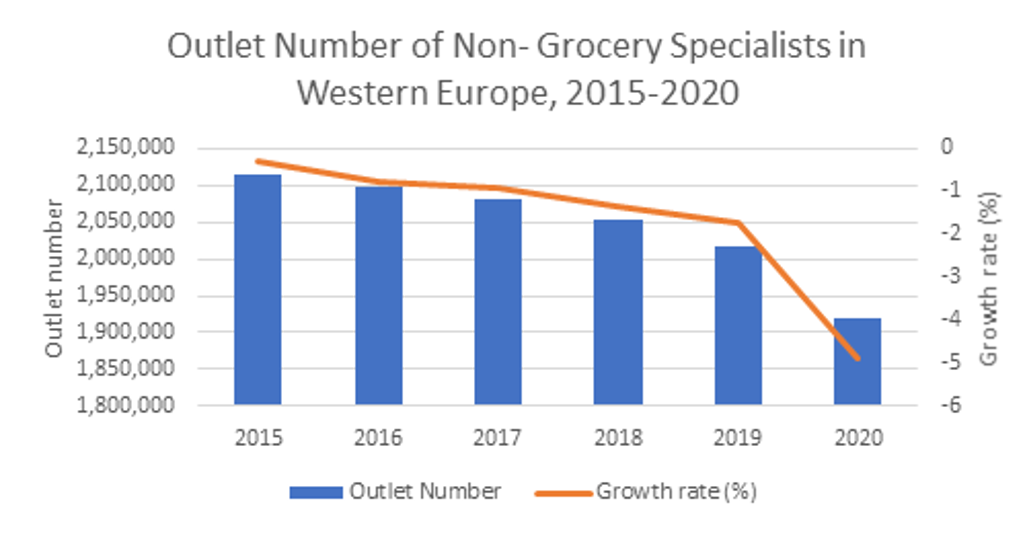

Euromonitor International estimates that some 5% of all non-grocery retail stores in Western Europe and North America permanently closed in 2020 due to lower footfall, operational challenges and the stiff competition from online retailing.

In the UK, Arcadia Group, owner of some of the UK’s most iconic high street clothing retail outlets – Topshop, Topman and Dorothy Perkins, among others – has gone into administration, while the UK’s oldest retail chain, Debenhams, is closing down. Central city locations were hit particularly hard by the pandemic with officials continuously asking people to stay and work from home in an attempt to slow down the spread of the virus. However, retailers’ urge to experiment and innovate did not diminish in 2020. Instead, we saw some impressive innovations, with retailers recognising that they need to reimagine their growth strategies, positioning and ways of communication with customers in response to dramatically changing circumstances.

Source: Euromonitor International, Retailing 2021 edition.

E-commerce boom brings unique challenges

According to Euromonitor’s latest 2021 retailing industry research, while the adaption to digital and the unprecedented 24% real growth of e-commerce sales globally was certainly one of the most positive stories in 2020, the increased demand for goods sold online has brought a set of unique challenges with immense pressure for micro and urban fulfilment efficiency. Though physical and online retail are often seen as opposite ends of the spectrum, it was a combination of traditional retail and digital that helped many online operators meet the extraordinary demand for online orders. For instance, some retailers have had success converting their shops to dark stores, which are essentially warehouses that can be used to facilitate click-and-collect services.

This has been particularly important in highly densely populated areas in the cities, as retailers needed to find ways to improve their operational efficiency and get their goods into customers’ hands as quickly as possible. For example, in France, in April 2020 alone, Monoprix transformed five Parisian stores, located in office areas that registered less traffic, into dark stores to grow order preparation capabilities.

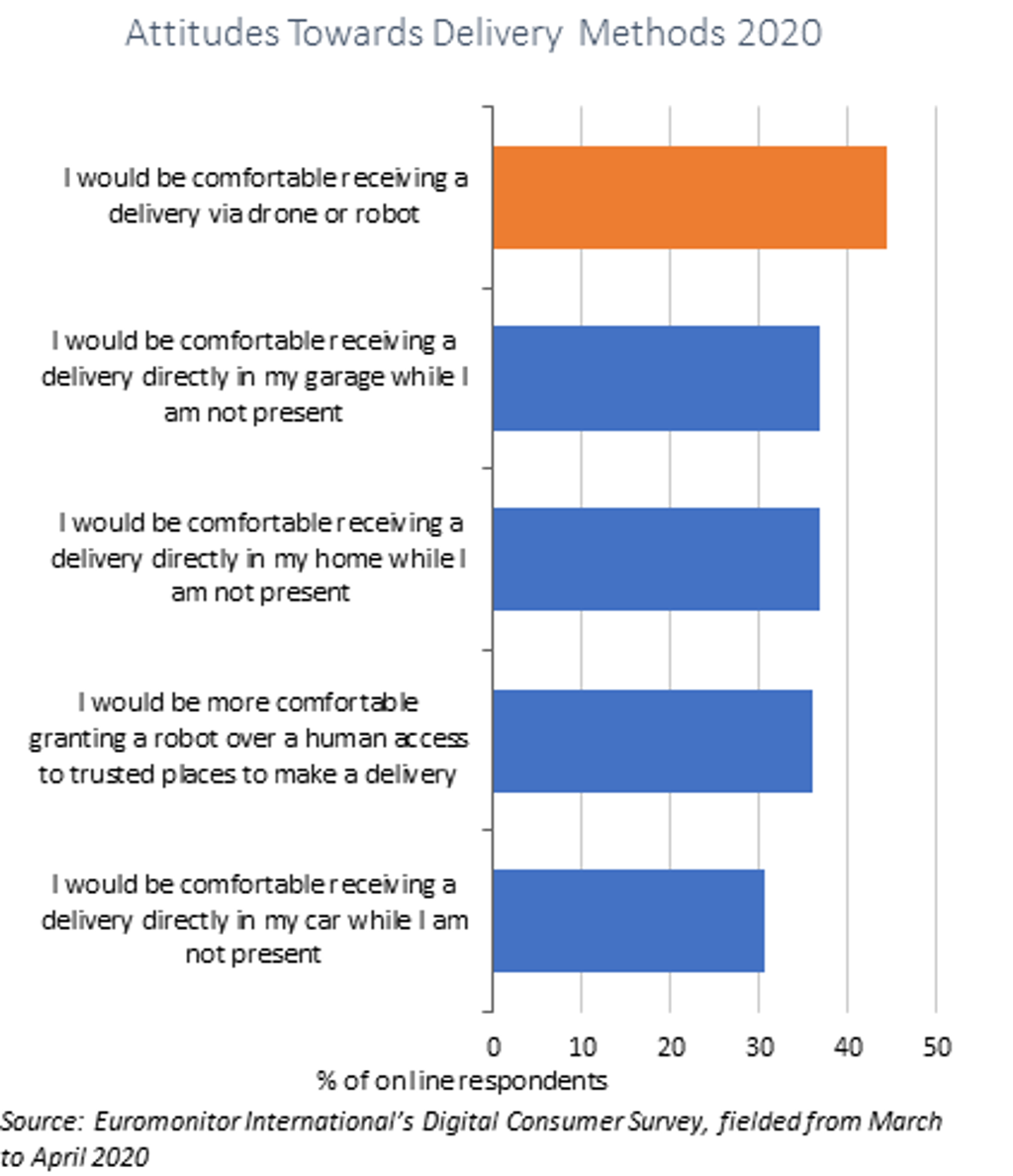

The e-commerce boom has also magnified the impact of delivery costs to the bottom line, which has led companies to explore new methods, from high-tech robots to low-tech curbside pickup options. While autonomous deliveries had already been progressing prior to the Coronavirus (COVID-19) outbreak, the current crisis is fuelling ever greater interest and purpose in utilising autonomous delivery in urban e-commerce markets, not only as a solution for last-mile deliveries but also a health and safety measure. Several companies have been actively piloting autonomous deliveries of essential medical supplies and food during the COVID-19 crisis. For example, in February 2020, during the COVID-19 outbreak in China, JD.com, a major Chinese e-commerce company, carried out its first autonomous delivery of goods to a hospital. According to Euromonitor’s Digital Consumer Survey, 2020, 44% of global connected consumers said they would be comfortable receiving a delivery via a drone or robot.

Growth of mixed-use real estate developments expected in cities

Another new concept that has received much attention during the COVID-19 pandemic was the 15-minute city. This is an urban planning idea grounded on making all essential goods, services and consumer needs, such as shops, work and school, available within a 15-minute walk or bicycle ride. The concept has already been tested in Melbourne prior to the COVID-19 pandemic with promising results and the mayors of some major cities such as Milan and Paris have voiced their support for this idea. Some of its characteristics have already been implemented, including the greenification of cities with parks and green zones and the growth in popularity of mixed-use real estate developments that incorporate retail, residential and commercial spaces.

In the UK, for instance, even prior to the pandemic, in January 2020, according to the Office of National Statistics, applications for retail-to-residential conversions were up almost 10% year-on-year. With 2020 being annus horribilis for most central city locations, the conversion of retail and office buildings that otherwise may be left unoccupied to residential ones is an obvious solution and will likely plant the seeds for the future development of the high street, re- imagining some of its stores and services and making it more personalised and local.

According to Euromonitor International Lifestyles Survey, 2020, fielded in pre-lockdowns, in Jan-Feb 2020, nearly 28% of global consumers tried to shop more in local stores. For much of the rest of the year, consumers were obliged to shop locally, which has been a vehicle for them to support local businesses and help prevent their bankruptcies. Governments and local authorities have also been looking for ways to motivate people to get back to physical stores. For instance, to spur the economic recovery of the city of Akron, Ohio, US, the government developed a community engagement app that incentivises citizens to shop locally by rewarding them with digital “Blimps,” Akron’s city coin, that are redeemable at participating local businesses.

Omnichannel strategies will drive recovery

While understandably in 2020 much of the focus has been on innovations in e-commerce, it is omnichannel that will drive growth and recovery for retailers beyond the pandemic. The look and feel of brick-and-mortar stores may be different for the foreseeable future; however, physical retail will remain the most important and the biggest channel globally over the next five years. Outside of government-assisted programs, more incentives will be needed to promote the return of people to physical stores, not only locally but also in central city locations. Despite urban living coming under scrutiny during COVID-19, the overarching trend will remain mass urbanisation, a key driver of economic development and job creation.

For more insights, download Euromonitor’s white paper Retail Innovation- What’s Here to Stay?