Although amongst the last few countries globally to have been infected by coronavirus (COVID-19), the Indian government’s announcement on 24 March to lockdown 1.3 billion Indians in the second-most populous country globally for a period of 21 days initially, and then extended by an additional 15 days, has led to the shutdown of factories, crippled the supply chain and made around 278 million sq m of retail space redundant.

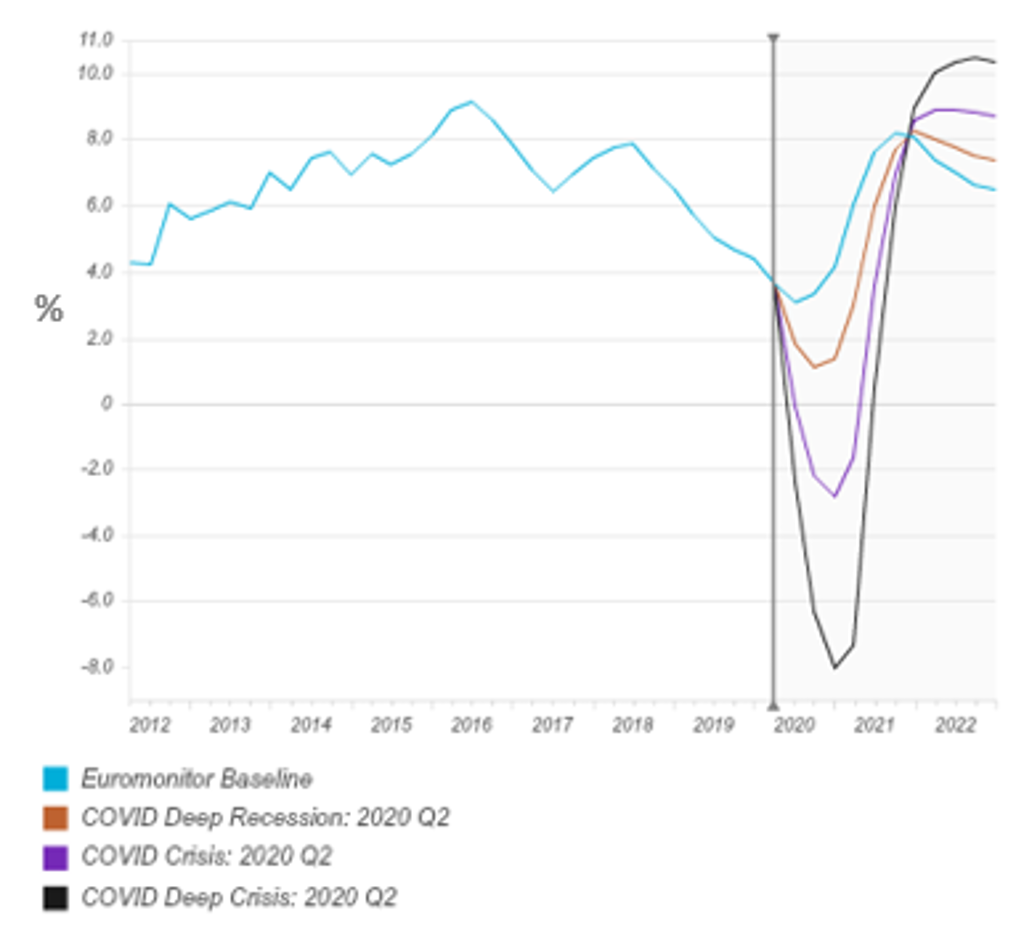

This comes on the back of the worst economic slowdown in a decade that the government was trying to revive prior to the COVID-19 outbreak. Euromonitor International predicts that Indian real GDP could dip into negative territory in 2020 depending on the severity of the COVID-19 crisis.

Indian Real GDP Growth: 2012-2022

Source: Euromonitor International Macro Model

Those FMCG industries selling necessity-driven and essential products, such as fresh food, packaged food and bottled water, are being impacted due to supply chain breakdowns, stockpiling and stockouts. The COVID-19 pandemic has resulted in a slight shift in the paradigm of what we consider to be essentials; hygiene products have entered this category, whereas industries like apparel have shifted to discretionary.

Discretionary products more generally have taken a backseat. Travel, consumer foodservice, luxury, apparel and footwear, consumer electronics, alcoholic drinks and tobacco have been severely impacted, as most companies have halted or scaled down their operations during the lockdown. However, some companies have transformed their facilities to produce products like masks, hand sanitisers, ventilators, etc, that aid the government and community in fighting the pandemic.

Our on-ground team of analysts in India tracking these industries has summarised the impact of COVID-19 on India’s top FMCG industries and services.

Retailing: consumers develop online grocery shopping habit

During the lockdown, grocery retailers, which account for more than 60% of store-based retailing sales, have been permitted by the government to continue operations as they sell essential and consumer healthcare products. While grocery retailers saw an initial uptick in demand due to panic buying, they struggled to replenish stocks due to disruption in supply chains, resulting in stockouts.

E-commerce companies focusing on grocery sales also recorded an initial spike in sales due to people being confined to their homes, but many later had to halt operations due to logistics issues. E-commerce is expected to benefit over the long run, with a greater number of consumers developing an online grocery shopping habit.

Non-grocery specialists, especially apparel and footwear specialist retailers, which went into complete shutdown, will witness a larger impact on their revenues. It will take a few more months after the lockdown for retailing operations to normalise, while a period of precautionary measures would lead to a shift in consumers’ shopping channel preferences.

Packaged and fresh food: Stockouts and price volatility make staples a luxury

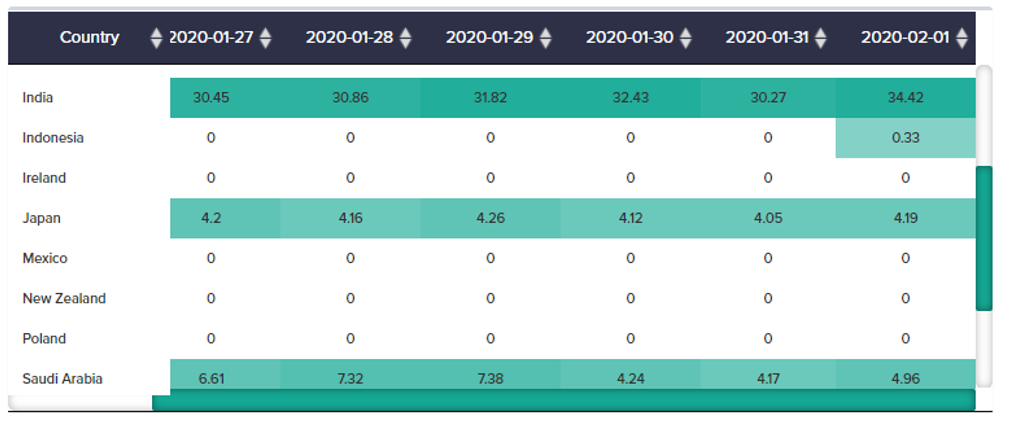

Packaged food saw a surge in sales starting on 26 March as consumers continued to stockpile. Categories such as breakfast cereals, rice, instant noodles, pasta, edible oils, cooking fats and cooking ingredients saw amongst the highest gains, but they missed out on sales due to frequent stock outages.

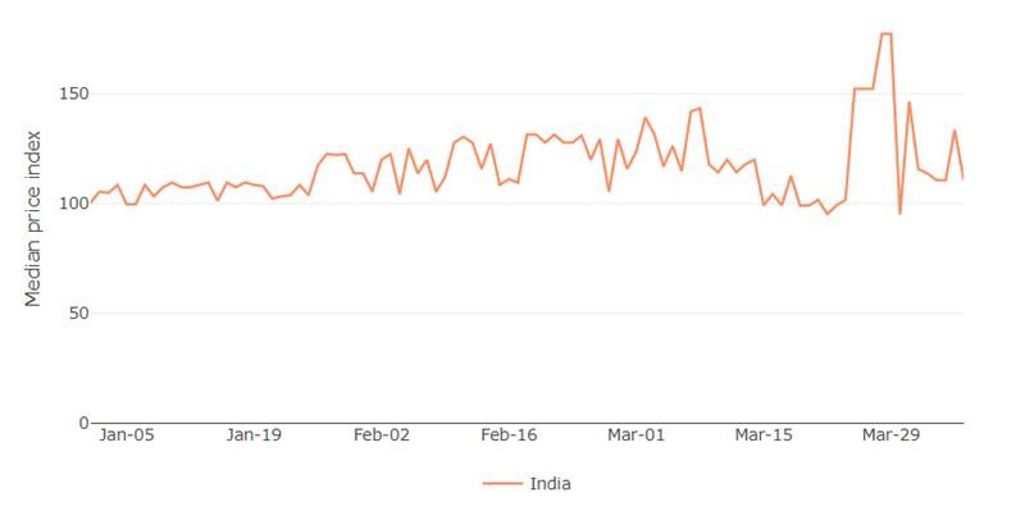

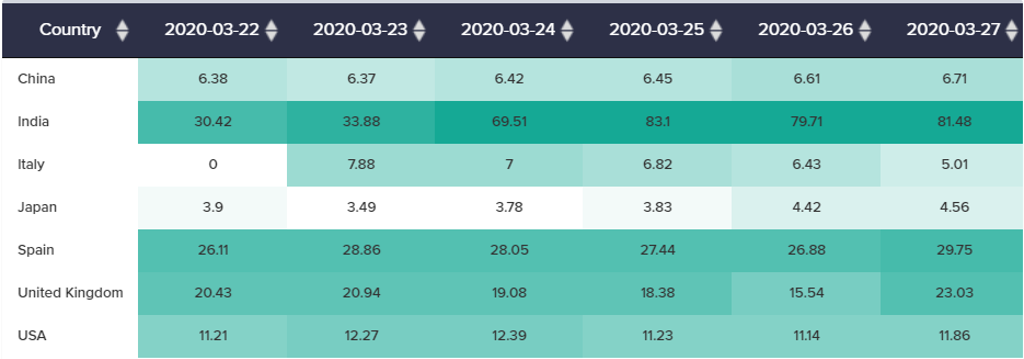

Rice Stock Outages Comparison Between January and March in India and Select Countries

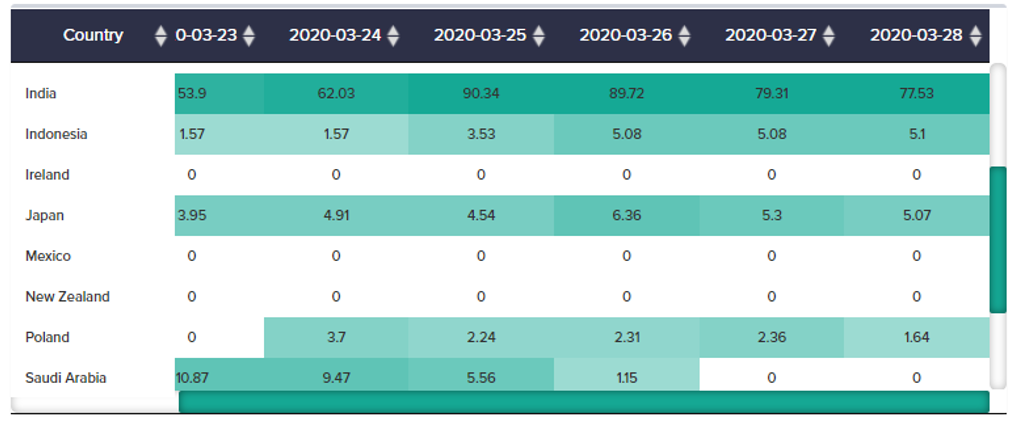

Price Movement for Noodles Over a 3-Month Period in India

Source: Euromonitor International Via Price and Availability Tracker

In line with government guidelines, manufacturers are aiming to ramp up production and address the supply side shortage of essentials across channels. However, a limited workforce and challenges in inter- and intra-state transportation are restricting capabilities.

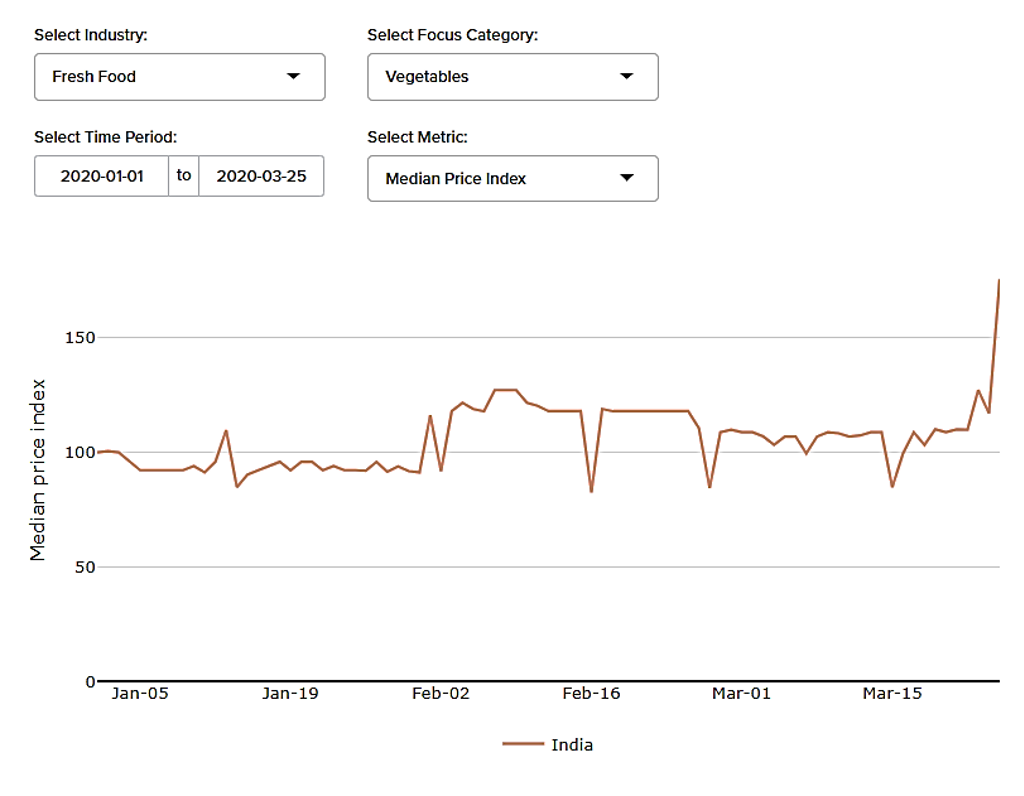

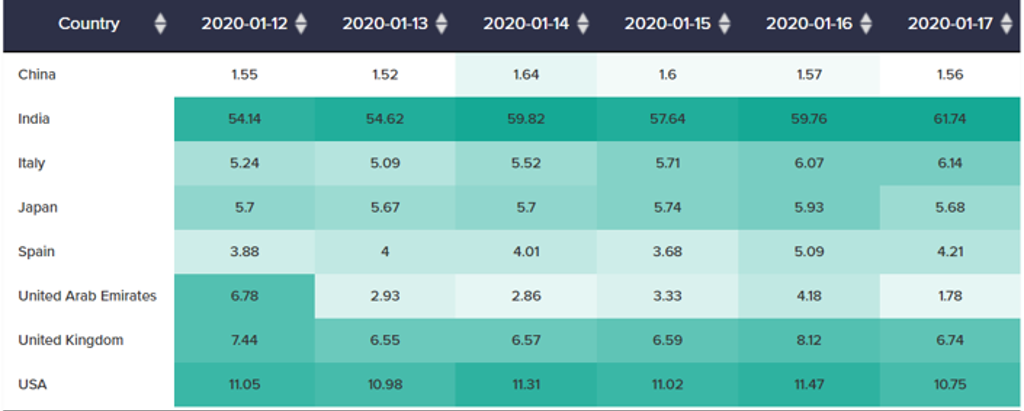

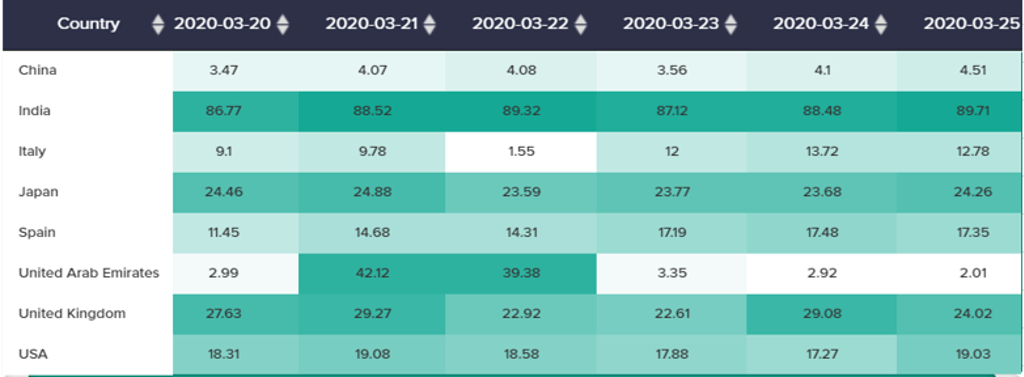

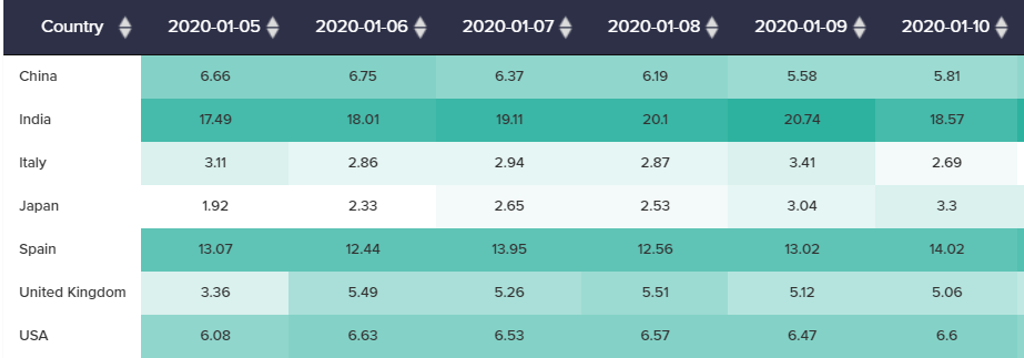

For fresh food, while supply-side challenges have been short-lived, the lockdown has impacted the inter-state distribution of fruit and vegetables, at least temporarily, and caused price fluctuations. The prices of vegetables across various e-commerce channels have seen fluctuations and a massive spike in the latter half of March.

Price Movement for Vegetables Over a 3-Month Period in India

Source: Euromonitor International Via Price and Availability Tracker

Additionally, consumers’ newly developed aversion to meat and eggs, which accounted for 7% of fresh food value sales in India in 2019, impacted fresh food further, with rumours about COVID-19’s link to consumption of poultry products coupled with reported cases of bird flu in some parts of the country.

Beauty and personal care: focus on personal hygiene while beauty takes a backseat

Growing awareness of maintaining high hygiene standards to prevent the spread of COVID-19 resulted in a spike in demand for personal care products, especially bar soap, liquid handwash and sanitisers, during March. These categories accounted for 22% of overall value sales of beauty and personal care in India in 2019. As consumer priorities shift to focus on purchasing necessities, discretionary spending on beauty and personal care categories such as colour cosmetics, fragrances, deodorants and skincare are expected to witness a fall in demand in the short term.

Established and start-up brands have deferred their product launches, especially for discretionary spending products, until the situation returns to normal. Multinationals such as Hindustan Unilever, ITC and Godrej Consumer Products have suspended the manufacturing of most product lines and enhanced the production of necessities, including hygiene products, to ensure there are no supply constraints. These companies are also working closely with the Indian government to provide price cuts for liquid soap, hand sanitisers and bar soap to ensure higher access and affordability.

Liquid Soap Stock Outages Comparison Between January and March in India and Select Countries

Source: Euromonitor International Via Price and Availability

Home care: home hygiene points to a more permanent shift in consumer behaviour

Consistent efforts to increase awareness of washing hands and disinfecting surfaces has resulted in consumers overstocking these products, leading to stock outages in the short run while benefitting these categories in the long run with supply chain recovery. Floor cleaners and toilet cleaners were some of the few categories that exhibited stronger growth compared to the pre-COVID-19 period, on the back of stockpiling and frequent purchasing, including from first-time consumers. These categories will likely continue to witness higher usage post-COVID-19 on the back of habit persistence, accelerating home care growth in the world’s fifth-largest home care market (2019).

Home Care Disinfectants Stock Outages Comparison Between January and March in India and Select Countries

Source: Euromonitor International Via Price and Availability

Consumer health: preventative healthcare remedies will gain in the long term

The COVID-19 outbreak resulted in a surge in demand for consumer health products, especially cough, cold and allergy (hay fever) remedies, as consumers anticipated possible supply shortages in the short term.

The pandemic has resulted in a change in consumer lifestyles, with an increased focus on preventive healthcare remedies. There has been a surge in demand for immunity-positioned supplements, including Ayurvedic medicines and products, as consumers pursue different ways to combat the virus.

Established Ayurvedic companies, such as Dabur India, Himalaya Wellness and Patanjali Ayurved, are witnessing high demand for products like Chyawanprash, Guduchi and Giloy tablets, Septilin and other immunity syrups. In addition to traditional Indian medicine, other immunity-improvement products, such as vitamin C, fish oils, multivitamins and mineral supplements, will likely see a sales boost as consumer priorities shift to a complete focus on inner wellbeing.

Multivitamins Stock Outages Comparison Between January and March for India and Select Countries

Source: Euromonitor International Via Price and Availability Tracker

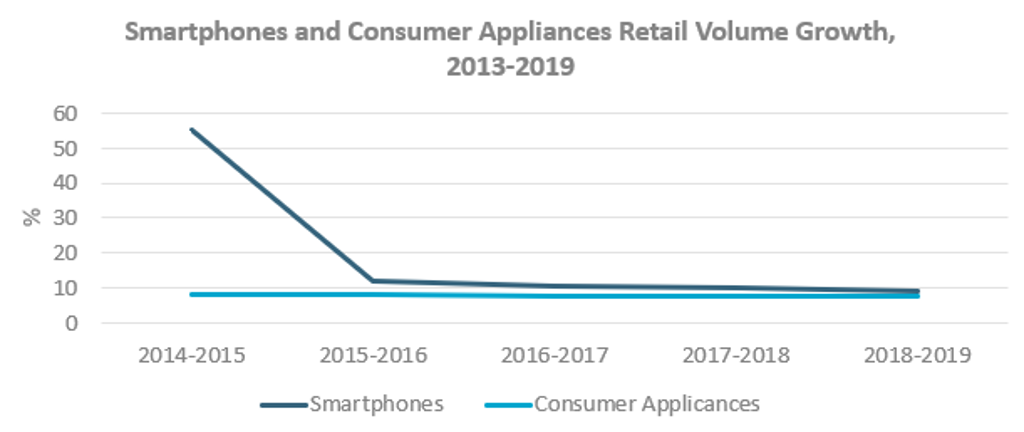

Consumer electronics and appliances: heavy reliance on Chinese imports

Amidst weak consumer sentiments for discretionary products, as part of the economic slowdown prior to the COVID-19 outbreak, the lockdown is negatively impacting both consumer electronics and consumer appliances. The high dependence on Chinese imports has already impacted the production of consumer electronics, especially phones, in the first two months of 2020, causing the temporary shutdown of production facilities by manufacturers such as Xiaomi, Samsung, Oppo, and Vivo.

For consumer appliances, under the “Make in India” movement, the dependency on imports for components like compressors and heat exchange coils for premium products persists. With factories being shut in China over the COVID-19 outbreak, there were already delays in imports. Now, with assembly lines also ceasing their Indian operations under lockdown, production and supply in the next few months will be lower compared to the same period last year. Retail prices are likely to increase, with most players offering no discount.

Alcoholic drinks and tobacco: interruption of sales

In response to the lockdown, all major tobacco players, including ITC and Godfrey Phillips, have either closed their manufacturing plants or scaled down their operations. Under the government guidelines, the ceased distribution and retail sales of alcoholic drinks and tobacco is negatively impacting the bottom line. For tobacco, the current situation, in conjunction with the rise in the National Calamity Contingent Duty (NCCD) at the start of 2020, will have a negative impact of close to 10% on cigarette volumes during 2020 overall.

For alcoholic drinks companies, the lockdown comes at a very sensitive time at the end of the financial year. In most states, there is a fee involved in carrying overstocks from one financial year ending March to the next. Therefore, companies only start manufacturing for the next financial year at the end of March to avoid stock accumulation and save on the transfer fee.

Even after the lockdown, it will take alcoholic drinks manufacturers 7-15 days to get back on track because of the strain on supply chains and the resulting unavailability of raw materials for production and packaging, and shortage of labour owing to the dispersal/displacement during the lockdown. After the restrictions are lifted, state governments might prioritise the smooth functioning of the alcoholic drinks industry, as it is one of the top three revenue sources for most state governments.

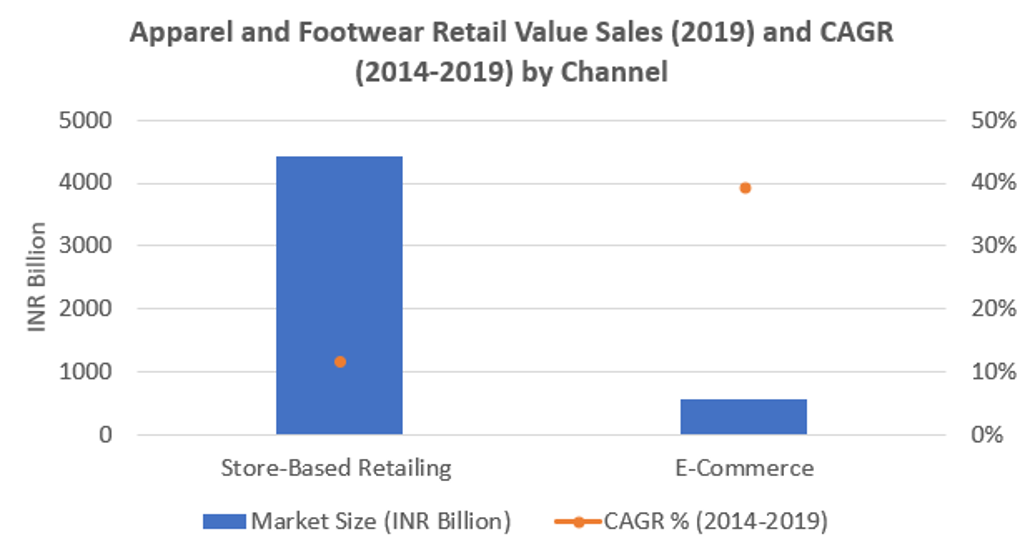

Apparel and footwear: fashion becomes discretionary

With COVID-19’s rapid spread worldwide, the fashion industry finds itself amid strong headwinds due to a supply chain that is intertwined. In February and March 2020, brands started launching their spring-summer collections with full inventories. However, stores gradually experienced less footfall because of COVID-19 concerns, even before the lockdown, thus impacting sales. Capitalising on e-commerce through deep discounting will remain key as fear of visiting shopping centres will persist. Deep discounting will allow players to clear their inventories and infuse cash flow, even though it will not actually benefit profitability.

Source: Euromonitor International apparel and footwear data, 2019

Luxury fashion brands will be hit harder as consumers will refrain from spending heavily on discretionary products. The pandemic has now shaken brands and made them rethink their supply chain models to be more agile. Players such as Welspun and Limerick are producing masks and disinfectant wipes with their excess capacity, while other players, though keen, are failing to do so due to lack of machinery, raw material and manpower.

Consumer foodservice: consumers move back into kitchens

Consumer foodservice is one of the largest industries in India, with value sales of INR4,078 billion in 2019 and its contribution to Indian GDP standing at 2.2%. The industry is witnessing a major downturn in demand due to the lockdown, which has forced the majority of restaurants to close their dine-in operations. Ghost kitchens and other offline restaurants are catering mostly to online demand, which accounts for less than 10% of total industry revenues.

However, the restricted movement of delivery executives creates further challenges. Besides, high fixed costs, coupled with low cash in hand, will make it difficult for many of the country’s small independent restaurants to sustain a business if the current situation prolongs. According to Euromonitor International, independent restaurants account for more than 90% of value sales within the consumer foodservice industry.

With limited ordering choice on offer, consumers have gone back to cooking at home instead, to avoid any risk of being exposed to the virus. Even though leading restaurants and delivery aggregators have introduced contactless delivery, consumers are sceptical about ordering food from outside, and this is likely to lead to a long-term shift away from dining out and eating takeaways.

Consumer behaviour expected to change longer-term

The situation is evolving day by day, and the Indian government has just extended the lockdown by an additional 15 days, while companies are continuing to look for solutions to resolve supply chain and distribution challenges. In the longer run, the COVID-19 recovery is likely to result in a more permanent shift in consumers’ attitudes and shopping behaviour, especially in urban areas, with increased usage of home and personal hygiene products and an accelerated shift to digital purchases.

Further insights can be found in the report, "The Impact of Coronavirus on Indian FMCG Industries".

The following analysts contributed to the article: Anul Sareen, Amulya Pandit, Anjali Jain, Vishnu Vardhan, Pradeep Srinivasan, Neeraj Talele and Ina Dawer