The apparel and footwear industry was among the worst hit by the COVID-19 pandemic, but just as recovery was taking place faster than expected, the industry is now facing more turbulences around the fast-moving uncertainty in Ukraine, galloping inflation rates, which mean rising production costs, further supply chain woes, not to mention weakened consumer spending.

In this challenging context, fashion players are accelerating their transformation to adapt to the new post-pandemic world, and this article looks at what these changes are likely to mean for the industry in the longer term.

Home-centric lifestyles and digital living will redefine engagement strategies from D2C to D2A

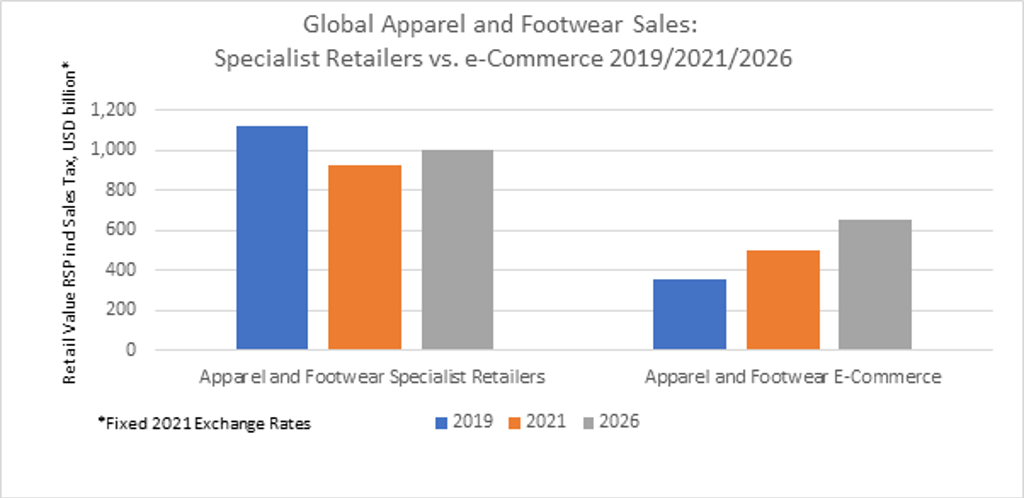

The pandemic has forced many people to work from home and reorganise their lifestyles accordingly, which has spurred a surge in e-commerce, with online sales accounting for 30% of global apparel and footwear sales in 2021, versus 19% in 2019, and will continue to grow in the future.

As learning, working, eating, shopping and socialising move further into the home and online, fashion players will need to go above and beyond to create new bonds with customers in both the digital and physical space. This, and the string of bankruptcies prompted by the COVID-19 crisis, is forcing a major reshuffle of retail spaces, and accelerating industry players’ focus on direct-to-consumer (D2C) strategies, as well as the reinvention of stores.

For example, the largest player in sportswear and fashion, Nike, has been enhancing its websites for a better shopping experience, e.g., livestreaming features in the Nike Training Club app. Meanwhile, to drive traffic into stores, Nike offers its limited-edition drops, and the most sought-after products are available via its own websites or through its concept stores.

Virtual garments and fashion NFTs have recently enjoyed a surge in interest, from luxury to high-street brands. They will continue to proliferate because fashion players are banking on such digital new products suited to gaming and social media to gain a new – lockdown-proof – revenue stream. Moreover, virtual fashion bypasses traditional supply chains and helps boost fashion brands’ sustainability credentials.

Hence, Nike recently pushed hard into Web 3.0 with the launch of its own virtual Nikeland world within the online game Roblox, where players can buy Nike products for their avatars. Nike has also acquired digital sneaker-maker RTFKT to create “metaverse-ready sneakers and collectibles”, with the aim of bringing the scarcity culture of streetwear and limited-edition drops to the digital world.

With many signs pointing to the possible mass-adoption of virtual avatars, the next fashion revolution is set to be about D2A or Direct-to-Avatar, i.e., a fashion economy made of collections and accessories for digital doubles and in-game avatars that do not physically exist.

Consumers’ greater focus on health, wellness and sustainability will shape new product strategies

With new working arrangements here to stay, allowing consumers in various professions more flexible lifestyles, dress codes are further casualising. Meanwhile, interest in health and wellness remains high because many consumers have become more aware of the importance of physical and mental wellbeing and how the two are inter-related.

Moreover, after being locked down for parts of the years 2020 and 2021 in various parts of the world, consumers have felt a growing desire to escape and get up close to nature. Access to parks, nature and wildlife has become paramount to many; all the more since faraway travel is still not as easy to plan as before the pandemic, and/or consumers have learnt to enjoy more local destinations.

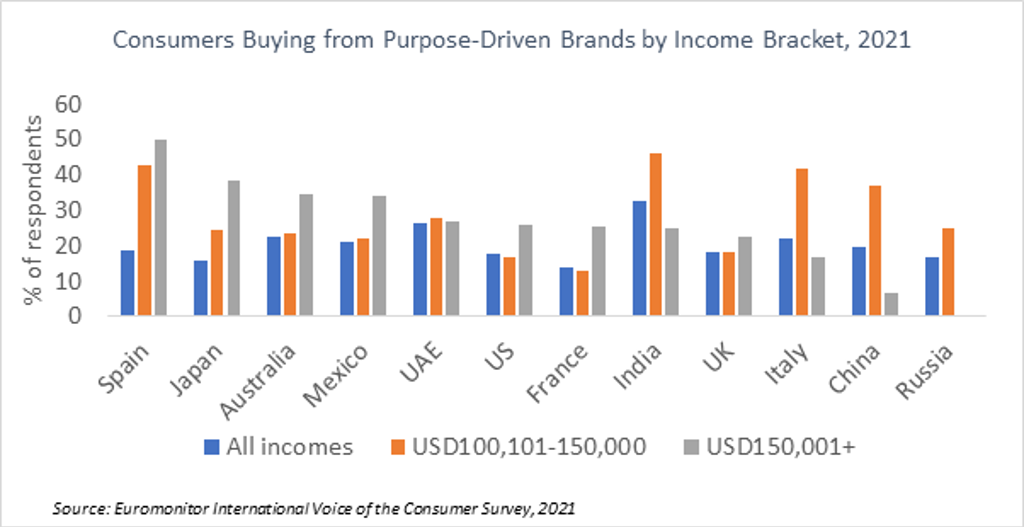

Consumers’ wellness and outdoor aspirations are not only set to benefit smart comfort coupled with technical capabilities, but also brands that are purpose-driven. Those in higher-income groups in particular recognise the importance of brands bringing value beyond profits.

In this context, more fashion companies will be looking at more sustainable ways to conduct their business, from stringent audits of their supply chains, to ethical product designs, and embracing the resale trend. This is becoming all the more imperative, since regulations about greenwashing and waste management might be about to change in the EU, while the UK and the Biden administration have taken a new approach to ESG requirements.

Supply chain reboot: fashion players will seek manufacturing sources closer to their end markets

The pandemic brought a shock to the fashion industry’s complex and opaque production supply chains, that were particularly exposed following record excess inventories and scandals about the plight of textile workers in Asia. This prompted the industry to vow to change its social and environmental practices.

Nowadays, the conflict in Ukraine is further disrupting the global economy and worsening already galloping inflation rates, while the increasing costs of shipping and raw materials, as well as the lack of warehousing, are driving up costs and forcing fashion companies to review their pricing and production strategies.

In this challenging context, fashion players will seek manufacturing sources closer to their end markets. Some players, such as Uniqlo, are exploring micro manufacturing, or are experimenting with on-demand production, like the Amazon Made For You B2C service. Such solutions are still niche at the moment, but might scale up in the future, especially if new carbon taxes and waste regulations come into play and bring down the relative costs of producing locally, such as the proposed new regulations included under the EU Strategy for Sustainable Textiles, for example.

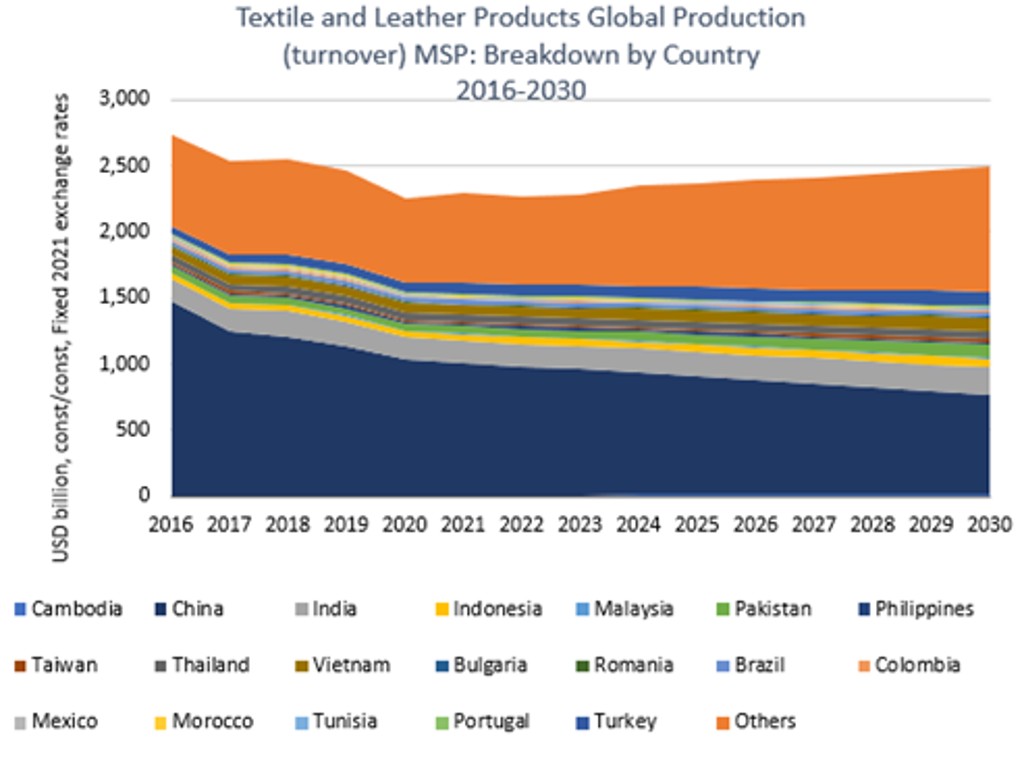

In the immediate future, nearshoring will continue to gain traction to limit complexity and dependence. For example, Benetton has decided to move its production centres away from low-cost manufacturing hubs in Asia, in favour of hubs closer to home. The Italian fashion house has already moved 10% of its output from Bangladesh, Vietnam, China and India to Serbia, Croatia, Turkey, Tunisia and Egypt, and aims to halve production in Asia from late 2022. Meanwhile, German fast-fashion player C&A inaugurated its Factory for Innovation in Textiles in Germany in 2021, with the aim of developing more sustainable products and increasing local production to 400,000 pairs of jeans per year in 2022, and 800,000 pairs in the future.

Last but not least, the fashion industry’s industrial fashion landscape will be further changed in the future, as many international brands seek to reduce their reliance on China for production, following the cotton scandal in the Xinjiang region, which exacerbated the Guochao trend and highlighted how geopolitical risks can suddenly change trade policies. China, which currently accounts for 47% of the world’s production of textile and leather products, is expected to see this share decline to 33% by 2030.

For more information, please read our briefing ‘Apparel and Footwear beyond the Pandemic’