Across the world’s top-flight competitions, between 2020 and 2021 the number of crypto deals has risen from 14 to 150 – a staggering 971% year-on-year growth. This is a testimony of both crypto players’ eagerness to leverage the unique ability of sports to tap into loyal fanbases, and also sports properties’ hunger for partnering with an industry that can both bolster commercial revenue and open further opportunities in the technology space.

While sports properties are eager to leverage crypto sponsorships to increase their revenue streams, crypto brands want to drive exposure, familiarity, and integrity with consumers to ultimately achieve wider acceptance and adoption levels among the wider population.

All of this happens as the legal framework surrounding crypto technology is still being defined across key countries, adding further challenges to an already quickly evolving and complex landscape of partnership opportunities for sports properties.

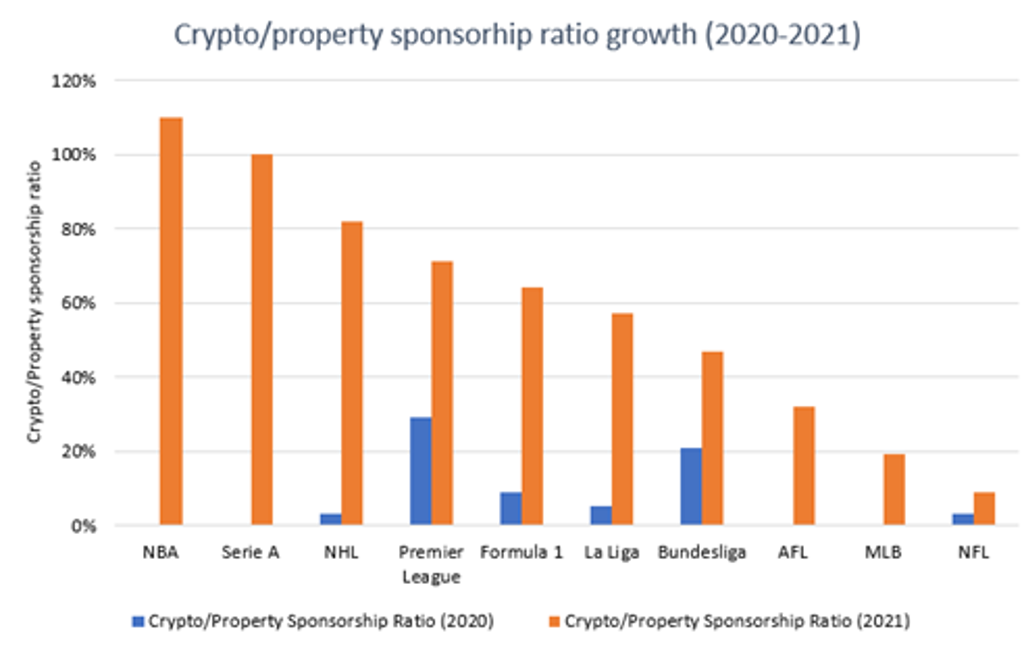

NBA leads while growth spikes across all top-flight leagues

Source: Euromonitor International

Note: Crypto/Property sponsorship ratio is the number of crypto-related sponsors within a league divided by the number of properties researched in it.

The NBA has been a frontrunner when it comes to securing crypto partnerships, with a sponsorship ratio of 110% (essentially the number of deals divided by the number of teams in the league and the league itself). Other leagues are seeing similarly high levels of growth as well: for instance, in the NHL there was only one deal in place in 2020 (the Montreal Canadiens’ partnership with Crypto.com), yet in 2021, the sponsorship ratio in the league grew to 82%, meaning that 27 of the 33 properties in the league had a crypto deal.

As for European football, sponsorship ratios across the region’s top-flight leagues are all close to or above 50% - having grown from 12% to 59% on average regionally. Italian league Serie A has outpaced other leagues by reaching a 100% crypto-property sponsorship ratio – meaning that, on average, each team in the league has a crypto sponsorship in place.

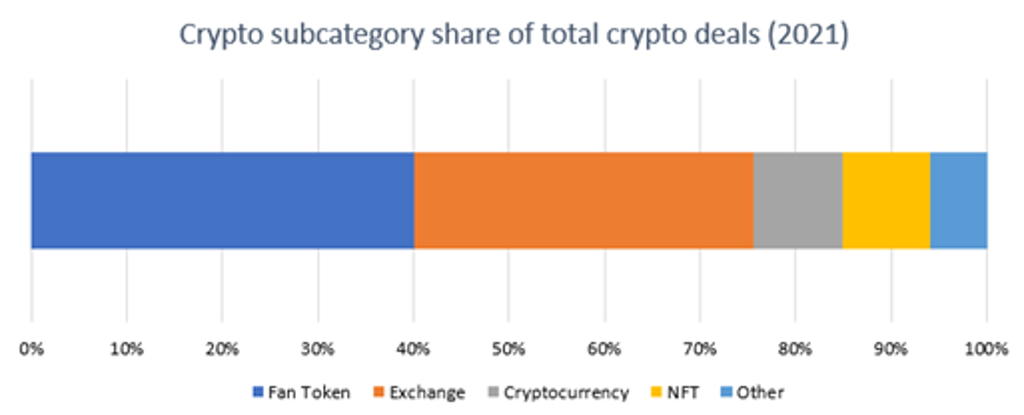

Fan tokens spread rapidly while crypto exchanges battle for prime positioning

Different categories of crypto players have entered the sponsoring space: cryptocurrencies, exchanges, non-fungible tokens (NFTs), and fan tokens, to mention the most relevant.

Fan tokens comprise 38% of all crypto deals researched in 2021. Due to their clear connection to sports, fan tokens are the most popular crypto sponsor category overall across the world’s top sporting leagues. These tokens are cryptocurrencies released by a property and purchased (or earned) by fans, allowing them to unlock unique fan experiences (both physical and digital), earn rewards and merchandise, but also take part in digital polls that will impact the property’s decision-making.

Crypto exchanges are another key battleground for sponsorship – in 2021 there was at least one deal across nine out of the top 10 leagues, with the category comprising 36% of all the researched sponsorships in the cryptocurrency space. The reason behind crypto exchange deals’ popularity is the high spending power they hold that has enabled them to ink some of the highest paying deals seen recently in the industry. For instance, the Crypto.com deal to acquire the naming rights of the Staples Center – home to the Los Angeles Lakers and the Los Angeles Kings – is reported to be worth USD700 million over 20 years.

Although lower in volume, cryptocurrencies and NFT deals are also becoming increasingly popular: the former usually allow fans to purchase tickets and merchandise directly in crypto as well as facilitating other digital services, while the latter allow properties to sell digital memorabilia and branded sports art.

Source: Euromonitor International

Synergies of crypto players and sport properties: What is at stake?

While the sports industry recovers from and adapts to the impact brought about by the pandemic, many properties have turned to crypto sponsorships to increase their revenue streams. However, the benefits are not limited to cash, as blockchain technology can have a deeper impact on sports, especially as it pertains to innovative fan engagement and participation strategies and activations.

Depending on the rights provided by the partnership and how they are activated, crypto players are also benefiting, often leaning on these partnerships to build trust and grow usage beyond the core crypto consumer.

If crypto players and sports properties navigate emerging regulatory hurdles, the stage is set for crypto exchanges, currencies, and tokens to play an increasingly pivotal role within the sports sponsorship ecosystem.

Note: the following leagues and competitions were analysed to produce this article: Australian Football League (AFL), Bundesliga, EuroLeague, Formula 1, Indian Premier League (IPL), La Liga, Ligue 1, Major League Baseball (MLB), Major League Soccer (MLS), National Basketball Association (NBA), National Football League (NFL), National Hockey League (NHL), Premier League, Serie A.

For further insight see our webinar, Discovering Investment Opportunities in Esports.