Euromonitor International's global network of analysts have identified six Coronavirus (COVID-19) themes that are transforming consumer markets. This includes The New Normal: What’s Here to Stay? How consumers work, shop, eat, drink and play will be driven by lingering home seclusion and “risk dread”. Changes to the consumer mindset and a recessionary era will see reduced consumption of non-essential items and anti-ostentation, a focus on self and family and on preventative and immune health.

In a digital event on 9 September 2020, we looked at which trends are likely to stay beyond the pandemic and how companies are adapting. Here are the responses to a sample of questions that were asked.

1, As health and wellness is a high priority now, do you see home fitness as a trend to stay? If so, will we see new and emerging brands with new forms of exercise hit the market?

We do see home fitness as a trend with longevity. While people are returning to gyms and other fitness facilities as they have opened up, many people remain cautious and these facilities are operating based on reduced numbers, so not everyone is able to attend in person. This is driving the home fitness trend in the short term.

Looking ahead, the lack of a vaccine and continued social distancing means this situation is unlikely to change anytime soon. Most importantly, consumers have adjusted to home fitness and it is sticking. The flexibility and ease of home fitness mean consumers can fit exercise around their daily lives. We expect the future of fitness to be a more blended approach with a mix of on-site and at home.

This will likely lead to more players entering the home/digital exercise markets. Advanced technology, even before COVID-19, enabled us to take part in online classes and even virtual races and events. Digital presence via at-home workout services has expanded enormously:

• Lululemon (where sales of athleisurewear have doubled since March) has acquired Mirror, which provides wall-mounted, internet-enabled screens for USD1,495 and USD39/month as a membership fee. Mirror offers classes from boxing to meditation.

• Peloton: The CEO refers to 200 million daily gym-goers in the world, half of which they aim to capture “one day”. It currently has 3.1 million members in total for its live and on-demand classes (which includes those who only pay for its digital subscription, accessing programs through a phone/tablet for USD12.99/month) of which 1.1 million are connected fitness subscribers, up by 113% compared to the previous year (and who pay USD39/month to connect workout classes to their Peloton equipment).

• Apple Fitness Plus was launched in September 2020 as a subscription service for virtual fitness classes. Whilst originally built for the Apple Watch, it also integrates with iPhones, iPads and Apple TV costing USD9.99/month or USD79.99/year. No expensive equipment is needed for its classes (including cycling, treadmill, core, strength, rowing, yoga) and users can view statistics on screen.

The acceleration of the fitness trend is increasingly interrelated with other front-of-mind themes such as emotional health, evidenced in increasing numbers of classes for meditation and the connecting of physical and mental fitness. The digital surge will remain for as long as COVID-19 restrictions continue and more people work from home. Whilst gyms and virtual fitness will co-exist post-lockdown, the demand for a truly live and sweaty environment for classes will ultimately bring more fitness buffs back into the gym for their endorphin fix.

2. You touched on how “all players must consider themselves wellness players”. Could you expand on this with any of the trends we're seeing?

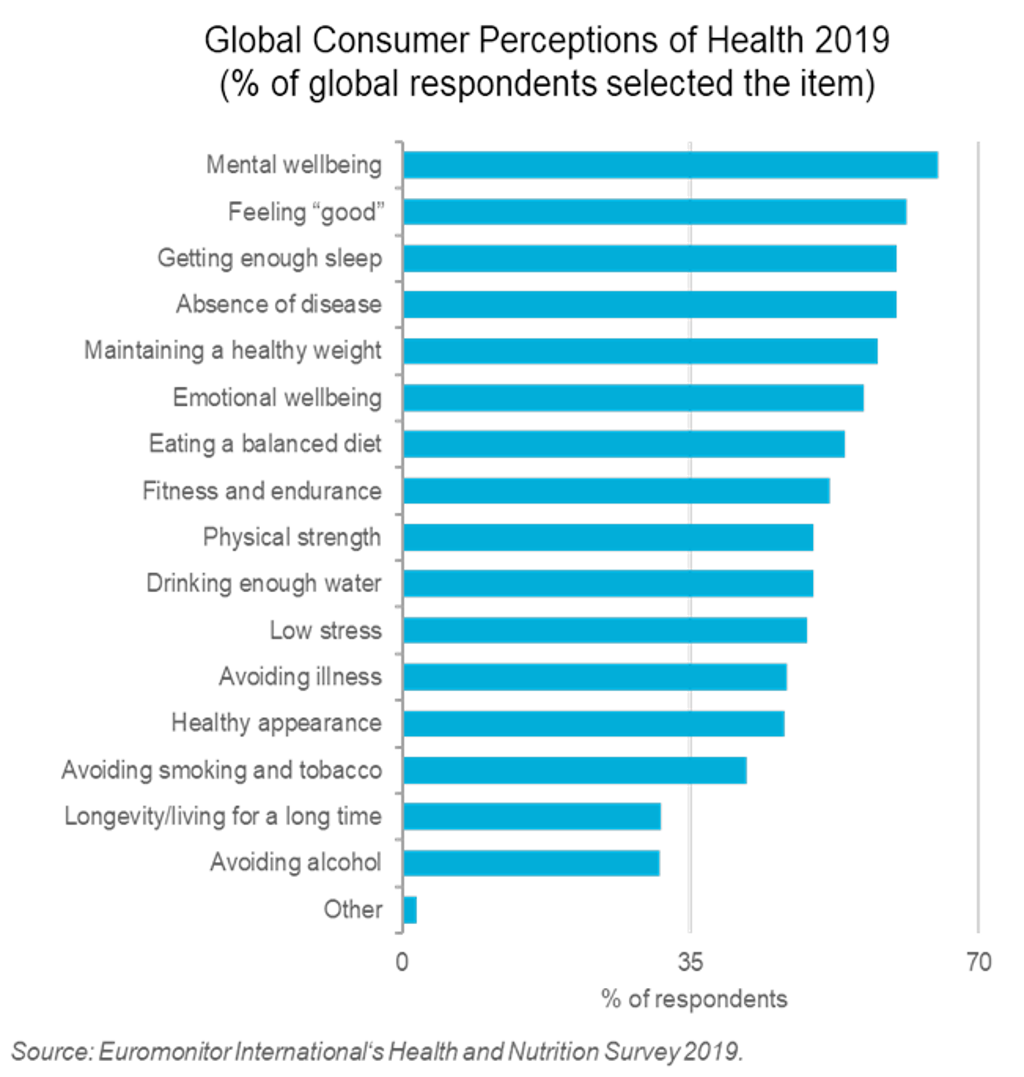

COVID-19 has heightened consumers’ quest for health and wellbeing. More consumers will undertake basic preventative measures, adopt healthy lifestyles and seek products and services that support mental wellbeing. The home will become their wellness hub, while the demand for digital health and remote healthcare is expected to rise, beyond the pandemic.

With health dominating everyone’s thinking, every business, including those not in the health industry, will need to respond by promoting public health and focusing on hygiene and safety for their customers and employees alike. Health could thus become a permanent component of product development in the future.

Wellness post-lockdown will be driven by immunity health and sanitation:

Immunity health will see continued growth in sales of vitamins and dietary supplements that boost immune health (vitamin D, vitamin C, zinc, multivitamins, etc). The concept of food as medicine will grow, with a focus on natural health, alongside mood food supporting mental wellbeing, coupled with a focus on the gut biome and its link to mental wellbeing (alongside a possible backlash against over-sanitation owing to its impact on the gut biome). Beverages that profess to support immunity (“immunity shots”, with ingredients such as CBD, turmeric, etc) will grow.

Transparency of ingredients and sourcing will be paramount with a trend towards natural ingredients pronounced also in beauty products, alongside destressing and anti-anxiety benefits.

Sanitary health: disinfectants to continue to grow as “risk dread” lingers, with a short term impact on re-usable packaging and “pre-loved” apparel.

3. A large part of the impact mentioned is for the Western/developed world. How do you see the contrast with the new normal for emerging markets?

Every country/region had its own specific restrictions/laws (eg bans on alcohol and tobacco, mandatory face coverings, the strictness of lockdown) which determines consumer trends post-lockdown, but where some of the developed markets lead in some of the more nascent trends, emerging markets tend to follow – within the framework of traditional culture. Areas such as digital acceleration will be tempered in some countries/regions by lack of access to digital equipment and unreliable power supply, whilst many others already have a natural food/beverages culture which may see a resurgence in the wellness crusade.

One of the areas where we expect to see an increase in demand in emerging markets as a result of the pandemic is for digital financial services. In many developing countries, cash is still the most utilised and often only method of payment, as many street vendors and independent stores supply goods for local consumers.

These merchants often enact low digital payment acceptance rates due to high usage fees, not wanting to familiarise themselves with a new process and a general lack of trust in digital payment services. The pandemic has positively influenced online financial service players in many ways, driven by the fear of contracting the virus and World Health Organization recommendations to avoid cash.

4. Regarding the economic outlook, is there any view on how this impacts the trends you predict or see, and do you expect any new trends to be born from this?

The impact of COVID-19 on the global consumer trends we identified for 2020, and indeed our longer-term megatrends, has mostly been an acceleration of trends, with some, however, stalling. You can find more detail on these in Euromonitor’s webinars Coronavirus: Implications on Megatrends and How is COVID-19 affecting the Top 10 Global Consumer Trends for 2020.

As we near the end of 2020 and look to 2021, the worsening economic situation will start to have a greater effect on consumer behaviour as well as continued impact from health and safety concerns relating to the virus. One of the biggest reactions will be heightened consumer frugality and caution when it comes to spending. This is not a new trend but one that comes to the fore again. Business must consider consumers’ need for finding the best deals – it’s not about the lowest price, but the best value for money and optimising resources.

5. Would you please comment on available data on savings, and if consumers are saving more already? How do you see savings rates progressing?

During the COVID-19 pandemic, savings have been impacted in two ways. We have seen precautionary savings rise due to uncertainty about income in light of pandemic-related lockdowns. Additionally, business closures and confinement at home meant people were not able to spend in the way they wanted – giving a rise to involuntary savings.

According to the U.S. Bureau of Economic Analysis, the personal savings rate reached 33.7% of disposable income in the US in April 2020. Since the uncertainty has decreased and lockdown restrictions are lifting, the personal savings rate started declining and stood at 17.8% of disposable income in July 2020. However, it remains significantly above the range of 6-8% observed in the five years leading up to the pandemic.

As individuals learn to live with the pandemic and uncertainty about job prospects diminishes, the personal savings rate is unlikely to reach April 2020 highs. However, it may linger higher than historic trends in case uncertainty about the future path of the pandemic intensifies, for example, if vaccine development is delayed or there are significant additional global waves of the pandemic. The savings rate, similar to the situation in labour markets, will likely take several years to come back to normal levels.

6. How do you foresee the premiumisation trend; will it continue or will consumers also be more focused on the price for premium products?

In 2020, the global economy is expected to experience the worst recession since the Great Depression. As we have seen in previous recessions, such as following the Global Financial Crisis of 2008-2009, uncertainty, employment losses and a cutting back of business and government spending will hinder income growth for many consumers.

One of the trends that emerged from the last global recession was the retreat of the middle class, who saw years of stagnant income growth and a drop in living standards. As a result, they focused their attention away from conspicuous consumption and sought out value for money, and experience-led consumption instead.

Following the pandemic, the focus will also be on value-for-money – so premiumisation will exist, but it will be driven by what the consumer feels the most need for: ie added health/ sanitary benefits, affordable mood-enhancing treats/items, etc. The “revenge spending” and pent up demand in some markets (eg China) post-lockdown will be short-lived.

The main thing to remember is that priorities have changed for all consumers: the focus is not on acquiring more but on living better, for example, with products to support the mind/body or fewer, better-quality items. Quite apart from restrictions on affordability in recessionary times, the lockdown has also engendered a sense of immobility amongst consumers: the sense that we are weighed down by our possessions – so a sense of wanting to shed and not re-bed-down.

7. Do you think that city centres will ever recover from the pandemic and do you envisage a return to the 5-day week in the office any time soon?

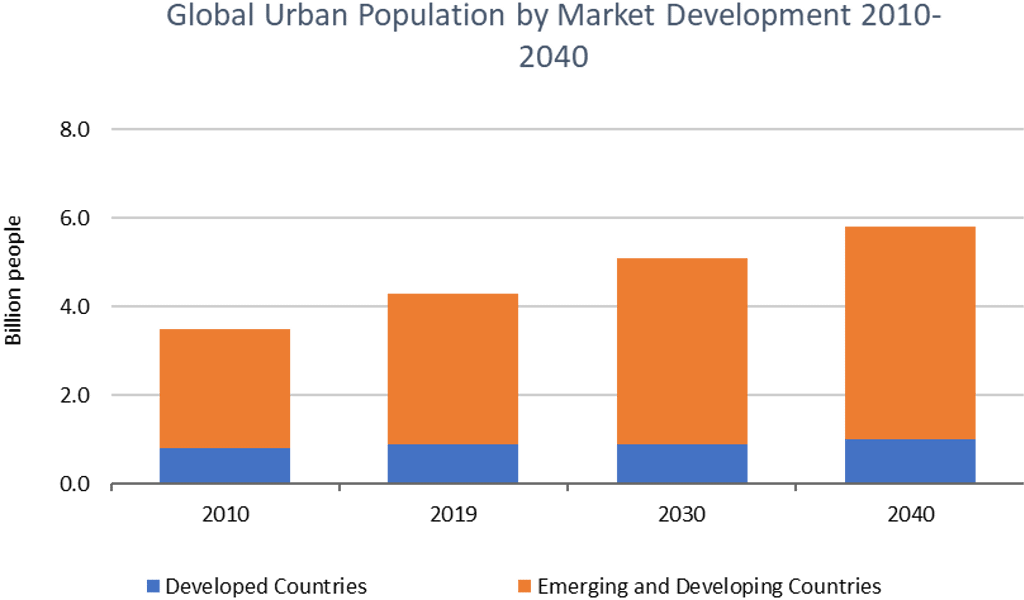

There has been much talk about the pandemic potentially marking the end of city-living as lockdowns around the world pushed consumers to live, work, shop and entertain all within their homes. Working from home policies were already present prior to the COVID-19 outbreak but the pandemic has pushed the concept into the mainstream, aided by technology such as video conferencing. We expect the future of work to be driven by an increase in remote working beyond the pandemic, with more companies adopting flexible working policies but this is likely to be blended with continued office working at times, in order to encourage collaboration and creativity.

We also expect to see higher interest in moving to suburbs or more rural areas, in line with the newly discovered need for space that many consumers are craving following months of lockdown and remote working. The high cost of living and travel in urban areas is another reason that consumers will be seeking more affordable options, driven by the recession in 2020 and economic uncertainty in 2021. In 2019, Londoners spent 32% of their expenditure basket on housing compared with 23% in the remaining non-major urban areas of the country.

This does not signal the end of city living as once a vaccine has been developed, the attractiveness of cities will once again resume. They continue to be the centres of economic output, with higher standards of living and better accessibility and connectivity. The pandemic is likely to affect how cities evolve with a greater focus on health and hygiene, while disinfection of public spaces and contactless/touchless technology become the norm. The share of the urban population is set to increase from 56% of the global total in 2019 to 64% by 2040.

Source: Euromonitor International from national statistics

8. Isn't the growth of plastic packaging a short-term effect because of the sustainability aspect? Will paper be more attractive in the long term again?

The pandemic has resulted in a greater reliance on packaged retail products, driven by health and safety concerns (packaging acts a protective layer), while home seclusion has left many consumers opting for bigger pack sizes as they shop less frequently. Sustainability initiatives were paused during the pandemic but there continues to be a widespread commitment to remain on the sustainability path.

Plastic will stay the best online-fit pack type for a number of products (eg beverages), not only for sanitary reasons, so the focus now is on the recyclability of that plastic and encouraging recovery rates. Innovation is driving sustainable plastic packaging variants (ie without closures) and smaller pack sizes, for example, for dairy products (in some instances an excuse for brand owners to reduce content weight but retain the same unit price).

In terms of paper as an alternative to plastic, there are more paper pack launches (eg Nestlé’s Yes Bar in packaged food and Coca-Cola’s upcoming paper-based multipack for beverage cans in Europe to replace a difficult-to-recycle plastic multipack). Sustainability of this raw resource is also in the frame: FSC certification is growing, although the surge in online sales has seen an increase in e-commerce outer packaging (paper, plastic, etc) which doesn’t quite get the same press attention – but will be in the spotlight more in the future.

Contributing Authors:

Alison Angus, Head of Lifestyles

Media Eghbal, Head of Content Strategy, Economies and Consumers

Zora Milenkovic, Head of Drinks & Tobacco Research

Giedrius Stalenis, Economist