The pandemic has significantly changed consumer behaviour in Asia’s home kitchens, encouraging new routines and eating habits in the home derived mainly from reduced mobility and heightened hygiene awareness.

While forecast economic recovery through 2022 is divergent across Asian markets, growth in consumer expenditure on food products and household durables in the region is expected to be more positive than global performance over the period to 2025. This will amplify consumer interest and pockets of opportunities for multiple stakeholders in the kitchen, including food, beverage, appliance and home care companies, to drive innovation that speaks to consumers’ new habits.

Considering pre-existing cultural nuances in Asia, Euromonitor International has identified key consumer behavioural changes and growth strategies in the kitchen, from preparation to cooking and cleaning. Making sense of these trends and the evolution of home cooking is essential for companies to be tomorrow’s leaders in innovation and market penetration.

Convenience leads innovation, but experience still matters

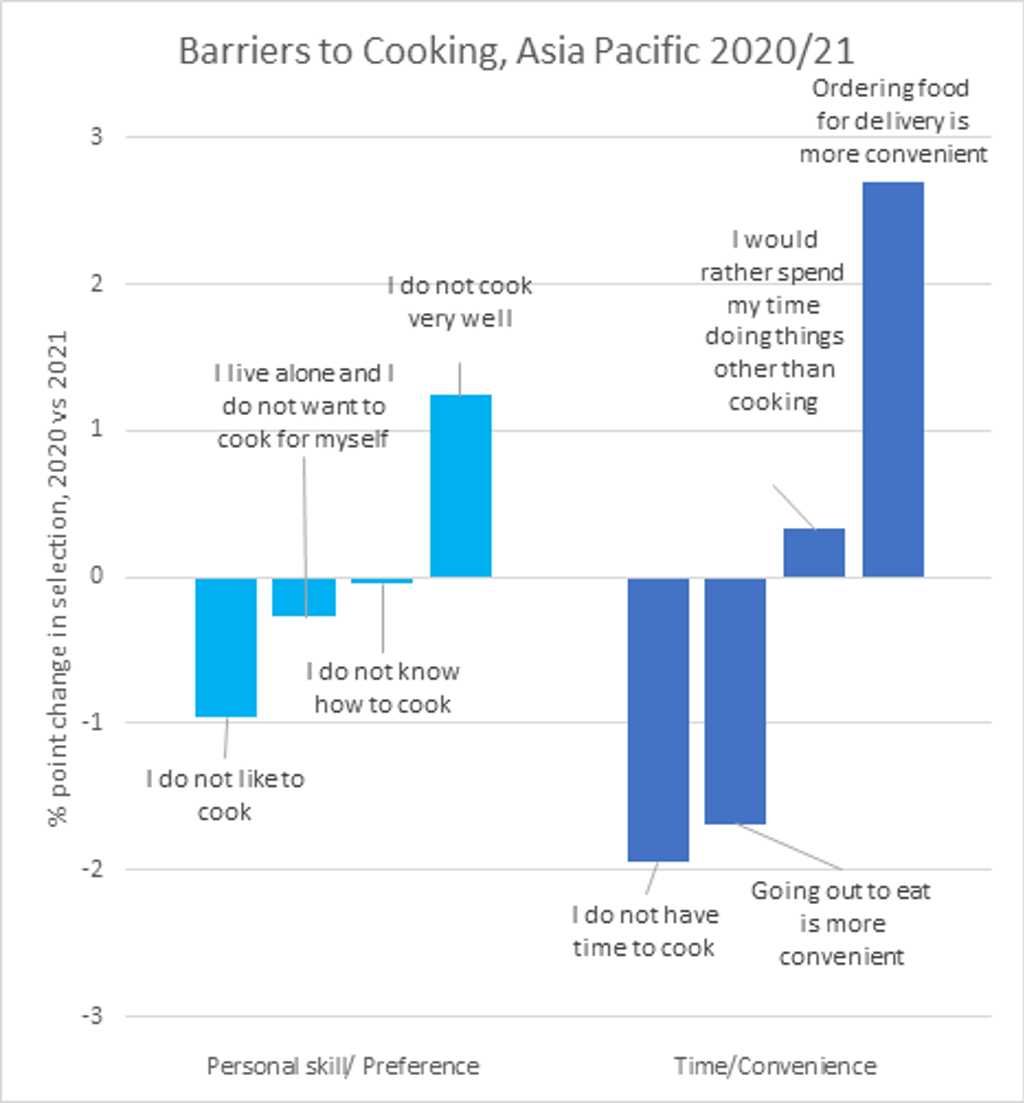

Convenience has long been a key driver and has been further elevated by the pandemic’s impact on purchasing decisions in the kitchen. Creative pre-portioned or single-use meal solutions that balance freshness and convenience, as well as effort-saving kitchen appliances that simplify or automate the process of preparation, cooking, and cleaning - regardless of skills - are expected to benefit. Freeing consumers from fatigue is key to encouraging home cooking against prepared food delivery.

However, the shift in eating occasions has also led to a desire to consume more sophisticated foods at home, and with it the experience of food preparation and cooking. With mobility regulations still fluctuating in Asia, consumers may switch more fluidly between convenience and enjoyment; thus, companies must consider both needs through their products.

Source: Euromonitor International Voice of the Consumer: Lifestyle Survey; Fielded Feb-Mar; n=14,365

Versatility needed to win and suit local needs

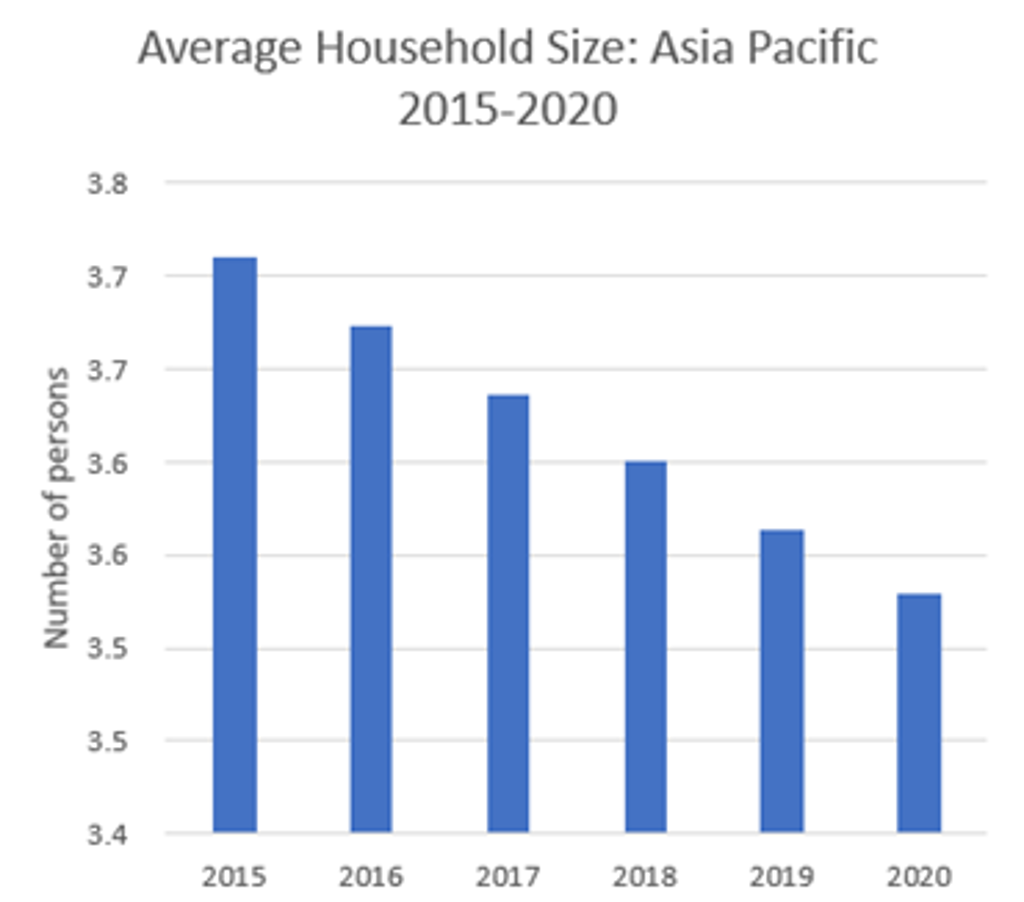

Multifunctionality is important when competing for countertop space in the kitchen and share of wallet, given the rising incidence of apartment-living and a growing number of single-person households in Asia. Consumers are gravitating towards multifunctional appliances that are cost-effective to help them recreate different meals at home. This is leading to the rise of category-blurring appliances such as microwaves that combine light frying features.

The challenge for industry players is, however, to marry multifunctionality and local consumer needs. Companies must explore local needs and habits to address unique pain points and identify innovation opportunities given the diversity of Asian cuisine. Transferring strategies from other regions will not necessarily succeed.

Consumers’ digital familiarity spurs cross-industry partnerships

The rise of super-apps, food delivery and the widening of food options in Asia means that consumers are increasingly familiar and comfortable with digital solutions and integrating automation in their daily routines. A lack of cooking experience, especially amongst the younger cohort, along with the acceptance of technology as a time-saver, drives innovation in the appliances space. It is an opportune time for traditional kitchen and technology brands to innovate together and form a symbiotic relationship for the benefit of consumers. For instance, packaged food that is compatible with newer kitchen appliances, or scan-to-cook ovens that partner with food companies.

Asia embraces both affordable and premium kitchen offerings

Affordability remains a crucial need for price-sensitive Asian consumers hit by the pandemic and struggling with a lack of income stability, and plays a significant role in guiding the adoption of new cooking and cleaning routines in kitchens. This is especially relevant in emerging Asia, where consumers may be less familiar with products such as dishwashers. Price competitiveness converts rising consumer interest in sophisticated appliances to actual purchases, helping to drive greater efficiency and quality in home-cooked food.

Meanwhile, premium products will attract consumers seeking to make their lives easier in the kitchen with spending saved by the absence of travel and out-of-home activities. A portfolio of diverse price ranges will cater to consumers with different means and willingness to pay.

For further insights into the latest consumer trends and case studies in preparation, cooking, and cleaning stages of eating at home, see the report, The Evolution of Home Cooking in Asia Pacific.