Companies and consumers are continuing to struggle with inflation around the world due to both cost push and demand pull drivers. Packaged food products in particular are seeing price rises across the board and companies are struggling to maintain stable prices due to rising ingredient costs, increasing demand and a variety of other issues. Ready-to-eat (RTE) cereals is a category that has been particularly impacted by inflationary pressures and many leading companies have had to make public announcements about their need to raise prices to address the inflation situation. With so much uncertainty from internal and external factors, monitoring inflation has never been more important. Using Via, Euromonitor International’s e-commerce tracking tool, median prices for product categories and leading players can be easily tracked and compared to understand:

- How online median prices in RTE cereals are faring compared to leading inflationary indicators such as the consumer price index (CPI)

- How online median prices for leading companies in RTE cereals are changing, both from a stock keeping unit (SKU) and a standardised unit perspective.

- In the wake of the pandemic in 2020 with consumers spending greater time at home, RTE cereals witnessed a strong increase in sales due to a shift in purchasing and consumption habits. Even as consumers increasingly return to work and eat on the go, cereal is an important staple breakfast item, and this makes RTE cereals an excellent gauge for monitoring how inflation is impacting purchasing decisions.

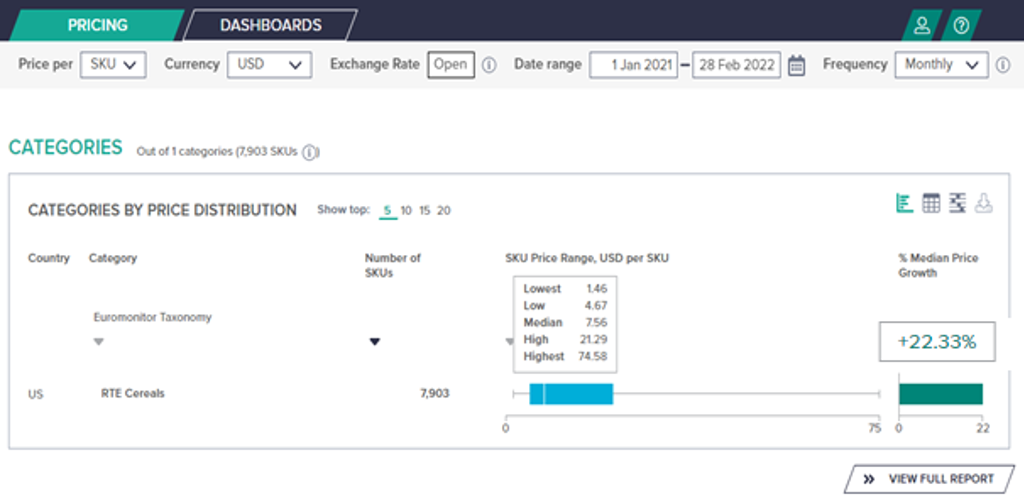

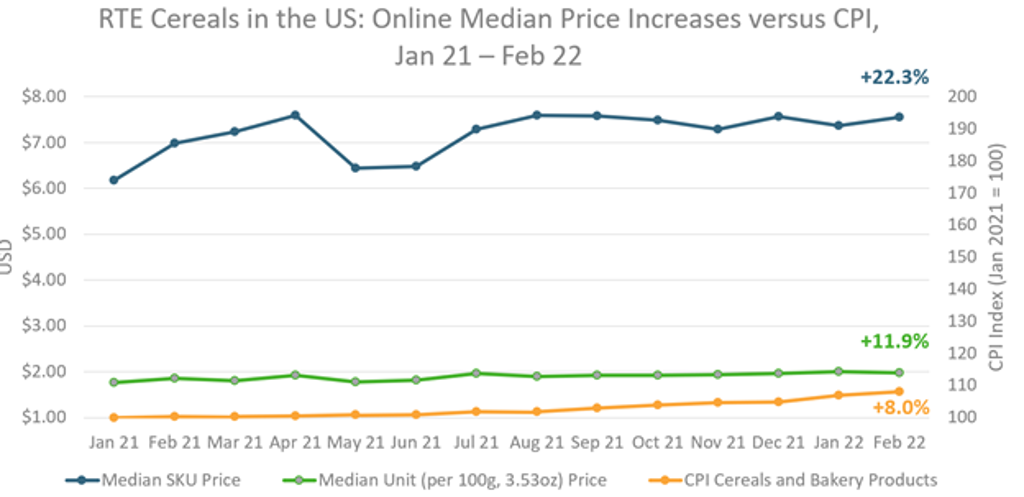

- In the US, the largest RTE cereals market in the world, we can see above that of 7,903 stock keeping units (SKUs) tracked across leading online e-commerce websites, the median price was USD7.56 in February 2022. This median price has risen by over 22% in the 14 months since 1 January 2021, as companies have struggled to maintain consistent prices due to inflationary pressures.

- However, monitoring how online prices at the SKU level are rising might not always be the best indicator of inflation as this measures the price of the entire product being offered by a retailer, regardless of pack size or the number of packs. As consumers have increased their purchase of products such as RTE cereals online due to the convenience aspect and long shelf life, many SKUs are simply larger or are being offered in multi-pack options, which command a higher SKU price.

- Tracking at the per unit level allows for more comparable figures of how prices are increasing and impacting consumers. In the above chart, we can see that although SKU prices have increased at a strong rate, the median unit price (at a per 100g or 3.53 oz level) has also strongly increased, up by 11.9% in the 14-month time period.

- Compared to the CPI for cereals and bakery products from the US Bureau of Labor Statistics, the online per unit price growth of RTE cereals is nearly four percentage points higher. This indicates that consumers are seeing a stronger rise in online prices of cereal compared to the larger basket of goods being tracked in the Bureau’s coverage of cereals and bakery products.

Source: Euromonitor International, Passport

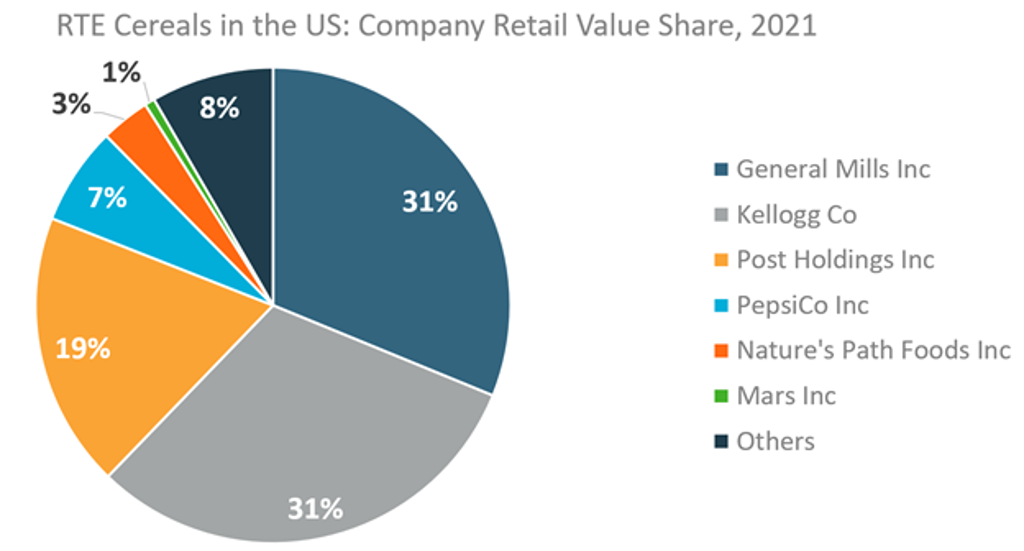

With Via’s coverage of leading companies and brands within RTE cereals, we can also see how the leading companies are faring against the price increases for a category as a whole. Based on sales data from Euromonitor International’s Passport system in 2021, the category is heavily concentrated, with the three leading players - General Mills, Kellogg and Post Holdings - accounting for over 80% of retail value sales.

Source: Euromonitor International, Via

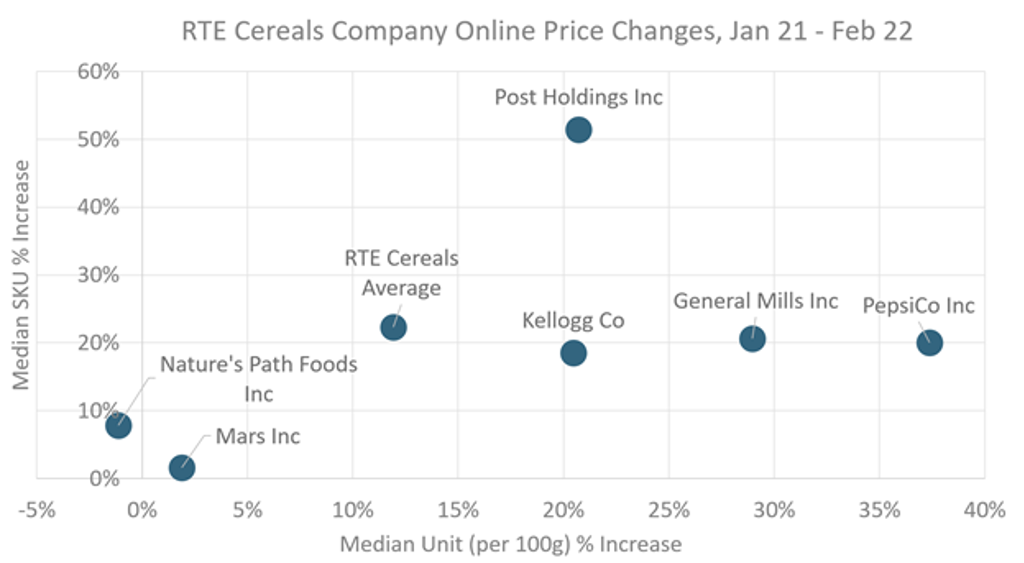

- By showing median price changes on a per SKU and per 100g basis, we can see how the leading players compare to price changes for RTE cereals overall for this online sample. As indicated by the SKU price increase on the y/vertical axis, we can see that only Post Holdings had a higher increase in average SKU price.

- This increase can be misleading based on size and multi-pack options being offered online. Looking at the x/horizontal axis, it is evident that the four largest players are all significantly higher than the average price increase of 11.9% with PepsiCo cereals seeing the largest per 100g (or per 3.53 oz) increase in online retail prices.

- As manufacturers struggle with how to deal with inflation and the impact it has on their business, monitoring price increases at per unit level needs to be closely monitored alongside total price increases at an SKU level to see how companies’ portfolios compare to peers and overall averages.

Source: Euromonitor International, Via

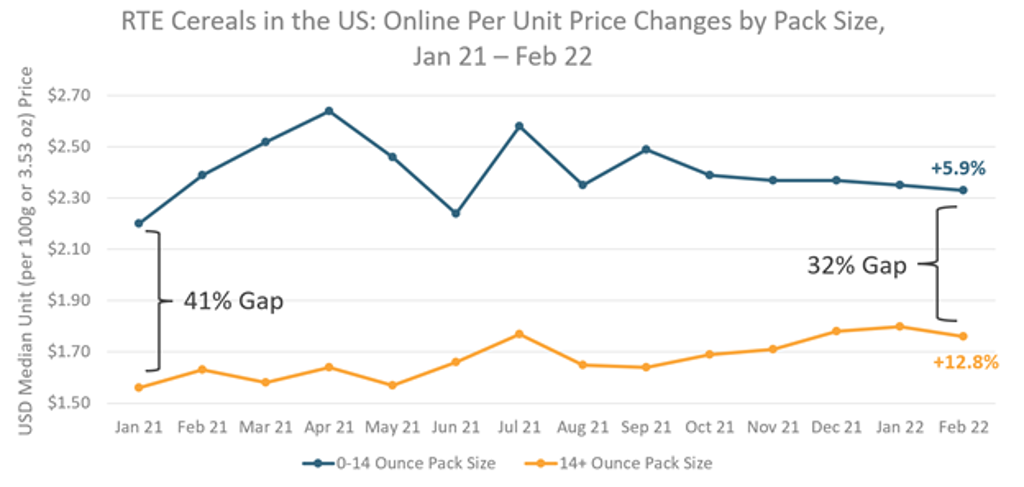

- Monitoring price changes by different pack size offerings can also provide valuable insights into inflationary trends. In the case of the sample for RTE cereals, we can see in the chart above that more “normal” sized boxes of cereals (under 14 oz) saw a per unit increase of 5.9% over the observed period. However, the larger or traditionally known “family boxes” (over 14 oz) saw a per unit increase of nearly 13%. This has led to a significant reduction in the per unit differences between the smaller, more individual box of cereal and the family-sized units as indicated by the change from a 41% gap in January 2021 to 32% in February 2022.

- Companies must closely observe how prices are rising across a variety of perspectives as consumers are carefully watching prices and looking for additional ways to stretch their budgets. Within RTE cereals, suppliers can often keep SKU prices largely the same but pass on price hikes by slightly reducing pack size volume in a practice known as “shrinkflation”. However, this can run the risk of alienating consumers, so companies must carefully consider the benefits and risks of this practice versus raising prices on consistent pack sizes.

As consumers and companies struggle to adjust to new cost push and demand pull drivers behind inflationary pressures, monitoring online prices for select categories and baskets of goods provides key insights into how price increases are manifesting themselves across categories, companies and pack sizes. Companies need to closely track these changing prices from a variety of perspectives in order to track competition and identify pricing advantages and opportunities. Learn more about how Via can support your business and help you unlock key strategic and tactical insights with its standardised online product coverage across 40 countries, 1,500 online retailers and 11 consumer goods industries.

Note: Sample based on SKU prices found in Euromonitor International’s e-commerce tracking tool Via with data extracted in March 2022. Please note that due to ongoing improvements to the AI-led product matching of SKUs to categories, supplier, and brands, data and SKU counts can be revised based on system updates. SKU counts used for the analysis include: Total US RTE Cereals SKU Prices (7,903), Total US RTE Cereals Unit Prices (2,497), Supplier RTE Prices: Kellogg Co (404), Post Holdings Inc (347), General Mills Inc (328), PepsiCo Inc (122), Nature Inc (122) and Mars Inc (12). SKU information extracted from the following e-commerce retailers: Amazon, Walmart, Kmart, Target, Wegmans, Hy-Vee, Harris Teeter, Fred Meyer Stores, Giant Eagle, Pavilions, Safeway, H-E-B, iHerb, CVS, Publix, Meijer, Sam’s Club, Peapod, Walgreens, Thrive Market, Jet.com, Rite Aid, Whole Foods, Costco, Vitaminshoppe, Fresh Direct.