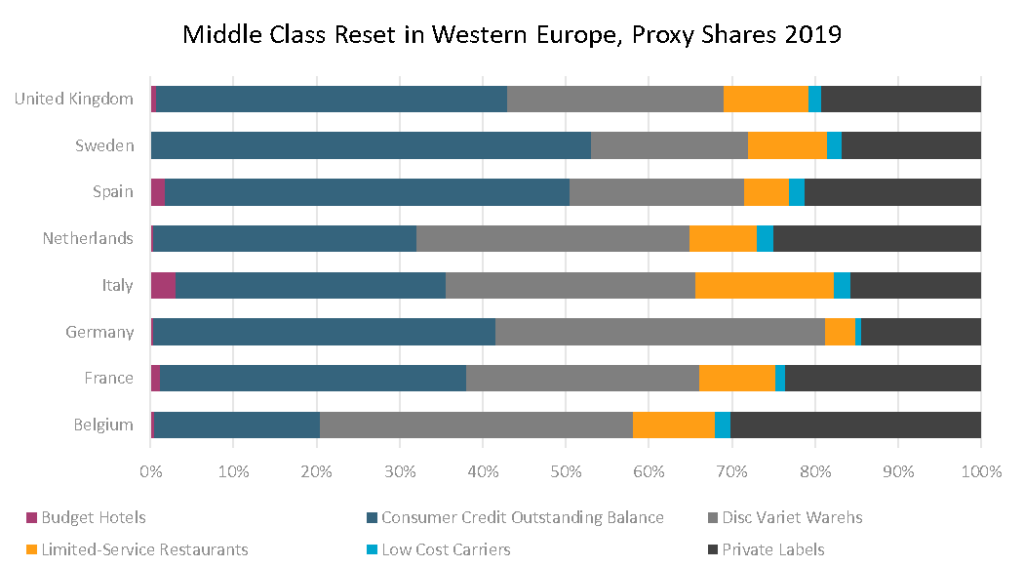

Opportunities mainly linked to value for money in Western Europe

It is a completely different picture for developed markets in Western Europe. Here, opportunities arising from the Middle Class Reset align primarily with discounters and private labels.

In contrast to emerging and developing markets in Asia, where middle class consumers are confident about their future prospects and where consumption is therefore fuelled by consumer credit, middle class consumers in Western Europe are finding ways to stretch their limited resources and to make their money go further by shopping at discounters, as well as turning to budget options and private label.

For companies seeking to target these consumers in Western Europe, a key strategy is therefore price stratification, which enables them to expand into the discounter/private label space while retaining a foothold in more premium segments so as to also capture the spending of consumers trading up.

Source: Euromonitor International

For further insights on how Euromonitor’s new tool for quantifying megatrends, alongside qualitative megatrend analysis, can help you evaluate the potential of consumer expenditure on goods and services that align with the Middle Class Reset, watch the webinar Quantifying Megatrends: Expanding Your Portfolio in the Right Spaces.