Two years into the pandemic, and businesses entering 2022 are having to face ongoing uncertainties and risks. Although the global economy saw a strong rebound in 2021, supported by the advancement of vaccination campaigns and stimulus spending, the pandemic’s effects still linger and are having a long-lasting impact on economies, consumers and global supply chains. Euromonitor International has identified the three challenges in its latest report that are likely to impact businesses the most in 2022: Omicron, supply chain bottlenecks and inflation.

Omicron

The latest COVID-19 variant has led to a surge in infection rates around the world, adding pressures on the labour market and global supply chains, posing a downside risk to near-term growth. The weak economic start to the year due to Omicron can affect 2022’s overall growth outlook. Euromonitor International’s 2022 real GDP growth forecasts for the world and most key economies in Q1 2022 represent a downgrade from forecasts made in Q4 2021.

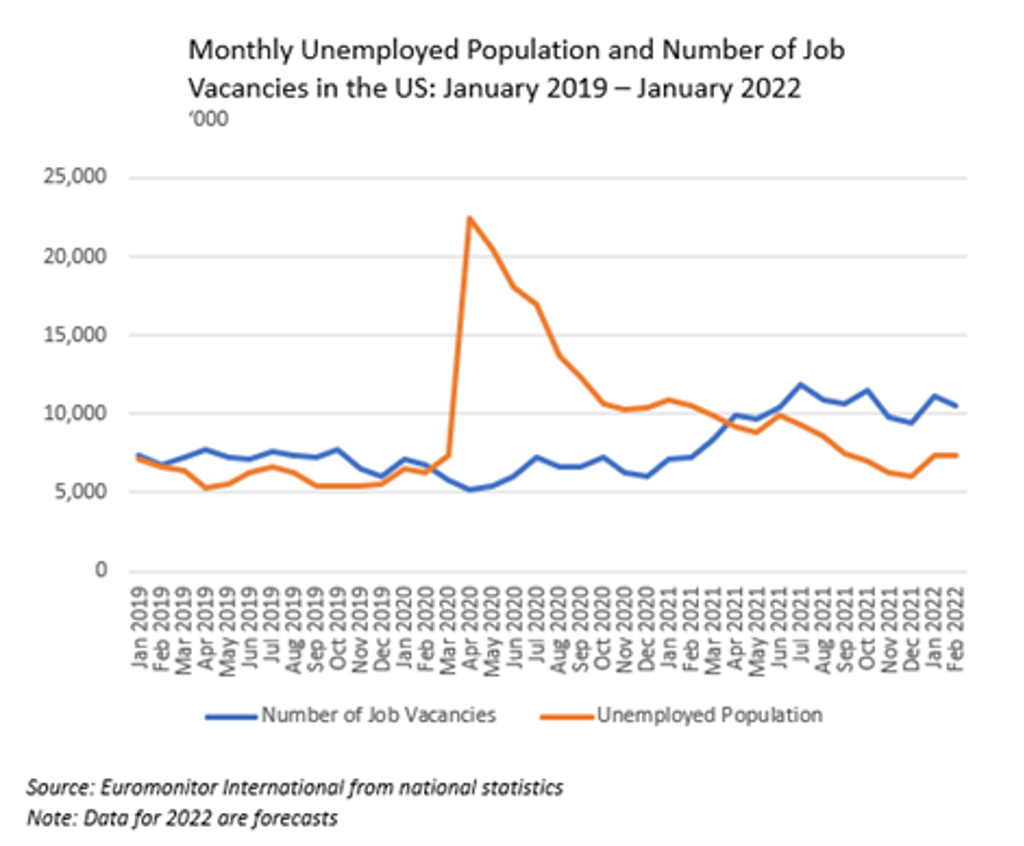

One of the main concerns with Omicron is that it has caused staff shortages in many countries, as employees become infected and need to self-isolate. In the US, for example, Omicron is exacerbating the problem of worker shortages, while businesses in the country have already struggled to fill a record number of vacancies.

In order to address Omicron’s threats to workers and supply shortages, some e-commerce retailers such as India’s Flipkart, have geared up vaccination rates for staff and enhanced warehouse capacity. Overall, as Omicron leads to a delay in normalisation of the labour market and supply chains, it also adds risks to inflation. If consumers do not shift part of their spending to services, the rise in prices of global goods could be more persistent than previously expected.

Supply chain

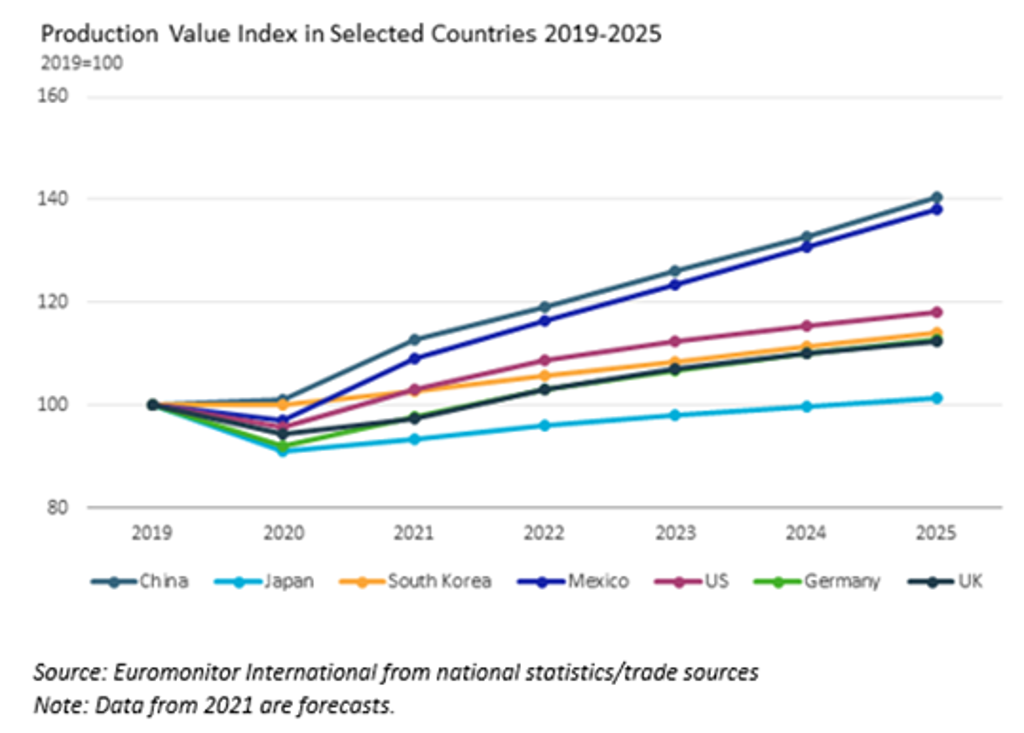

The global manufacturing sector is predicted to recover in 2022 and exceed pre-pandemic production output levels. Industrial production data forecasts indicate that output should increase in the second half of the year. This suggests that suppliers will have greater capacity to increase production volumes. Moreover, recovering investments and trade value also indicate that global supply chains are set to recover in 2022.

However, many risk factors beyond the control of companies will remain and pose a threat to supply chains in 2022. Transportation bottlenecks and rising shipping prices will be two of the main issues for businesses. Lack of shipping capacity, rising energy costs and truck driver shortage in the largest economies will also remain relevant and inflate transportation prices in 2022. However, transportation problems are predicted to ease in 2023 when a higher number of shipping vessels will be constructed, and shipping capacity will improve.

China’s zero-COVID-19 policy is another risk factor that could impact global supply chains in 2022. The lockdown measures in China largely affect companies purchasing hi-tech goods, textiles and household goods from Chinese suppliers, as the country accounts for 30% of global exports in these industries. Restrictions on economic activities and border closures could also impact manufacturers in neighbouring Asian countries, such as Vietnam or Thailand. However, the risks are anticipated to be short-lived as COVID-19 infection cases are forecast to begin declining in the second half of 2022.

Lastly, companies are expected to feel an increased shortage of workers and competition for input materials. The faster spread of the Omicron variant and consequently higher numbers of employees on healthcare leave will further add to the labour market problems in the first half of 2022. These shortages would primarily hit agriculture and food processing industries, as these sectors remain relatively labour-intensive, and not all processes can be automated.

Moreover, companies are attempting to better prepare for potential supply disruptions and move to “just-in-case” delivery models, meaning extra inventory of critical components in warehouses. Although such a strategy works for individual companies, on a global scale, this could intensify competition for input materials and lead to further price increases. Global inventory levels contracted by 60% in 2020 and suppliers are already struggling to satisfy the existing pent-up demand. Excess stockpiling would place further pressure on suppliers in 2022.

Inflation

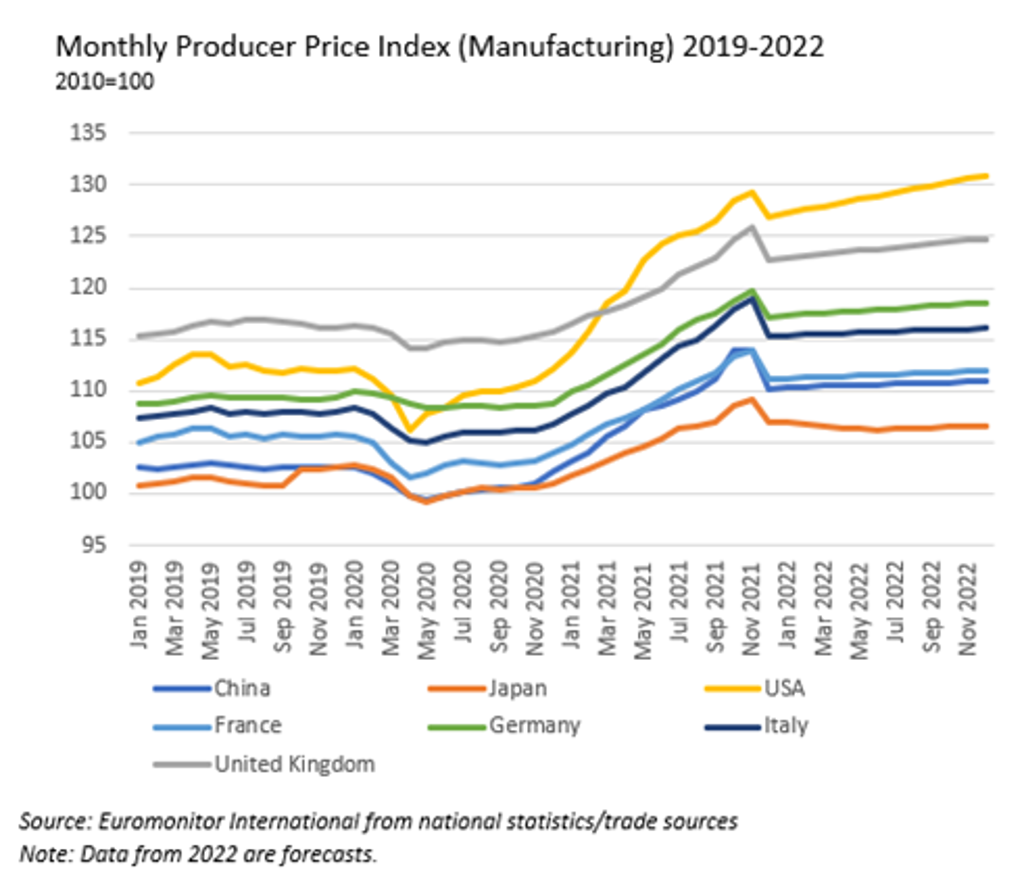

Global inflation is predicted to rise from 4.3% in 2021 to 4.6% in 2022. Inflationary pressures will remain high in most key economies, as some supply-demand mismatches and labour shortages could last throughout 2022. Rising geopolitical uncertainties in Europe (particularly surrounding the Russia-Ukraine conflict) and elsewhere are a main downside risk, placing further pressure on energy prices. Heightened inflationary pressures could trigger central banks in some economies to tighten their monetary policies in 2022, while consumer behaviour could change due to rising costs. Business will continue to be confronted by the twofold impact of inflation. On the one hand, rising energy, material and freight prices are weighing on companies’ production costs and profit margins. On the other hand, consumer income and thus spending, can be eroded by higher inflation, impacting sales.

To address inflation, companies are adjusting their business strategies in order to regain growth momentum and maintain profit margins. Some large consumer goods companies have used their pricing power to pass costs on to the customer, while others have adopted targeted pricing strategies by revising product portfolios (such as enhancing private label offerings). Some producers, including Daikin, a Japanese manufacturer of air conditioners, are also considering alternative raw materials as the price of copper soars.

Amid an inflationary and slower growth environment, it becomes vital for businesses to understand consumers’ changing spending power and shifts in behaviour in order to build effective pricing strategies. With uncertainty on the rise, analysing supply chains to identify potential weak spots, and innovating and building resilience across the supply chains can help companies to prepare for potential disruptions and reduce costs.

For further analysis, please read Euromonitor International’s full report “Top Business Risks in 2022: Omicron, Supply Chain and Inflation”.