As food origins and food security trends converge with unprecedented investment in food tech, e-commerce and delivery, transparency is growing across the “farm to fork” journey. This will disrupt food supply chains, consumers’ path to purchase and the broader competitive landscape in food. These trends are very relevant in the fresh and packaged food industries as well as in pet food.

As consumer interest in food origins grows, technology will create new opportunities

Product origins will play a central role in the future of food, with locally-sourced products holding a distinct advantage. Local production has become a policy focus for governments, as food security concerns were exposed during the pandemic. Consumers are also turning to local food, which they view as safer, more sustainable, and an important part of their identity or heritage.

Interest in sustainability will also drive a focus on food origins. Brands that can credibly source food with an environmental or ethical purpose will resonate with more conscious consumers.

E-commerce and an increasingly tech-savvy consumer base will shape the evolution of this trend. Digital platforms will transform how people gather information on product origins and will create new expectations in areas like digital traceability. Marketplaces and social selling platforms will allow buyers to go directly to the source, creating new opportunities for messaging around origins.

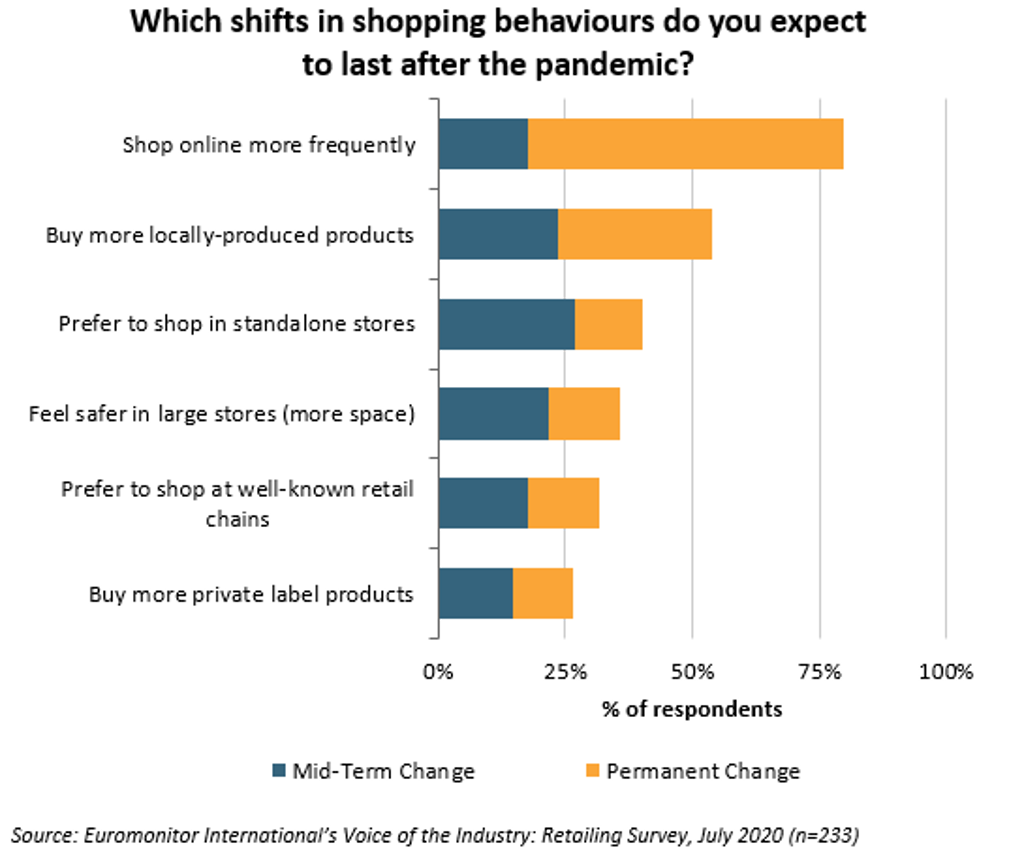

Euromonitor International’s 2020 Voice of the Industry survey asked retailers to identify the most important changes driven by the pandemic. Respondents cited the shifts to digital channels and local sourcing as the most likely areas of permanent change.

Key focus areas for business growth strategies in the “farm to fork” journey

Food Security: The pandemic has shown the fragility of the global food trade, leading governments to prioritise local production. These concerns are not limited to emerging markets but also countries like the United Arab Emirates or Singapore are limited by geography and are investing heavily in agri-tech and promoting local production. Singapore’s “30 by 30” goal, for instance, aims to produce enough food locally to meet 30% of its nutritional needs by 2030.

Sustainability: Sourcing is at the heart of food sustainability claims as brands develop an ethical or environmental purpose. Claims like organic, fair trade, free-range, charitable support or locally sourced all refer to specific elements of a product’s origins. In line with the trends seen in the fresh and packaged food industries, sustainability has been a hot topic in the pet food space as pet humanisation continues to be a major trend in the global market.

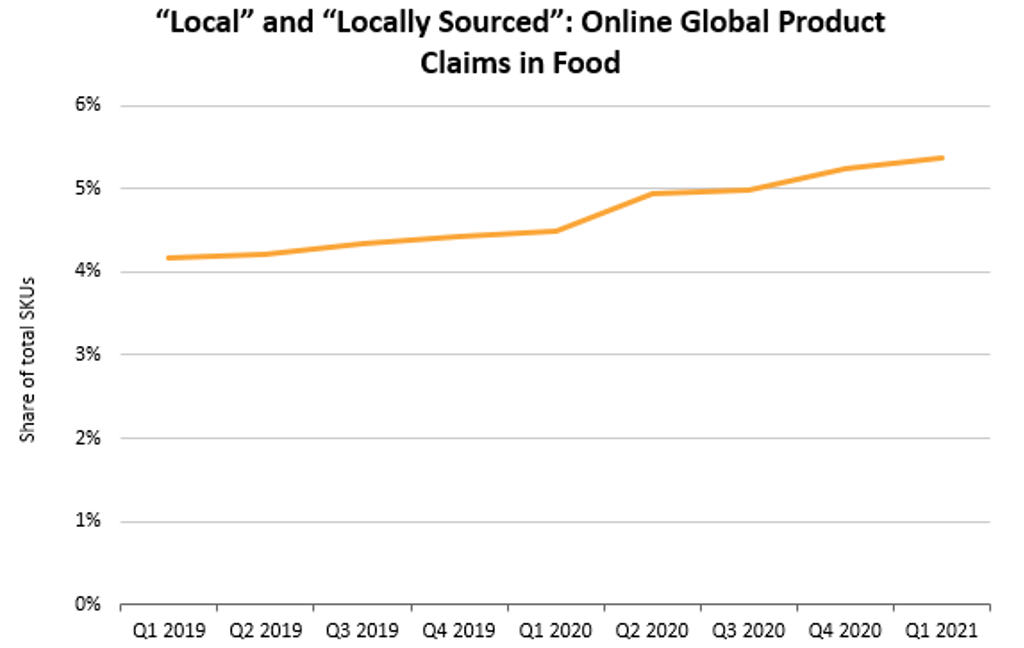

Back-to-Local: Local food surges as a source of identity and to ensure food safety, limit food miles and support local economies. During the pandemic, this long-standing interest in local food grew. Consumers turned to local products to ensure safety, transparency and consistent supplies amidst stockpiling and out-of-stocks. In fact, the share of online food SKUs with “locally-sourced” claims jumped with the pandemic’s onset, and has continued to grow.

Experiential Food Production: A wave of interest in home-grown food reflects values around experience, sourcing, origins and freshness in food. As people were stuck at home under quarantine or to avoid the virus, gardening provided a much-needed distraction, both in urban and rural locations. Sales in the gardening industry jumped to record highs as the hobby of growing food at home surged. While consumers are still a long way from producing all of their food at home, this surge of interest in home-grown food reflects a broader shift in values around experience and sourcing in food.

Vertical Farming: Investment in indoor systems is making it possible to grow food sustainably throughout the year and in more places. Over time, investment in vertical farming may transform food supply chains. In addition to vegetables and fruit (the main focus of vertical farms today), innovations in cell-based meat are driving down costs. As such, the future of food production will depend less on fields and more on technology.

Direct-to-Consumer: New e-commerce platforms, like direct-to-consumer and social selling, are set to transform food supply chains and play a pivotal role in the evolution of food tech and origin trends by shortening the supply chain. Direct-to-consumer models allow shoppers to buy directly from the producer, increasing transparency and trust. In fact, DTC platforms can radically transform brand storytelling through livestreaming or social selling elements. This space is slightly more developed in the pet food industry with subscriptions models and online pet specialists such as Chewy, Zooplus and Pets at Home gaining ground.

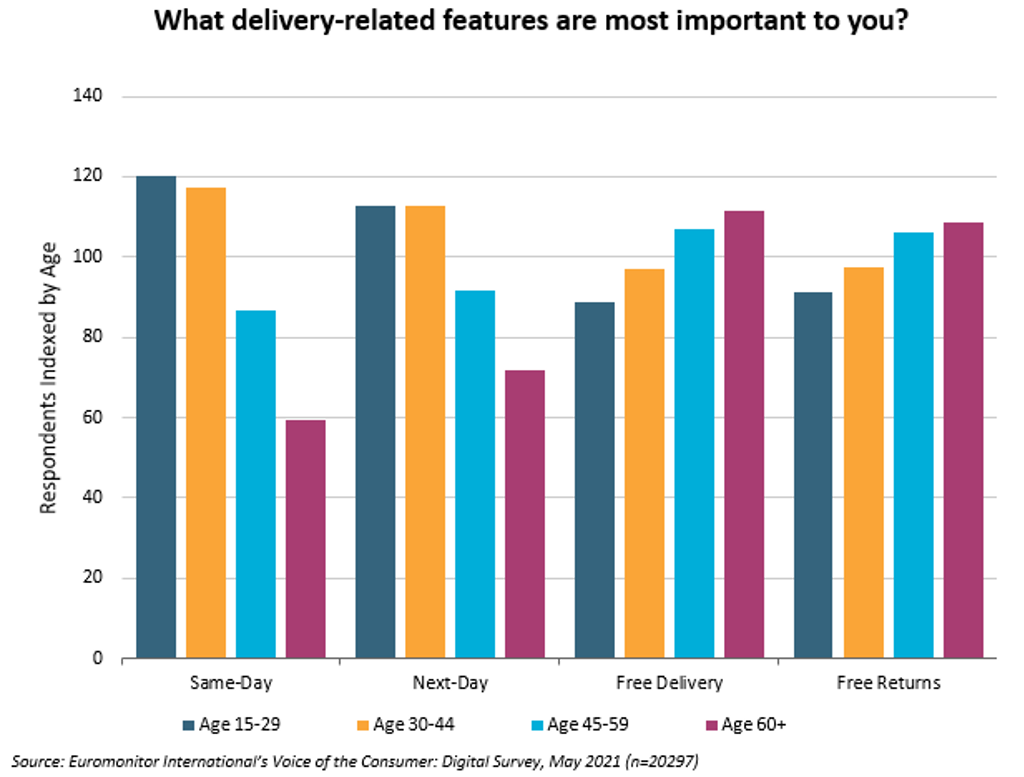

Hyperlocal Delivery: Using proximity to facilitate faster deliveries, third party delivery services and micro-fulfilment centres are on the rise. Preferences amongst younger shoppers are evolving to favour fulfilment speed over more traditional concerns regarding free delivery or returns. By locating micro-fulfilment centres closer to consumers and working with hyperlocal delivery couriers, the prospect of on-demand e-commerce delivery is becoming increasingly possible.

Digital Traceability: Lower costs for radio-frequency identification (RFID), artificial intelligence (AI) and blockchain technologies make it easier to trace food across the supply chain. Facing labour force disruptions, supply chain instabilities and shopper concerns with food safety, companies made investments in a future defined by automation, digital traceability and tech-driven supply chains. Relative to in-store shopping, digital platforms make it much easier for consumers to utilise digital traceability tools and conduct research on product origins and sourcing while they are shopping.

Opportunities in the food and drink industries

Food origin stories need to become a focal point. Stories that can appeal to proximity, traceability and sustainability or leverage new technologies will be most effective. As people focus on food origins, retailers should invest in experiential elements that feature local offerings, this being part of a seamless omnichannel experience and with a focus on direct-to-consumer platforms that are revolutionising the future of food retail.

For more insights, see the report “From Farm to Fork: Food Tech, Origins and Security”