Toasting the Digital Era of Alcoholic Drinks

E-commerce and the rise of digital channels have suddenly become headline stories for alcoholic drinks. Necessity has driven some consumers online for the first time during the pandemic, and others have gained new familiarity with the range of options available. Changing legislation has also opened up new possibilities in markets such as the US. Far more than a short-lived spike in interest, this instead represents an overdue paradigm shift for the industry.

The level of activity in this area underlines the transformative nature of the changes

taking place. In the last month alone (at time of writing), Pernod Ricard agreed to acquire UK-based Whisky Exchange, an online-focused specialist wine and spirits retailer, and DoorDash announced its expansion into alcohol delivery across much of the US, plus Canada and Australia. The latter follows other high profile developments in on-demand delivery, notably Uber’s US acquisition of Drizly at the start of the year.

Direct-to-consumer sales: Access to data tops a list of benefits

The expansion of direct-to-consumer (DTC) capabilities has been a core feature of recent e-commerce growth across the industry, with the largest international players through to micro producers seeking involvement in a long-term channel shift.

The benefits of DTC sales to companies are clear – greater control over the consumer experience, potentially higher margins and access to considerable amounts of data on purchasing behaviour. The larger volumes of data available will prove invaluable in informing strategy, and also for personalised recommendations – a feature that is increasingly expected in consumer goods in general.

For luxury products there is an elevated expectation of service. Direct-to-consumer platforms offer these brands the chance to curate the entire consumer purchase process, and it is often ultra high-end options that command the loyalty required to prompt a visit to a dedicated brand website. Rémy Cointreau, for example, launched a US e-boutique for its Louis XIII cognac in 2021, following earlier launches in the UK and China, with exclusive features and links to physical events.

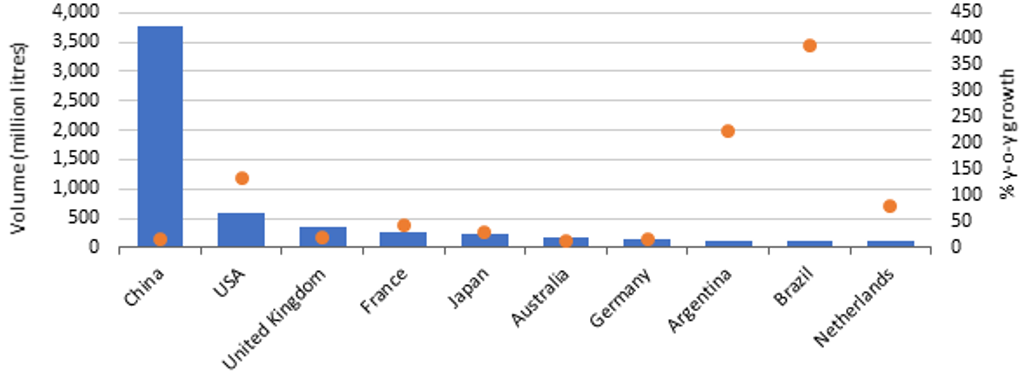

Alcoholic Drinks: E-Commerce in Leading Countries 2020

Two sides to the story: Digital native brands vs the need for adaptation

Digital native brands sell and speak to consumers online first and foremost, often bypassing traditional retail channels. Instagram has been at the heart of AB InBev-owned Babe canned wine brand from the start, playing a key role not just in creating connections, but in gaining consumer insights and guiding future direction. Influencer marketing through brand ambassadors is at the core of promotion efforts.

In contrast to brands structured around their digital focus, others have had to rapidly adapt during the pandemic, as consumers began spending more time online. Interactions that would previously have taken place in the on-trade, such as tours, tasting sessions and mixology demonstrations, were initially moved to online platforms as a necessity. However, both physical and virtual approaches are now viewed as integral to many producers’ offerings; the choice between going out or staying home is part of the growing consumer demand for flexibility.

In early 2020 Jägermeister launched its international Save the Night campaign, supporting bartenders, musicians and artists. The brand is intrinsically associated with nightlife and high-energy occasions that were severely affected by the pandemic. One initiative, the Meister Drop-Ins, allowed consumers to book entertainment for their own virtual parties during lockdowns, helping to replace lost income for those involved. Jägermeister intends to maintain Save the Night long-term, noting the ongoing challenges still facing the sector.

Conclusion

One of the essential requirements of an omnichannel approach is consistency of message and service quality throughout the consumer journey – from social media interaction and browsing to purchase and product delivery. Digital engagement can greatly enhance relationships with consumers; however, it also presents the risk of significant reputational damage if not approached in the right way.

The rise in digital native brands will continue to accelerate, while existing brands seek to shift the balance in that direction. New business models, personalisation, partnerships and innovative social media campaigns offer opportunities to connect with consumers in the new environment. The digital age of alcoholic drinks has finally arrived, and after years of cautious discussion and tentative steps, the need to commit is clear.