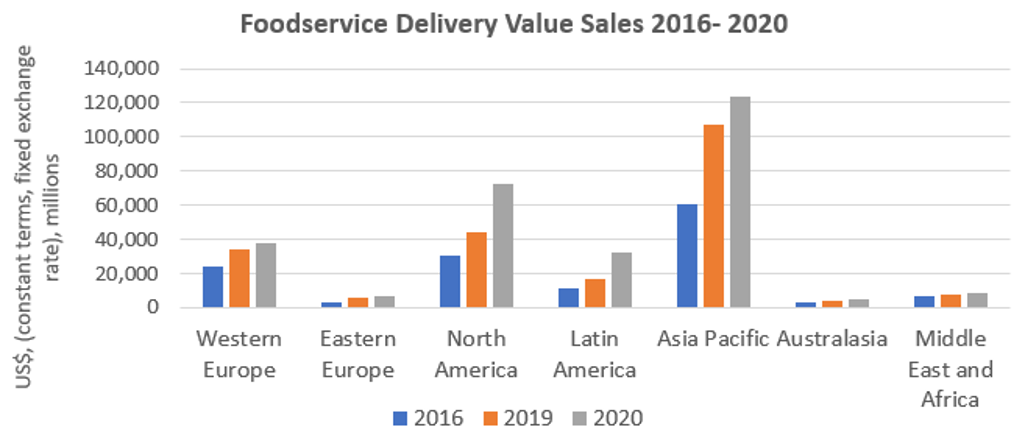

Home delivery has become indispensable for restaurants around the world to continue operating through the pandemic and stay relevant post-crisis. When looking at foodservice delivery sales globally, Latin America and Asia Pacific are regions that have led growth over the past five years. Historically, home delivery has been a strategy used by chained restaurants, but the development of delivery apps in these two regions has been a key tool to empower the great mass of independents set up in these territories, providing an online showcase for new audiences during the Coronavirus (COVID-19) pandemic.

Main factors that push for delivery growth

• Smartphone Penetration: Five of the top 10 countries with the highest smartphone penetration per household in the world were from Asia Pacific and Latin America in 2020.

• High Penetration of Independent Outlets: Asia Pacific and Latin America are the regions with the highest penetration of independent outlets in the world, comprising over 80% of the world’s independent foodservice outlets in 2020.

• Delivery Couriers: One of the factors that makes delivery fees more accessible in these regions is the large mass of couriers available to deliver at a low price. High migration from countries with economies in crisis have made this type of gig economy grow.

• Highly Populated Cities: 50% of the world’s most populated cities belong to Asia Pacific and Latin America.

Source: Euromonitor International Consumer Foodservice Restatements, August 2020

Asia and Latin America lead growth as independents onboard last-mile apps

Prior to the pandemic, it was important for a brand to choose which delivery app to work with; now brands are forming alliances with as many delivery players as possible to maximise visibility in times of prolonged lockdowns. Due to this, apps have increased their restaurant listings, offering consumers a more diverse and competitive offer. Although low prices in delivery can be a positive incentive for consumers, restaurants may pay a high commission fee, thus leaving them with low margins. Therefore, strategising on pricing, adding value to at-home experiences, catering for new consumer segments and enhancing logistics through digital innovations are crucial business actions to implement towards recovery.

Enhancing at-home occasions

Ordering food through delivery has become a recurring process during the pandemic. Consumers who previously ordered delivery for special occasions now order more out of routine, becoming less of an event and altering the experience. The vast number of restaurant listings found in apps make it hard for foodservice brands to stand out. Nevertheless, new attributes such as replicating the in-store restaurant ambience at home or offering personalised chef services for a premium experience can raise the average spent, and help brands to promote themselves among endless restaurant listings and discounts found in delivery platforms. Chilean restaurant, DeCalle which traditionally serves quick bites Asian street food, adds value to delivery by recreating the ambience of a restaurant at home, offering a custom delivery kit. The DeCalle kit includes a standard meal for two, a paper lampshade, a customised Spotify playlist and instructions on how to eat the food. Normally customers lean towards lower-cost products in delivery apps, however, a DeCalle kit is sold at USD38.

Families become the new audience for at-home occasions

Latin America and Asia Pacific are among the regions with the highest average household size in 2020, a trend likely to continue in the future. Due to home seclusion and lockdown, families have become a key audience and brands need to expand their product offer variety to fit a wider range of tastes. Consumers are looking for convenience through low-priced family combos, resulting in a great opportunity for players within fast food to increase the average spent using combos or family size products. The Mexican brand Vips has boosted its sales through the delivery channel by offering more family package options, as well as per litre or kilo side dishes to complement meals that can be cooked at home.

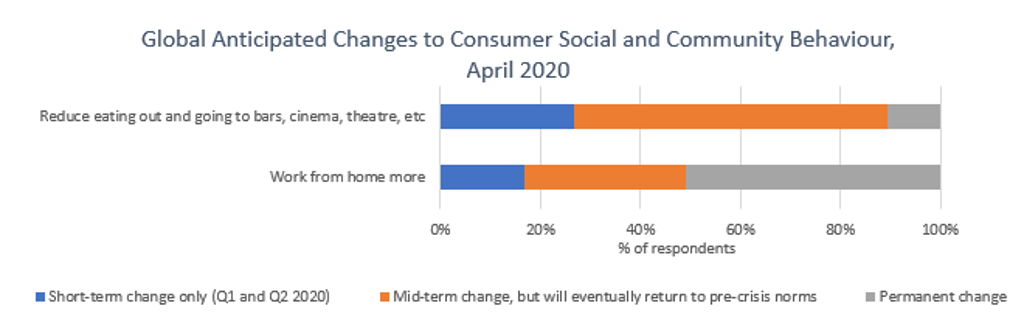

Managing a long-term growing demand for working from home

Lockdowns have shown the effectiveness of working from home and it is likely that companies will continue to make this type of work mode more flexible for employees. This is an important matter for foodservice as it directly affects dine-in traffic at lunch peak hours. There is still a great opportunity for restaurants to capitalise on consumers who spend more time at home. Although restaurant footfall may decline in the future, super apps with e-wallets might be a solution when creating B2B alliances with companies. Companies can load money monthly onto an app’s e-wallet for their employees to then spend in affiliated delivery app restaurants.

Source: Euromonitor International COVID-19 Voice of the Industry Survey, April 2020

Restaurant operators and delivery apps are rethinking logistics due to long-term high demand. The expansion of dark kitchens, digital payments and tech will play a stronger role in delivery speed and logistics, without affecting the quality of products due to a longer than estimated wait for delivery and other common delivery challenges.

To have more information about the consumer foodservice industry click here.