M-Pesa, the first globally known mobile money product, was launched in 2007 by Safaricom, a subsidiary of the Vodafone group. The service initially aimed at facilitating remittance transactions and targeted underserved lower- and middle-income households in Kenya. As mobile money spread globally during the pandemic, the concept has become a catalyst for innovation and a pillar in achieving sustainable economic development across emerging markets. In sub-Saharan Africa, the trend translated into over 600 million mobile money registered accounts and transactions valued at over USD600 billion in 2022.

A winning tool to reach the unbanked population

Historically, the socioeconomic development of sub-Saharan African countries has been hindered by the relatively low level of financial inclusion. According to the World Bank, 45% of sub-Saharan Africans aged 15 and above were unbanked in 2021.

The relatively low penetration in the banking system often leads to limited infrastructures like ATMs and point-of-sale (POS) machines, with burdensome application processes and expensive service fees, making them even more out of reach for many consumers. For instance, in countries like Ethiopia, which had 30 banks and 8,944 branches in June 2022, the service ratio was 1:11,500 people.

Banking services have also struggled to adapt to the region’s socioeconomic fabric built around informal economies where cash transactions dominate. Despite an 85% banked population in South Africa, cash still represented over 65% of individuals’ payments in 2022. In parallel, relatively low levels of financial literacy, delayed settlements and fraud concerns are amongst other factors affecting the momentum of banks across the region.

A gear to cashless transactions and resilience

As demand rises and operators continue to innovate, mobile money services have evolved from peer-to-peer (P2P) transactions – translating into cash in and out transactions to allow purchases of goods and services. The growth in Lipa na M-Pesa illustrates the trend. Launched in 2013 in Kenya, it reached over 400,000 merchants by May 2022.

Improved internet penetration and the influx of affordable smartphones have also allowed more of the unbanked population to rely on mobile money transactions online, effectively contributing to a 29% increase in e-commerce value growth in 2022 across sub-Saharan Africa. Emerging businesses like Bongalo in Cameroon are also betting on the service to gain an edge against global short-term rental companies like Airbnb, while Sendwave is relying on mobile money to effectively compete with global remittance services like Western Union.

More than facilitating payments, mobile money is creating new paths to understanding consumption patterns. Therefore, B2B and B2C businesses have leveraged transaction insights to improve customers’ experiences, develop targeted promotional and marketing campaigns, and consolidate brands’ loyalties.

Source: Flickr, Safaricom Kenya

Such services have also been efficient in cushioning socioeconomic shocks like civil unrest, monetary policy crises or disruptions affecting other payments. One prominent example is Nigeria, where the central bank announced plans to introduce new 200, 500 and 1,000 naira notes in October 2022. At the time, the banking sector held less than 20% of cash in circulation. Ahead of the initial 31 January 2023 deadline to swap old notes, the country experienced widespread cash shortages due to the limited availability of new notes. In response to the challenge, more individuals and businesses adopted mobile money services, leading to the country’s spike in monthly mobile wallet transactions volume, increasing by 231% in January 2023 compared to January 2022 and translating into over USD5 billion in monthly transaction values.

A catalyst to fintech innovation and a diversified revenue stream

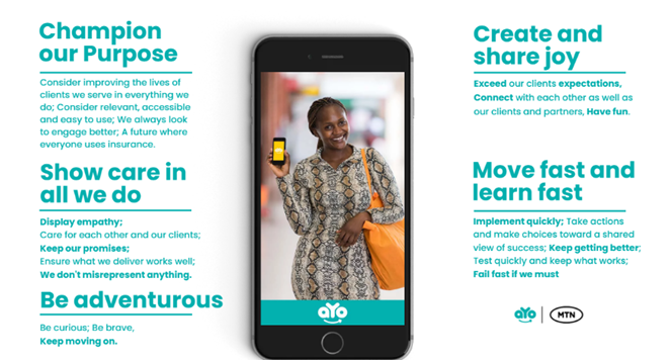

As central banks reduce barriers to entry in the financial sector, mobile money is also becoming a catalyst for innovation, giving room for diversified income streams across emerging services like micro-loans and insurtech. This opening gave ground to Orange Bank Africa to launch nano-credits in Côte d’Ivoire, with the company planning to reach 10 million consumers with such loans across Senegal, Mali and Burkina Faso by 2025. Along the same lines, MTN joined forces with Sanlam in 2022 to improve access to Ayo Insurance, an affordable micro-insurance targeting informal employees and self-employed users across Ghana, Uganda and Zambia through its mobile money services. The strategic partnership aimed at reaching 30 million users by 2025.

Source: Ayo

But despite the evolution of mobile money over the past decades, the service has yet to reach its full potential in a region inhabited by over one billion individuals, over half of whom will be under 25 years old by 2050. Forward-thinking companies across manufacturing, services and payments should consider integrating mobile money into existing strategies. The shift will allow them to adequately cater to the region’s growing populations and diversified needs, build resilience during economic shocks and, more importantly, expand their reach to a broader customer base.

To read more on this topic, take a look at our full report, World Market for Consumer Finance.