With physical outlets closed during the height of outbreaks, consumers had little choice but to turn to the digital channel to obtain goods and services. These shifts brought several consumers online for the first time and led existing e-commerce users to increase their online shopping frequency. To understand how much consumers have shifted towards digital during the pandemic, Euromonitor International analysed results from multiple consumer surveys. Here are three key takeaways:

Shopping more across all categories

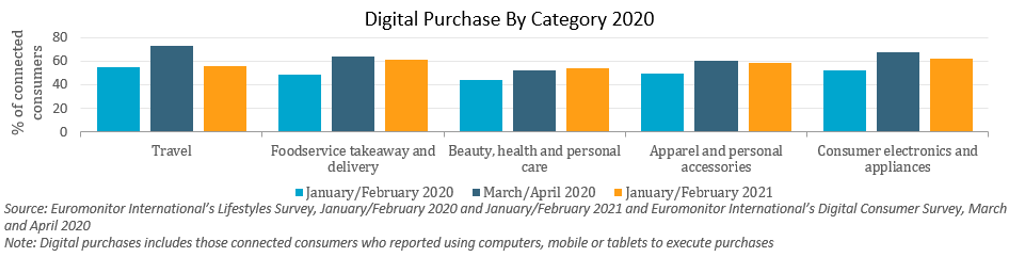

Almost every industry explored saw a double-digit percentage point increase in consumers making digital purchases between the early 2020 fielding of the Lifestyles Survey and the late March 2020 fielding of the Digital Consumer Survey. Comparing those results with the most recent Lifestyles Survey, fielded in January and February 2021, shows consumers have pulled back slightly from digital from a year ago, though, in general, much of the pandemic-inspired digital shift remains.

Besides shopping more in already familiar categories, consumers turned to the online channel across a broader range of products and services. The percentage of minimal online shoppers – connected consumers who did not use digital during the research and purchase steps in the consumer journey or only used digital to shop for one category – dropped significantly between the early 2020 and early 2021 fielding of the Lifestyles Survey. In turn, there was a sharp rise in the number of heavy online shoppers.

Digital shoppers skew younger

Connected consumers aged 30-44 years are the most frequent users of the digital channel across all industries. The 30-44 age group, which consists of the oldest millennials and youngest Gen Xers, are largely digital natives who are comfortable using the internet and devices across their lives. Unlike their younger counterparts, who have had their entire life unfold in the digital era, the 30-44 group has greater spending power that boosts e-commerce value growth.

While the 30-44 age group has the highest penetration of digital spenders, they also posted the greatest percentage point increase in digital spend during the COVID-19 pandemic, in the consumer electronics and appliances and beauty, health and personal care industries. Their younger cohorts, the 15-29 age group, led expansion in the foodservice, travel and apparel and footwear industries, as this consumer subset increased their spending overall.

Mobile continues its march

Across most industries explored in this analysis, a greater percentage of connected consumers turned to smartphones in comparison to computers to execute e-commerce purchases during the COVID-19 pandemic. Given the stationary nature of many consumers during the pandemic, the fact consumers turned even more towards their mobile devices to execute such purchases indicates how much this device has become the centre of the consumer’s world and commerce activities. Prior to COVID-19, Euromonitor International forecasted that 2020 would mark the first time that more than half of all digital commerce spend globally would be executed using a mobile device and the crisis only further reinforced this shift.

During the pandemic, consumer behaviour evolved, changing their relationship with the digital channels used to research and shop for products. Consumers are increasingly connecting with brands virtually, taking advantage of livestreaming for purchases and demanding new technology and delivery methods that support the e-commerce boom.

Learn more by downloading our webinar, Retail in Transition: Capitalising on Future E-Commerce Opportunities.