After Samyang Foods released its Extremely Spicy Chicken Flavour Ramen in 2012, videos of consumers attempting to finish an entire serving of the noodles went viral on social media. The company’s strong performance leveraging on its social media popularity continued up to 2018, and after a successful launch in Southeast Asia in 2016, introduced different versions of its spicy series, including cheese-topped variants.

The spice challenge remains popular, especially when compared to the Honey Butter craze in 2014/2015 which was relatively short-lived.

Spice in Asian cuisine has shaped consumer tastes

The longevity of the spice challenge could be attributed to Asian cuisine that heavily relies on spices. The diversity between countries and even within each market has given rise to region-specific spices particularly in archipelagic countries like Indonesia. Consumer familiarity and ongoing discovery of different types of spices continue to boost the relevance of spice trends unlike an altogether new flavour.

With urbanisation, an expanding middle income group and the rise of tourism, hyperlocal flavours have started to proliferate. This indicates consumers’ increasing knowledge and demand for more exotic and authentic flavours beyond standard mainstream options.

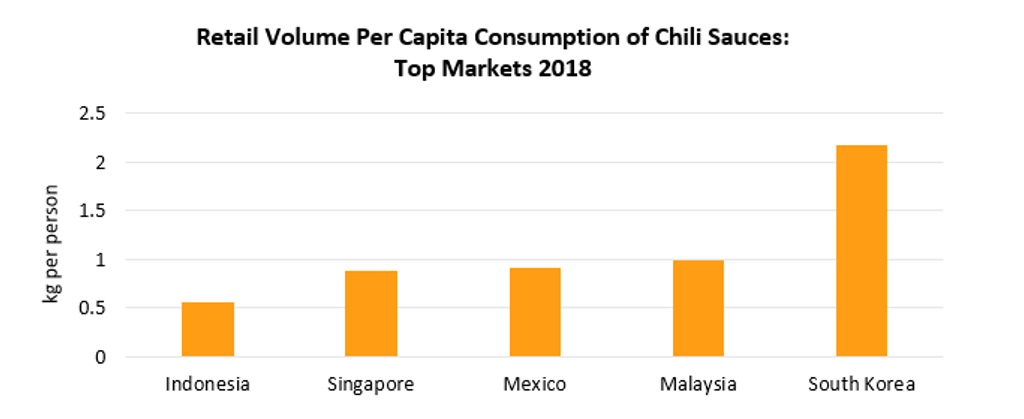

Source: Euromonitor International

Foodservice essential in viral trends

Many companies may aspire to replicate Samyang’s viral success not only within the region but on a global scale. For Indomie, foodservice helped to boost the brand to stardom in Indonesia, seemingly following in Samyang’s footsteps.

Abang Adek, a restaurant in Indonesia, featured Indomie noodles with various spice levels meant to challenge customers. The highest heat level is “pedas mampus” (deathly spicy), containing over 100 ground hot chili peppers. This level has attracted many local foodies and adventurous tourists.

The use of local lingo and heat levels to hype the spice

Like Abang Adek, foodservice and retail brands have incorporated the use of local lingo and heat levels to describe various spice levels. This strategy is not entirely new. Restaurants like Nando’s have already adopted such marketing. However, the rise of social media and using colloquial local language helped to invigorate the interest in spice and engage consumers with brands.

Both multinational companies and artisanal brands have adopted these marketing methods. Nestlé Malaysia introduced Maggi Pedas Giler (insanely spicy) instant noodle cups in March 2018, while a local celebrity launched her own product under the brand Betty’s Kitchen Sambal Gila and Sambal Sewel (derivates of crazy).

What’s next for spice trends?

Both foodservice and social media are critical for such trends as viral peer experiences help to spread the word on an international level. Market players must be quick to take them on, especially those that seek the quickest way to reach many consumers in a short amount of time.

This is especially the case since consumers tend to quickly move on to the next fad. While Abang Adek is still popular and the spice trend is still ongoing, ayam geprek (battered fried chicken with sambal) has already emerged in 2018. Dubbed the Fire Chicken and popularised by Richeese Factory, this spicy chicken continues to make its rounds on social media in 2019.

As for the next spice trend beneficiary, the market is still open to new types of spice-infused innovation that can step up and fan the flames.

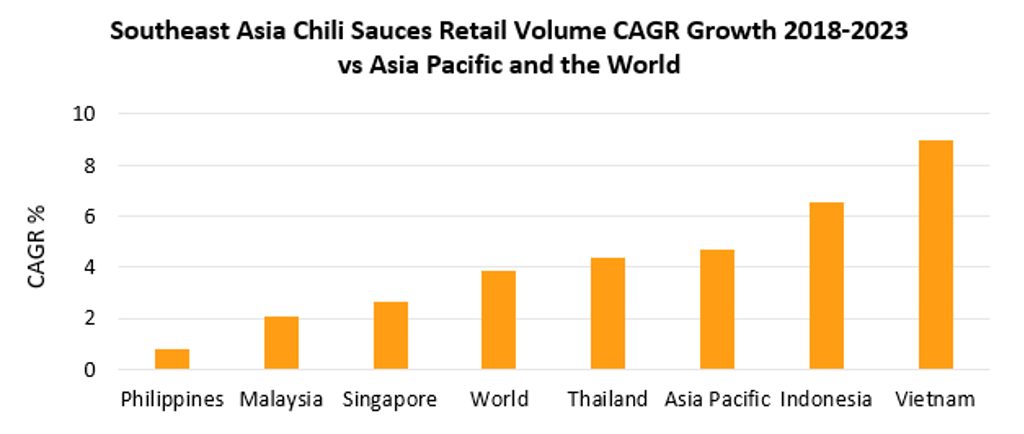

Source: Euromonitor International

Our Innovation in Meals: Focus on Asia Pacific report is available on Passport; or connect with me on LinkedIn.

Related analysis: