A version of this article originally appeared in Food and Beverage Insider’s digital magazine.

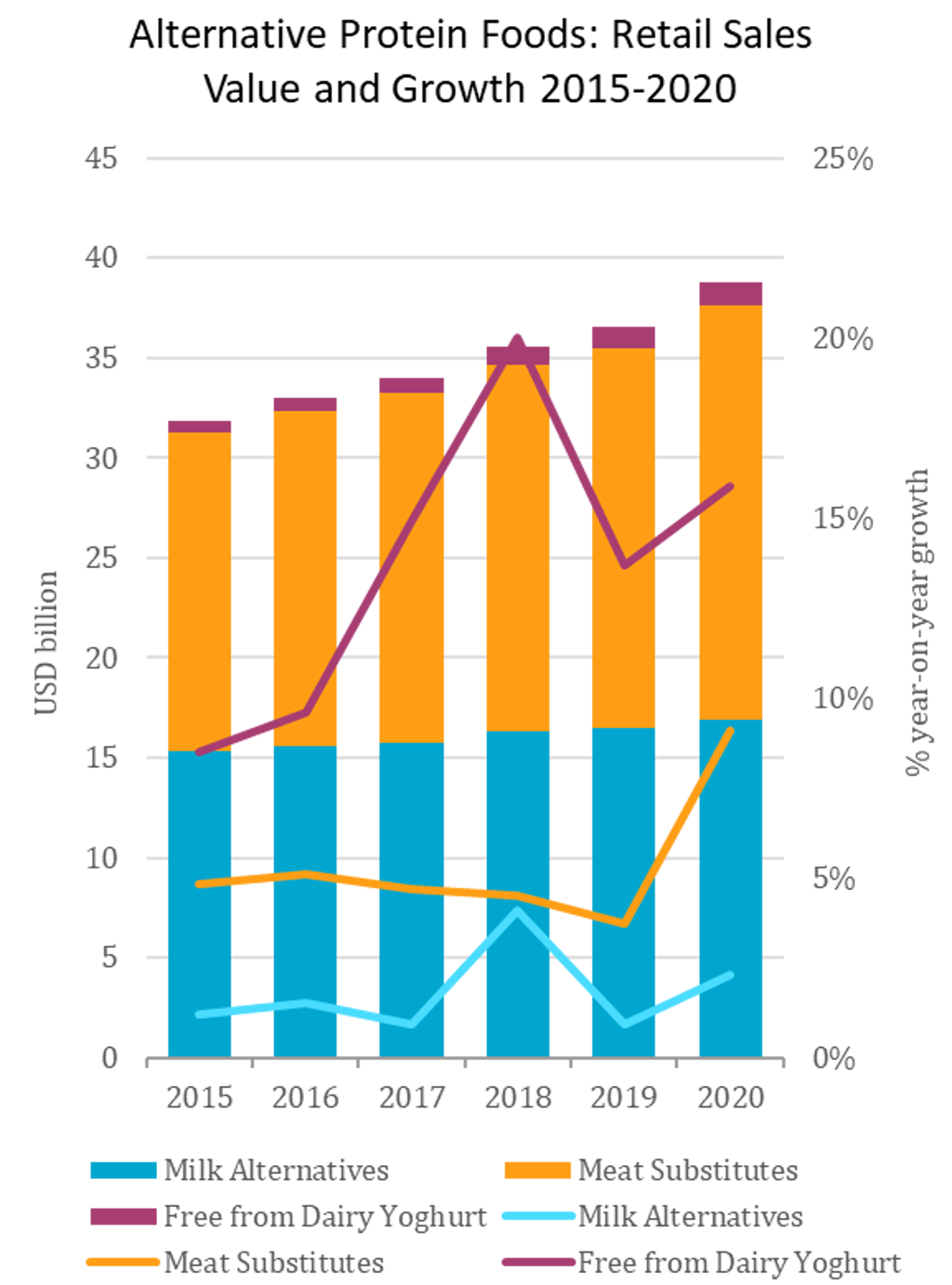

Sales of plant-based alternatives were growing strongly worldwide pre-pandemic. Meat substitutes, milk alternatives and free-from dairy yoghurt generated sales of US$36 billion in 2019, and sales growth accelerated sharply last year.

Several factors particularly benefited plant-based alternatives, including:

• The overall positive impact of the pandemic on food retail.

• Consumers’ increased focus on health from food.

• Consumer desire for novelty in eating and cooking choices

• Longer shelf-life goods being favoured.

• Plant-based meat avoiding meat’s associations with the virus transferring to humans.

Source: Euromonitor International

Sales of alternative protein foods are forecast to continue growing strongly. In 2021, the reopening of economies and easing restrictions on foodservice mean the substantial shift to home-based eating occasions will reverse to some extent. Nevertheless, reflecting the strength of the plant-based movement, total retail sales growth across the key categories will remain positive.

Retail sales of meat substitutes are forecast to remain ahead of milk alternatives and to grow more quickly, at a year-on-year average of 4% from 2022 to 2025 (versus 3% for milk alternatives). Free-from dairy yoghurt is forecast to grow more quickly, by a year-on-year average of 8%, but from a much lower base.

Despite this, there remains a mountain to climb if the industry hopes to achieve the goal of replacing animal agriculture. Globally, meat substitutes currently account for just under one-fifth of total volume sales of processed meat. That figure falls to just 2% if overall volume sales of meat are considered (including fresh meat), and it is important to note that the meat substitutes data also includes tofu and derivatives. On the dairy side, the picture is even starker, with 6% of total volume sales of drinking milk products coming from alternatives, and just 1% of yoghurt retail sales.

However, across a host of key motivations and behaviours relating to plant-based consumption, younger adults emerge as the most likely to hold such beliefs, to act on them, and to believe that their actions will make a difference This should greatly support success in the future. As such, the seemingly insurmountable challenge posed by the establishment of animal-based food production may well diminish over time.

For more insights, access the report “Choosing Substitutes: The Rising Tide of Non-animal Proteins”.