Although global growth in consumer health in 2022 is expected to be strong in current USD terms, at 6%, after stripping out inflation the industry will show a contraction of 0.7% in 2022, as inflationary pressures are dampening the near-term prospects for the industry.

Faced with increased competition from lower-cost alternatives such as generics and private label, companies in the industry are in a tough strategic position, choosing to institute emergency measures including trimming their product portfolios to ensure steady supply, adjusting pack sizes, or passing costs on to consumers.

However, consumer health is also witnessing areas of growth that together point the way to near-term expansion. Many of these trends have legacies in our COVID-19 era (the evolution of e-commerce, the emergence of mental health), while others are rightly moving to centre stage based on consumer pressures built up over years (the rise of holistic health, the increasingly loud examination of women’s health, the divestments of consumer health operations). Euromonitor expects these trends to influence which products are brought to market, which will prove most successful, and which will most likely change hands in the coming years.

Sustained rates of shopping via e-commerce

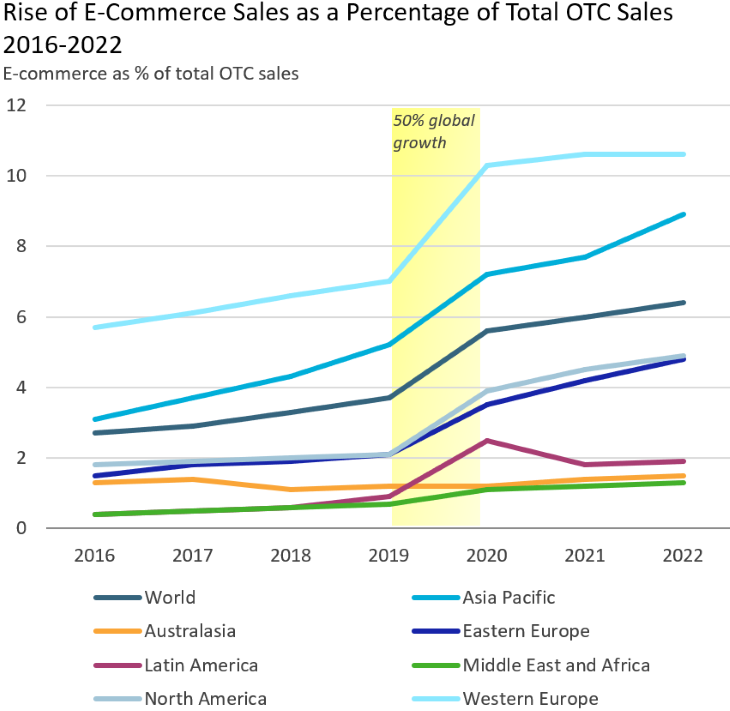

COVID-19 accelerated sales of consumer health products through e-commerce, as consumers, increasingly trusting online platforms for their health shopping, adjusted away from their long-standing preference for in-store purchasing. Rather than subsiding after the peak of the pandemic, the level of sales via of e-commerce has held strong since 2020, with e-commerce rising from 13% of all consumer health spending in 2019 to 19% in 2022. For OTC drugs, e-commerce is expected to reach 6% of global sales in 2022; after the scintillating 50% growth between 2019 and 2020, the industry has witnessed further 24% growth from 2020 to 2022.

E-commerce is likely to sustain strong interest moving forward, as the industry integrates novel online selling models (such as social commerce, livestreaming, integration with online filling of prescription products, and personalised recommendations) in the industry’s strongest online markets, including Germany and China.

The demand for mental health-orientated products is rising

One of the clearest impacts of the COVID-19 pandemic was consumers’ greater concern about their own mental health and their demand for ways to cope with the stress of the last few years. As consumers search for answers to mental health considerations, demand has surged for solutions ranging from the digital (mental health apps such as Calm or Headspace) to the lifestyle-orientated (surging rates of adoption of fitness activities and yoga) to the structural (as with the so-called “Great Resignation” movement of leaving stressful jobs).

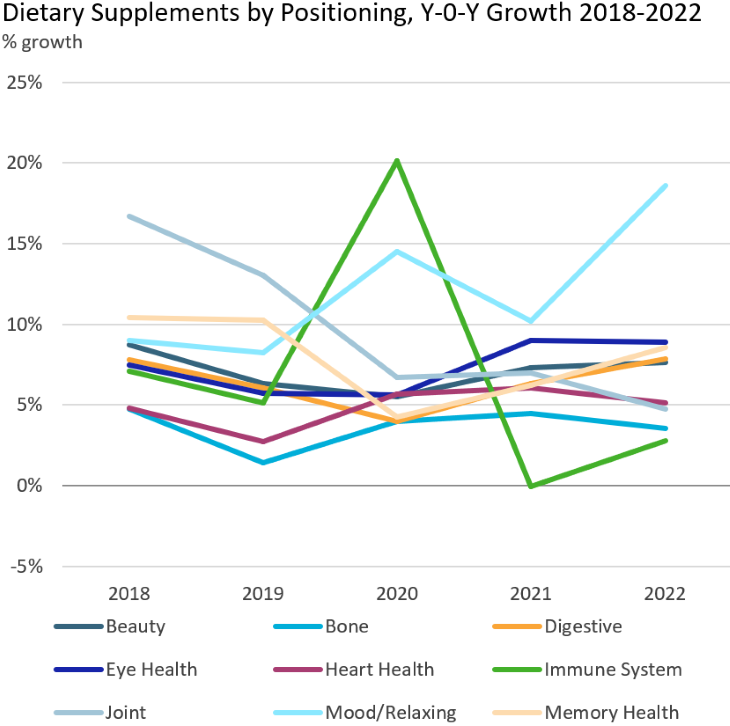

Consumer health fits easily in this moment, as many products in the industry are positioned around mental health, stress relief, anxiety reduction, or adjacent considerations. Sales of mental health-orientated dietary supplements have taken off since the onset of COVID-19, leading all other options in 2021 with 10% year-on-year growth, and then jumping further with 19% growth in 2022.

Source: Euromonitor International

The struggle to commercialise holistic health

Enterprising companies are taking cues from the nascent personalised nutrition marketplace to curate their off-the-shelf products to make them more comprehensible for the average supplements user. These companies are formulating and promoting a wider variety of benefits, especially among their vitamins and dietary supplements lines, in response to consumer demand for solutions to a range of considerations and concerns.

Product launches in 2022 demonstrate this approach. One of note is from Nature Made, the largest vitamins and dietary supplements brand in the US, which launched its Wellblends line in April 2022. This is orientated around an online quiz that curates products for particular needs within an immunity-stress-sleep orientation.

The urgency of coherent women’s health solutions

Many recent developments (not least the US Supreme Court’s decision in June to overturn the federal right to abortions) have played a role in bringing women’s health to the surface as a coherent category within consumer health that requires product development, education and, not least, regulatory protections to ensure that consumers have consistent access to these products.

As requests for more OTC solutions for women’s common health needs rise, some governments are pursuing whether to switch classifications to meet this demand. The UK is staking a claim on this front, approving Novo Nordisk’s July 2022 application to switch its Gina (estradiol hemihydrate) hormone replacement therapy in vaginal tablet format for post-menopausal women. The US is also considering switches after the Supreme Court announcement, with the Food and Drug Administration beginning its review to switch HRA Pharma’s norgestrel contraceptive pill in autumn 2022.

The wave of industry divestments is set to continue

Industry leaders in consumer health are in the middle of what looks to be a multiyear process to divest their consumer divisions from larger pharmaceutical operations. The newfound companies will have the space to build coherent, structurally-sound business units through a consumer lens that would not be possible under larger pharmaceutical conglomerates.

Most prominently, GlaxoSmithKline Plc created the independent company Haleon Plc to house its industry-leading consumer health portfolio in July 2022. Recent activities should be a prelude to a wave of industry separations in 2023 and beyond. Johnson & Johnson is expected to be next, with plans to transfer its consumer brands to a new stand-alone company called Kenvue at some time in 2023.

For further insight, you can find Euromonitor’s World Market for Consumer Health report here.