The COVID-19 pandemic has severely impacted the operation of foodservice providers in the UK. Outlets located in city centres, especially in central London, were hit particularly hard by the lack of footfall. As hybrid working arrangements are expected to remain in the long-term, London-focused foodservice chains need to rethink their location strategies. In order to thrive moving forward, they must expand their countrywide presence, with a specific focus on suburban areas.

Working from home, leaving the city

In March 2020, the UK Government, and thus, most companies, instructed personnel to work from home. This led to many businesses realising that they could operate without the physical presence of employees, and freed white-collar workers from living in commutable locations. London has long been associated with high living expenses, especially due to inflated rental prices and expensive transportation. Consequently, many decided to move out of London, resulting in a certain level of de-urbanisation in 2020. According to internal migration data from the Office of National Statistics, predominantly urban areas saw the strongest migration outwards in the year ending 30 June 2020. London was the key contributor with more than 100,000 residents migrating outwards.

In 2021, central London-based companies, including Google and HSBC, are turning to a hybrid working model. Often this comprises of working from the office 2-3 days a week, working from home and even working-from-anywhere opportunities. These new working arrangements are unlikely to generate pre-pandemic footfall for businesses in central locations. Therefore, foodservice companies that used to target office workers primarily in the city must reconsider their location strategies.

Shift to the suburbs can reimagine operations

Opening outlets in suburban or rural areas after having a city-centric approach is likely to force a rethink of various aspects of business operations. For instance, in the limited-service segment, the positioning of suburban locations is more consumer-experience focused than solely on the functionality of purchasing ready meals or drinks. The usually larger eat-in space enables operators to trial new designs and practices. It also allows for experimenting with new items on the menu. Businesses need to adapt their menus more to eat-in purchases at suburban locations, which hold many cross-selling opportunities. For example, eat-in customers at a coffee shop are likely to purchase a cake or snack to accompany their coffees.

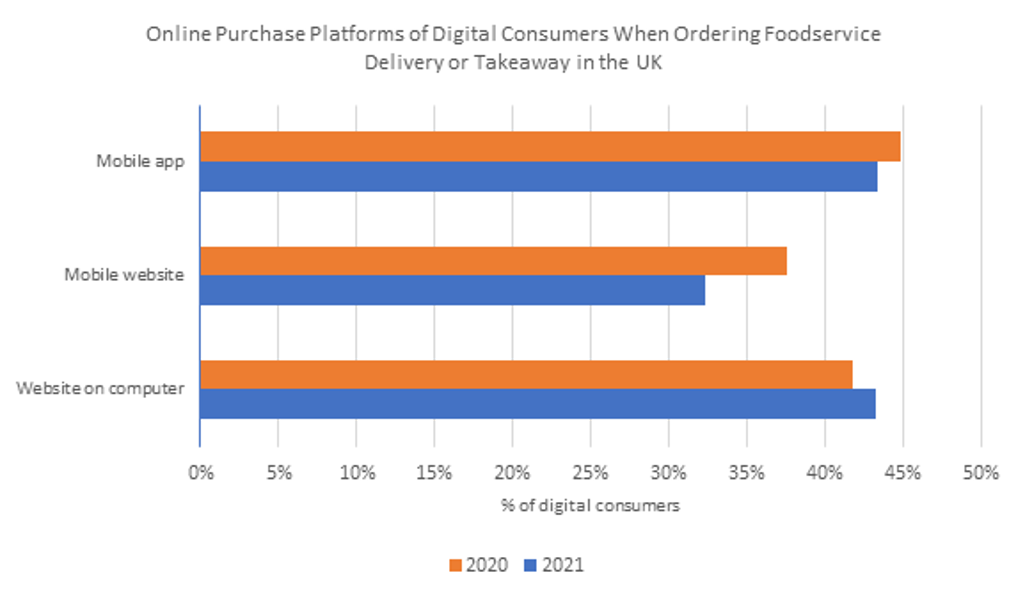

Using multiple technologies can further enhance the consumer journey and reduce operating costs. Moreover, the application of tech solutions, like app-based ordering, not only appeals to consumers, but helps businesses provide more personalised offers.

Source: Euromonitor International Voice of the Consumer: Digital Survey, fielded in March 2020

(n=643) and March 2021 (n=666).

In addition, suburban or rural locations offer opportunities to expand sales channels. Drive-through has been a big winner during the pandemic, and is expected to retain its popularity. In 2020, foodservice sales through the drive-through channel grew by 26% in the UK. The recent investment of well-known chains such as Five Guys and Leon in building drive-through lanes is set to further accelerate this growth over the forecast period.

Opportunities and challenges for foodservice in the suburbs

An example of a foodservice player with a strong city-centric approach in the UK is Pret a Manger. The chained coffee and sandwich shop’s revenue reportedly relied heavily on London-based sales pre-pandemic. However, the health crisis and changing lifestyles made Pret a Manger rethink its location strategy. The company has announced a shift in focus to suburbs, motorways and transportation hubs by opening around 200 new outlets in the next two years.

The suburbs and regional locations hold multiple opportunities for foodservice. Firstly, property rents are favourable compared to city centres, which makes it possible for chains to increase their consumer reach by operating a higher number of outlets in the suburbs. This way, offering takeaway or delivering to neighbourhood residents can also become more efficient. Additionally, targeting professionals working from home with special offers, such as lunch or dinner deals, can boost long-term sales as remote working is becoming a permanent part of many employees’ lives. However, chains moving to the suburbs can expect to face competition from independent providers. The pandemic increased the emphasis around the importance of supporting local communities. Therefore, residents’ loyalty to local, usually family-owned businesses may be an obstacle.

Conclusion

The shift in the location of foodservice outlets represents a long-lasting trend in the UK. Even though city locations will see brighter days again, the footfall in central London is unlikely to recover to pre-pandemic levels. Therefore, the London-only centric approach is not viable going forward. Foodservice in the UK needs to plan for a future where suburban and regional sales contribute to an increasing share of revenue.